Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Worth Shorting Even Now (Part 1 of 3)

As I've said 37 times already, I think we're in for a hearty rally to between 1250 and 1300, at which time I will short everything under the sun and use every penny of my buying power. Until then, I'm playing it light, and I am viewing any rallies with complete distrust.

There are, however, a small number of stocks that I think are worthwhile to short even now, and I'm going to share some of them with you today. I am 75% in cash, and the remainder of my portfolio is in a smattering of small stock positions and one large ETF – GLD. I think as the money flows out of safe havens like GLD and TLT and into equities, precious metals offer an interesting short-term trade. (Tip of the hat to my good friend Serge).

Anyway, here's the first block of short ideas:

Bonds Finally Ready to Ease Back

It has been a breathtaking run for bonds, as seen here via the TLT fund. It bottomed at 92.52, around the time the Greek parliament saved Europe (ha! ha, ha!) From then, one might be seen as one of the most boring financial vehicles on the planet (after all, we're talking about a non-leveraged fund that trades in risk-free government securities………..), it rallied over 18% in just over a month (!!!!!!!!) To say nothing of the fact it pays a 4% dividend anyway.

But all good things must come to an end, and I think TLT has reached its technical target. Easing back to at least the upper 90s would make sense at this point, which would line up nicely with continued strength in equities as we prepared for the Short Of The Decade Event.

Broken Triangles, Dying Dragon (by Springheel Jack)

I haven't been posting much in the way of shorter timeframe equity index charts in recent days, and that's simply because the intraday moves have been so wild that there haven't been any shorter term trendlines or patterns worth the mention. That has changed this morning, though since I capped the charts the support trendlines that I was looking at have already broken down. The first pattern is a nicely formed triangle on NQ that has now broken down:

The second is a support trendline on ES that has also now broken down, with an ominous looking H&S look to it:

I'm not expecting a big breakdown today. At worst I'm thinking we may see a retest of 1100 and I'm regarding this as part of a bottoming process before a decent rally. Other instruments are broadly supportive of this view. On oil a counter-trend bounce looks very likely here from the daily chart:

Copper futures hit rising support from the 2008 low overnight and are bouncing there so far. This bounce needs to survive the day though as the candle reversing at support is still ongoing. I'm expecting a bounce here:

I have a rising channel on EURUSD though I don't have much confidence in it. I'm wondering whether it would just be fairer to say that EURUSD is trading sideways around 1.427 at the moment. I am wondering about a diamond bottom on this and will be having a closer look at that later:

I've been having a look at some longer term charts that look interesting and relevant to the bigger picture and the first today is the XLF weekly chart since 2006. This is a very grim looking chart with XLF sliding down declining resistance from the 2007 high for over a year before breaking strong support in the 13 area. Hard to put a likely target on this chart but I'd be thinking in terms of a move to the 9.5 to 10.5 area:

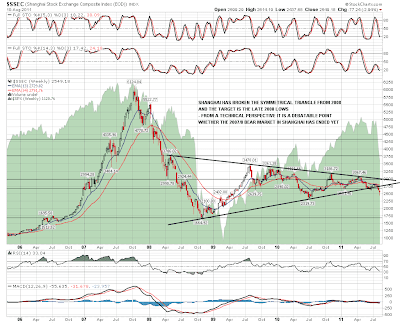

The SSEC chart is even grimmer, and raises a serious question whether the bear market that started in 2007 in Shanghai ever ended. Either way a decent symmetrical triangle formed on SSEC between 2008 and 2011 and that has now broken down. The first obvious target for this pattern is the late 2008 low in the strong 1650 – 1700 support zone:

My WAG for today is that SPX tests the 1100 area and then closes flat or up before a decent rally over the next couple of weeks. My WAG yesterday that we'd see a hard fall into support in the 1120 area went pretty well so we'll see how that goes.