Further to my last weekly market update, this week's update will look

at:

- + 6 Major Indices

- + 9 Major Sectors

- + Trendline Breaks on 7 Major Indices

- + Percentage Comparison Chart of 4 Major Indices

- + Ratio Charts of SPX:VIX, RUT:RVX, NDX:VXN

- + Ratio Chart of AAPL:NDX

- + 30-Year Bonds

- + European Top 100 Index

6 Major Indices

Five of the six Major Indices rallied and closed

higher this past week, as shown on the Weekly charts and the 1-Week

percentage gained/lost graph below. The Utilities Index extended its

prior weeks' losses.

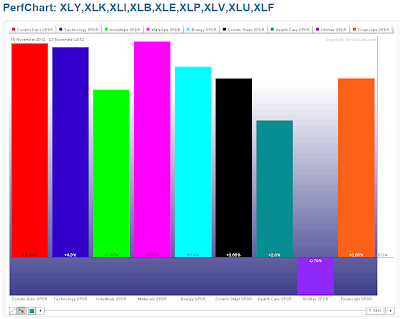

9 Major Sectors

Eight of the nine Major Sectors rallied and

closed higher this past week, as shown on the Weekly charts and the 1-Week

percentage gained/lost graph below. The Utilities Sector extended its

prior weeks' losses.

Trendline Breaks on 7 Major Indices

Each candle on the

charts below represents a period of three (3) days. The current candle

closed today (Friday). I first wrote about these seven Major Indices and their

major trendline breaks here and here. Since then, price did continue downward, but has since

rallied during the past six days.

Those indices now testing the

underside of their major uptrends from the October lows are the OEX and SPX. In

fact, the SPX has now closed just above this trendline. A hold above 1400 and

this trendline should produce a continued rally in the SPX. Similar backtests,

breaks and a hold above trendlines on the others should bolster such a rally in

the SPX. Alternatively, a failure of the SPX to hold above 1400 could send it,

along with the other indices, down to new lows.

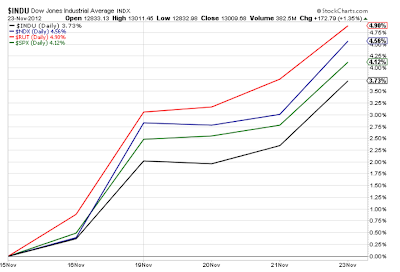

Percentage Comparison Chart of 4 Major Indices

I mentioned here that the Russell 2000 Index was the leader ahead of the

Nasdaq 100, S&P 500, and Dow 30 Indices in terms of percentage gained from

the lows of last Friday (November 16). As shown on the updated

percentage comparison chart below, that's still the case, and

it's still the one to watch to see if buying favours the riskier Small-Cap

sector over Technology and Large-Cap/Blue-Chip stocks. Alternatively, I'd watch

to see if this index begins to weaken, particularly below the 800.00 level and

on rising volatility, which could send the other indices down to fill their

respective gaps from this past Money, and lower.

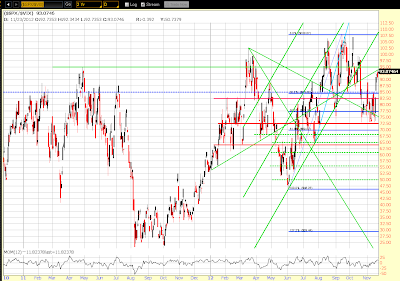

I've also included the

updated 60 min (market hours only) chart of the TF (E-mini Russell 2000 Futures

Index) (counterpart of the RUT), which shows the corresponding 800.00 level,

which is around the 40% Fibonacci retracement level from the September high to

the recent low. Monday's gap remains unfilled, and, whether this is a breakaway

gap and the beginning of a trend reversal remains to be seen. I'd like to see

price hold above the 800.00 level and begin to make higher highs and higher lows

on this timeframe before I'd make such a call. Otherwise, a failure around this

level would likely send price down to, potentially, fill the gap and on to a

lower low.

Ratio Charts of SPX:VIX, RUT:RVX, NDX:VXN

I'm still monitoring

market volatility to try and gauge market strength versus weakness going

forward. I prefer to measure the strength of several of the Major Indices

against their respective Volatility Indices by looking at the following

Daily ratio charts. As you can see on SPX:VIX, RUT:RVX, and

NDX:VXN, they broke above major resistance (broken horizontal blue line),

continued to rally, and stopped just below the next resistance level. The

Momentum indicator has continued its ascent above the zero level and may be

signalling that more strength is in store for the SPX, RUT, and NDX. A break and

hold above these next resistance levels will likely produce a continued rally in

these indices…particularly if the SPX holds above its 1400 level, as mentioned

above, and if the other Major Indices break back and hold above their respective

major trendlines.

Ratio Chart of AAPL:NDX

I've also added a Daily ratio

chart of AAPL:NDX. You can see that AAPL has declined at a greater rate

than the NDX, has been comparatively much weaker, and price on this has also

closed above major resistance (broken horizontal blue line) to rest in between

the bottom of the rising channel and horizontal price resistance. The Momentum

indicator, while still in a downtrend, may be signalling a positive divergence

with last Friday's bounce into the close…one to watch going forward into next

week(s), as any gathering strength (and break and hold above resistance) would

likely positively influence the SPX and NDX. Alternatively, a resumption of

accelerating weakness, which sends AAPL below its equity price of 500.00 (and

lower), would likely negatively impact these Indices (last Friday's low on AAPL

was 505.75, so this is still a possibility, as noted here).

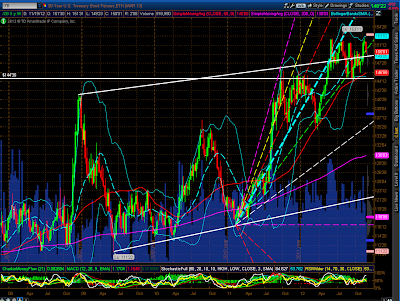

30-Year Bonds

Price on the Weekly chart below of

30-Year Bonds closed on Friday just above near-term support. Failure to hold

this support level may induce serious bond-selling, which could begin on a

larger scale if price then failed to hold at the next support level (around the

lower Bollinger Band/50 sma). Any substantial weakening of Bonds may produce a

large-scale rally in equities…one to watch over the next days/weeks.

European Top 100 Index

I last mentioned the European Top 100 Index

here. Price had broken and closed below horizontal support. It

then proceeded down to the 200 sma and bounced to close back above the 50 sma

and in between support and resistance, as shown on the Daily

chart below. As you can see, price has been wandering sideways in a

range since the beginning of August and has been reactionary to news events from

Europe. As I recently mentioned here, it would appear that delays are to be expected

indefinitely while Europe grapples with its many issues related to their

unravelling European Union and recession. As long as major decisions keep on

being delayed, no doubt we'll continue to see this kind of uncommitted price

action in Europe, which, would, likely have a negative affect on those U.S. (and

foreign) business/financial institutions involved with Europe.

In

summary, I'll be monitoring market reaction to Beige

Book data once its released this Wednesday at 2:00 pm EST. Any

surprises may send equity markets down…otherwise, I'll be looking for a

strengthening rally on declining volatility, if the Major Indices can continue

to advance and break (and hold) above major trendline resistance. Along with

that, I'll be watching the 30-Year Bonds and the European Top 100 Index for

strength/weakness signals.

Enjoy your weekend and good luck next

week!