I was very clear about the risks to any bounce setup yesterday on equities and sure enough the setup failed. That increases the odds for the next setup working and we are getting close to the first of the downside targets that I gave last week so I'll have a look to update those targets today.

On the SPX weekly chart I gave a target at or near the weekly lower bollinger band (BB) on the clear break of the weekly middle BB. That is now at 1340, though this target only fixes at the weekly close, so depending on what happens between now and then I'd put that in a range between 1338 and 1342. Of the last twelve clear breaks of the weekly middle BB nine hit the weekly lower BB and two of the other three were near misses. With yesterday's close at 1355.49 that target is now close:

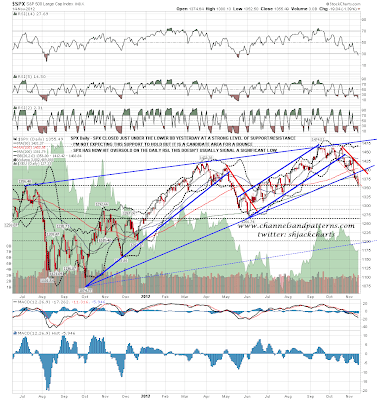

On the SPX daily chart the RSI is now under 30 for a clear oversold reading. This does not generally mark a low as there is generally a bounce soon followed by a lower low on positive RSI 14 divergence. There is a chance of a bounce from this area as there is a major support/resistance area around 1356 marked on this chart:

On another view of the SPX daily chart I am showing the NYMO readings at the top of the chart. NYMO has now hit -80 which suggests that we should see a significant bounce start within two or three days. As with the daily RSI however there is usually a lower low on SPX with positive divergence on NYMO before a big swing low is made. Of the three significant lows made in 2010, 2011, and 2012, not one of those made the actual low with NYMO still under -80, though on small swing lows the NYMO signal is often immediate. This is a signal for a decent bounce to start soon, but not for a likely major swing low at that reversal in my view:

On the SPX 60min chart the declining channel broke down decisively yesterday, which is very disappointing as there is now no clear support trendline. SPX is now well over halfway to the H&S target at 1325 and I can see no reason to think that target won't be made before we see any strong reversal. The daily BBs are now trending down strongly so if SPX continues to ride the band downwards that target could be hit close to the lower BB on Monday or possibly even tomorrow:

The rally I was looking at on EURUSD yesterday morning is still ongoing. and a short term rising channel has formed with an obvious upside target in the 1.28 area. My downside target on EURUSD is still in the 1.244 area so once this short term rising channel breaks I'm expecting the downtrend there to resume:

CL hasn't actually moved much in recent days, though there was a boost yesterday back to short term resistance on increased regional instability. Declining resistance is now at 87.8 and if CL can get over that then the possible double-bottom on CL targeting 94 area resistance on a break over 89.2 is still in play. On a break below 84 I have trendline support in the 81.5 area, and the full rising wedge target is not far below that in the 79 area:

A lot of people are starting to accumulate swing longs here, and while I'm expecting SPX to go lower, the odds of making money on swing longs here are pretty good, as SPX and NYMO are very oversold here, and when we do see a strong bounce, I'd expect it to more than recover over the current level. I'm expecting better entries within days however in the 1320s.

If we are in a new bear market, and I'm definitely taking that possibility seriously, then the obvious downside target for the current move is a full retracement to the possible H&S neckline at the June 2012 low. That's in the 1266 area and if we see a break below 1300 that will be my top target area, particularly as rising support from the March 2009 low will be in the same area.

Listening to Obama yesterday the negotiations to avoid the fiscal cliff may be hard and may well fail. If so that could take us back to 1266. If we made that target and the H&S continued to form I would expect from looking at the left shoulder of this (still very theoretical) pattern to see a bounce that would take two or three months to peak, with a likely target at the 200 DMA in the 1350-70 area, though the left shoulder peaked at 1422 of course. That's not my primary scenario here (yet) but it's worth mentioning.

Short term the overnight action on ES looks like a bear flag, and there is now a strong resistance area established in the 1362-6 ES range. I'm leaning bearish today as long as ES stays below that resistance though any downside should be limited to ten points or so as SPX closed under the daily lower BB.