Since Tim talked about precious metals, specifically the kooky idea of going long them, I thought I would do a follow-up to the volume hole entry SLV made a few days ago. My expectation at the time was for further declines, possibly down to $17.50. Well, Mrs. Market promptly slapped me upside the head with today’s surge across everything precious of the metal sort. I was stung enough to return to the chart and see what near-term outlook presented itself.

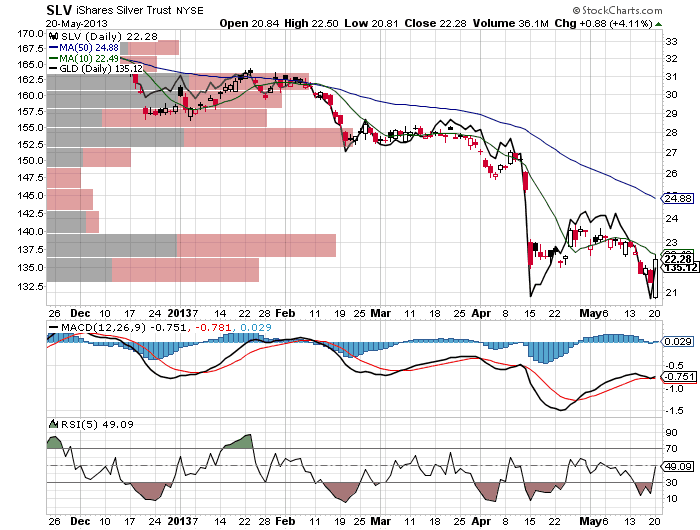

There’s a lot on that chart – SLV in candlesticks, GLD in solid black and a couple of moving averages for good measure. The gist here is that SLV slammed right into the 10-dma and into the second-longest volume pole, both of which were within pennies of each other. This portends weakness ahead. Plain and simple – and Mrs. Market will likely make me look like a fool for putting a line in the sand.

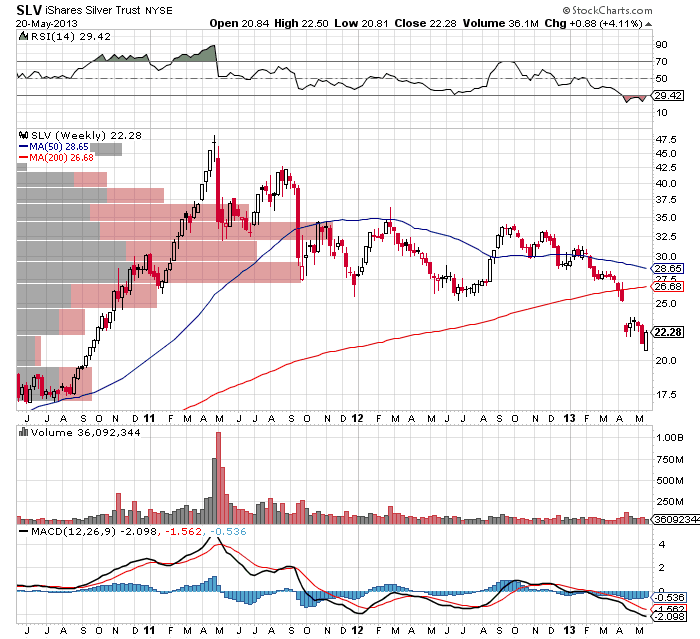

On a longer time scale, SLV looks like it isin no-man’s land, notwithstanding Tim’s argument about a gap-fill being in progress. The implication for SLV being that it will move up to $25 before experiencing more weakness. For a longer-term play, rather than a day-trade, $25 is technically a better entry level for a short.

Personally, I have been waiting for the SLV trade to come to me, either on the long side or the short, but neither has happened thus far. There are a few other plays that look ripe for the picking, at least more so than SLV.

Follow me at www.protectedreturns.com. Happy Trading!