I've mentioned often before that short term reversal setups often get steamrollered in a strong trend on a larger timeframe, and I'm mentioning that first before I outline the promising looking short term reversal setups on equities this morning. The action yesterday before the close and so far since yesterday's close is also not hugely encouraging. Nonetheless here it is ……

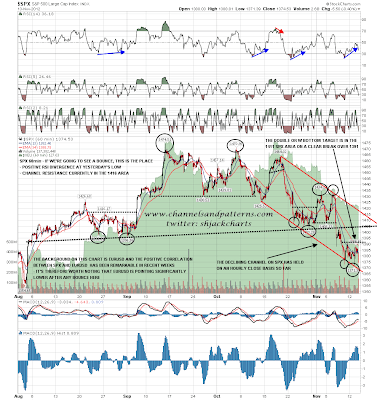

SPX has obviously been riding the lower bollinger band downwards on the daily SPX chart. Yesterday there was an attempt to break up from the lower BB which failed, but in the event that we see a rally here the obvious target would be the daily middle bollinger band, with a likely hit somewhere in the 1405 to 1415 area, depending on the time taken to reach it. Here's how that looks on the daily SPX chart:

The promising reversal setup is on the SPX 60min chart where there is a decent declining channel that has held so far on an hourly close basis. There was significant positive divergence on the 60min RSI at the opening low yesterday morning, and a potential double or W bottom setup that would target the 1411 SPX area on a clear break over 1391 SPX. That 1391 SPX level is also strong resistance at 1388 ES. Declining channel resistance is now in the 1417 area and dropping fast so a rally here could deliver a move to the possible DB target, and test both declining channel resistance and daily middle bollinger band resistance all in the same area:

There is a similar though much weaker setup on the NDX chart. That's weaker because the lower channel trendline hasn't held on an hourly close basis, and because the bounce from the low yesterday was significantly weaker. Nonetheless there is a similar setup there on positive RSI divergence targeting the 2670 area on a clear break over 2615. I'd be very doubtful about that pattern target being reached as it would require a break of declining resistance on NDX, which is very well-defined and strong. A break of that trendline should be a key indicator that the current overall downtrend has ended, or is at least bottoming out, and I don't think that's likely yet:

Looking at EURUSD this morning a bounce there already seems to be in progress. In a downtrend declining resistance tends to be well defined and unless there is a pattern or channel in play, there often isn't any declining support trendline at all. There is however a very well defined declining support trendline on EURUSD, and that is most likely part of either a falling wedge or declining channel where the upper trendline is not yet obvious.

If EURUSD is in a declining wedge of some kind then the bounce target could be almost anywhere, but if it is in a declining channel then there is only one likely place. I've marked that on the chart in thin red line and it's worth noting that will intersect with the 1.28 resistance area in a couple of days, making that an attractive bounce target for both price and time:

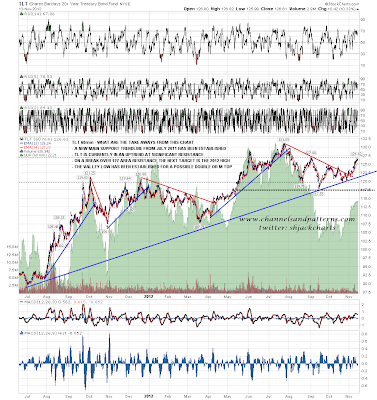

I haven't posted any bonds charts in a few days and that's because I haven't been getting a lot out of them in that time. I've had another look at TLT this morning, and on the 18 month chart there are a few points worth noting here. Firstly a new support trendline from July 2011 has now been established, and that's worth keeping an eye on. Secondly TLT is clearly currently in an uptrend, but is testing a significant resistance area around 127. If 127 is broken the next obvious target is a test of the 2012 high at 131.09. Thirdly in the event that TLT retests the 2012 highs, the strong decline from that previous high established a large possible double-top setup that would target the 104 area on a clear break below the September low at 117.55. 65% of possible double bottom or top setups never get back to the pattern trigger level, but that's well worth bearing in mind:

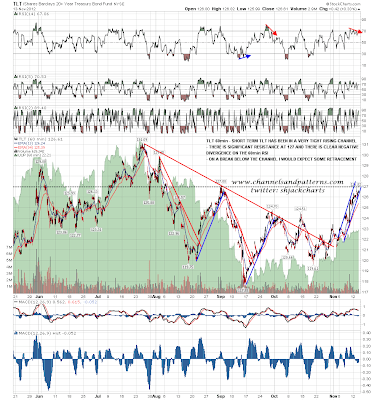

Looking more closely at TLT it has been in a very steep and tight rising channel over the last few days and is now showing clear negative 60min RSI divergence here just under resistance. We may well see a significant retracement here before (most likely) the next move up to test the current 2012 highs. On a break below that channel that retracement should have started and that retracement would obviously fit well with a bounce here on equities IF it happens:

Lastly today I have a chart showing a very nice multi-year short setup on the Japanese Yen, and this is an update of a chart I have shown every so often over the last couple of years as the Yen has ground relentlessly upwards. The rising wedge I have been watching has now finally broken down, a sloping H&S is forming, though that might yet evolve into a double-top, and looking at previous trend breaks on this 20 year chart,a multi-year downtrend on Yen from the current high now looks very likely. The economic fundamentals in Japan rotted away to rags and fragments of bone years ago so this is a really attractive looking long term short. For a good and fairly short summary of the disastrous mess the Japanese have made for themselves since 1990 there is a good article here. The setup on the monthly XJY chart is below:

A question for my readers today from this. What is the most cost-effective way to short the Yen over a multi-year period? Suggestions welcome 🙂

There is a decent short term rally setup here on equities. Will it deliver? I'd say that was 50/50 at best looking at the overall pattern setup and the very weak action since the high yesterday. If we see ES break up over strong resistance at 1388 however then the chances are that we will see at least a bounce into the 1405-10 SPX area.