Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Downgrade Monday (by Springheel Jack)

What a difference a week can make. This time last week ES had made a bullish looking recovery over 1300 and most analysts were expecting a rally. A week on ES is down almost 140 points, the Vix touched 40 (more or less) on Friday and the weekend was most notably marked by S&P downgrading US debt from AAA (expected) and riots in London (unexpected). The riots in London, strangely enough, seem to have been sparked off by a known criminal being killed in a shootout that started when one London policeman accidentally shot at another London policeman. It isn't yet clear whether the dead known criminal was armed or, if armed, whether he ever drew his weapon. My father always used to say that policemen here had so little experience with guns that when they were armed, they were a serious danger to themselves and innocent bystanders.

Be that as it may I have a possible declining channel on ES that is suggesting that we may see another test of broken support in the 1215-1220 area today or tomorrow. I was suggesting on Friday morning that ES might peak there which it did. The H&S target on SPX is not yet made and if we do see a retest of the 1215-1220 area I'd be seeing that as a sell opportunity:

it's obvious that USD bottomed out a few months ago, and I think what we are seeing here is the most pathetically weak USD rally that I can recall. EURUSD is still trading in a range around the 1.427 area and broke up from last week's declining channel at the open yesterday before declining back to the 1.427 area again:

I think gold has replaced USD in the flight to safety trade this summer along with Yen and bonds which are the other usual flight to safety destinations. It is a mark of quite how weak this rally on USD has been that it has failed to make much headway against embattled EURUSD. Gold has broken up from the rising channel of recent weeks and is consolidating above it. I'm leaning towards a reversal here but we might instead see a break up from the channel with confidence:

I'm having trouble buying a bear market here. Government credit is still too good, austerity is only hesitantly beginning, corporate earnings have been so good that the P/E ratio here (reported earnings) is the same as it was in March 2009. Perhaps, but this could just be a short term panic. 30yr treasuries are now in an area where we would normally start looking for a high:

NYMO is very much in an area where we would normally be looking for a low or at least a serious bounce:

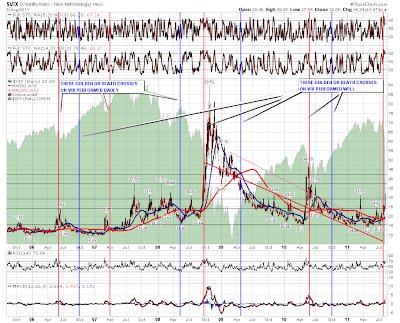

We've just seen a golden cross on Vix (daily 50 and 200 SMA cross), which is bullish for Vix, though the performance of these over the last few years have been hit and miss. There are four golden crosses apart from the current one on this daily 6yr chart. The first two were in the last bull market, and were failures as equity shorting signals. The third was in September 2008 and was a great success, and the last in May/June 2010 I'd see as a marginal success:

I'm leaning towards seeing a low with at least a decent bounce this week, though I don't have anything in the way of a reversal pattern on any equity index. The Fed is meeting tomorrow and it will be interesting to see what they come up with after the turmoil of the last week. Will they announce QE3 then or later this month? I think they might to try and head off recession in the US and panic in the equity markets. If so the outlook for USD and bonds particularly would look grim but equities might get another lease of life for a few more months of bull market.

Cape Fear

Well, a good night's sleep was pretty much out of the question last night. I went to bed at 11 and, starting at about 2 a.m., was awake staring at the ceiling, telling myself I needed more sleep. By 4 a.m., I gave up, and here I am.

One wonders what Geithner, Bernanke, and Obama must be thinking right now. Their plan is in full-blown fail-mode. I think they've got one bullet left – God knows what it is – to sustain this fraud for one more thrust, and then it's truly Game Over. Indeed, I do not think what we're witnessing is "the big one". I think that's coming.

Judging from the candles on the ES, as well as the fact that the measured move from the triangle has been satisfied, the odds for a bounce seem higher than ever to me. But "bounce-watching" has become an unproductive hobby the past few trading days, so everyone has to basically take things a tick at a time right now, since the cross-currents have become legion.

I am in 44 positions – all of them short, and on a morning like this, one-fifth as many as I'd like – and am watching and waiting.

The Circus Starts This Week

Who are our real masters?

I think there are 1200-1300 of them all over the world and their names can be found here

They and the businesses they control are the true masters of the universe. Every politician in every country is at their service. Why do you think the members of Congress are exempt from the insider trading laws? Is it because of the special relationship the politicians have with these masters? If we could follow the portfolio of the US Congressmen/women we would retire rich.

Given the above, how do you think the politicians will react to the current crisis? Bear in mind, this crisis is just the continuation of the crisis of 2008 which never went away. Here, we have a president who came to power on the promise of change and changed nothing. He has a war chest of $80 million for the coming election and most of this money came from Wall St. On the other side we have Tea Partiers who have been brainwashed to protect the interest of the rich by refusing to tax them and we also have union freeloaders who suck the system dry.

In a normal world, economy should drive the stock market. But 30 years of bull market have changed the character of the country. Now it is the stock market which drives the economy and the economic policies. Remember during the debt debate, both the Democratic president and Republican speaker would invoke the stock market for speedy resolution. All the actions for solving the crisis of 2008 have been centered on saving the stock market, Wall St. and “Too Big to Fail Banks”. That is where the masters of the universe keep their wealth. Uncle Ben created QE1, QE light and QE2 just to restore the wealth of the masters which eroded during the 2008 banking crisis. And you thought he wanted to create employment! Silly you.

So now we see that the politicians and central bankers of the world are holding emergency meeting over the week-end to solve the looming crisis. And they will do the only thing they know. Pump in more liquidity in the system. They mistake this credit crisis as liquidity crisis. But when one continue with the same mistake for three years, it is not a mistake any more. It is a way of life for them.

Do whatever they may; the response to these emergency measures is getting smaller and weaker. Like in Japan, where debt is 200% of its GDP, the debts of America and Europe have socialized the losses and created Zombie banks. And at some point all the kings’ men won’t be able to put “humpty dumpty” back together again.

As I said on 4th of August, the politicians will not give up without a fight. So we see the fight started. Between Fed and ECB they will introduce some sort of liquidity measures, which will keep the money flowing in the stock market. Short term, we might see a vicious rally. Let me again show you the SPX weekly chart.

Like in 2008, SPX made the first touch of the 80DMA on the weekly chart. So the next move should be upward and possibly a new high. Sounds ridiculous today, but it is a possibility. I do not think a bear market will start on such high negative sentiments. There has to be euphoria before the plunge. A speculative market top is formed when everyone who can be sucked in has been sucked in. And it is a stock market driven by speculation not by fundamentals.

The debt deleveraging has started and it is going to be a long process. Rest assured that the bear market is also going to be long and vicious. I do not think it will be one straight line down. It will be more of Chinese torture, 30% down followed by a 20% rally, untill such time all the excess has been cleansed out of the system. The central bankers will fight back hard and when everything fails the politicians will create war to divert attention from their failure. That has been the d history of mankind and there is no reason to think that it will be otherwise now. The military industrial complex is there for a reason.

The next three weeks are going to be interesting to say the least. Last week’s sell-off was a complete insider job in a completely rigged market because they knew about the coming downgrade. If my thinking is correct and a deal between FED and ECB and world politicians are done over the weekend, we will see dollar weakening and stocks rallying. Gold will reach new heights. That will be an opportunity to go short 200 %.

Visit World of Finance at http://bbfinance.blogspot.com/ for insightful analysis of the world economics and follow us in twitter: bbfinanceblog.

EDZ- For The Next Panic (by BKudlaQA)

Contrary to common belief, as the U.S. struggles, the world will be forced back into finding real dollars, and abandoning the emerging markets, why? It all has to do with leverage. The dollars that circulate pale in comparison to that which is borrowed into existence to fund speculation.

I currently own some shares, and will add on this upcoming relief rally (dollar weakness), but options are nice for some additional leverage. Right now the vol is too high to buy options, but I will sell strike 15 puts to pick up some shares at a discount, and will buy Jan 12 calls OTM that will give me potential 5 to 1 return at my target price, on my next buy signal.

On a shorter time frame you can see a cup formed and now I suspect a handle before we really breakout.

www.arum-geld-gold.blogspot.com