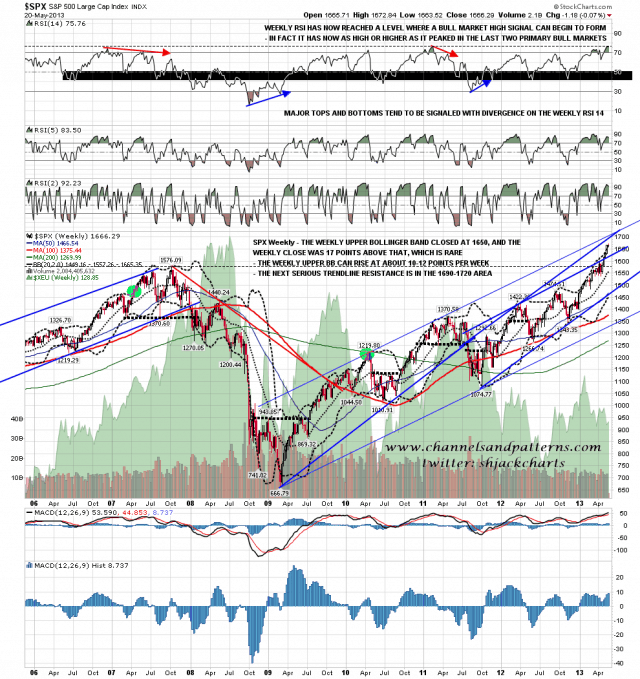

I was saying last week that punches well above the weekly upper bollinger band were a rare event, and I’ve been looking more at those this morning to see what happened after previous instances. Since the start of 2006 I have only found two instances of this and these were as follows:

– Q2 Start 2007 – Continued up 80 points into early Q3 first high 2007 bull market double top

– Q2 Start 2010 – Immediately preceded spring 2010 high made next two weeks

That’s not hugely helpful in this instance so I have looked further back, but here is the SPX weekly 2006-13 chart showing those punches:

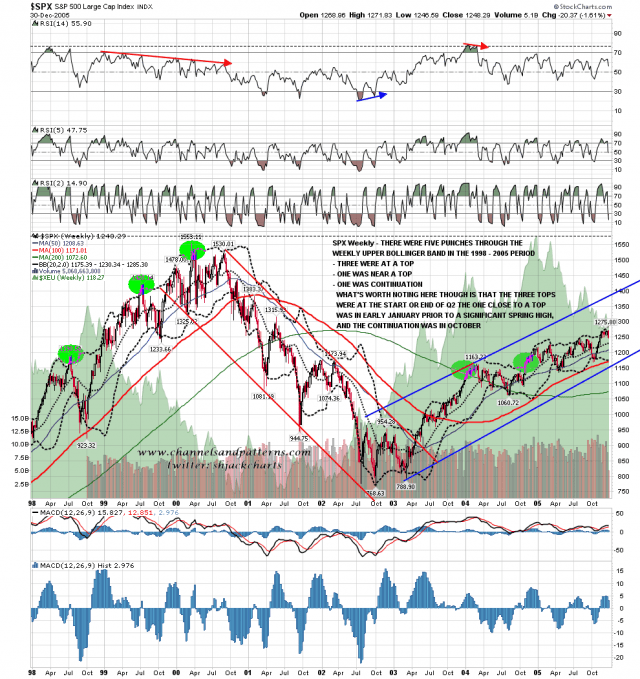

Looking at the the period from 1998 through 2005 I found five instances of similar punches and these were as follows:

– Q3 Start 1998 – At the 1998 interim top made over the next week

– Q3 Start 1999 – At the 1999 summer high made over the next week

– Q2 Start 2000 – At the 2000 bull market high

– Q1 Start 2004 – Rose another 40 points into the Q1 high over the next few weeks

– Q4 Start 2004 – Rose another 50 points into a resistance area not exceeded until Q3 2005

Now one thing you’ll note about all of these is that significant interim tops came fairly soon after these punches, and that the only instance where SPX rose more than 50 points afterwards was to make the first high of the 2007 bull market double-top. To an extent this is just stating the obvious, in that a market that has made the powerful upward move required to punch through the weekly upper bollinger band is likely to be close to a significant high, but it’s interesting regardless.

What I would add to that however is to say that if you screen these to select only the examples where the punch occurred when the weekly RSI was over 70, the list shrinks to the following examples:

– Q3 Start 1998 – At the 1998 interim top made over the next week

– Q1 Start 2004 – Rose another 40 points into the Q1 high over the next few weeks

– Q2 Start 2010 – Immediately preceded spring 2010 high made next two weeks

Of these three remaining examples, none were followed by bull market highs, but all were followed by retracements that tested the weekly lower bollinger band, currently at 1450, and the daily 200 MA, currently at 1480, with the exception of the 1998 retracement that tested the weekly lower bollinger band when the 200 DMA was a further 175 points or so lower than that.

In summary therefore, history suggests that we should see a significant interim top within the next 50 points or so, and may be making that top now. After the top is made the weekly lower bollinger band should be tested before the next leg up of this primary bull market from October 2011. Will this happen? I hope so, but it’s also worth noting that the Fed wasn’t pumping $85bn per month into assets on an indefinite basis in any of these previous examples. Here’s the 1998 – 2005 chart:

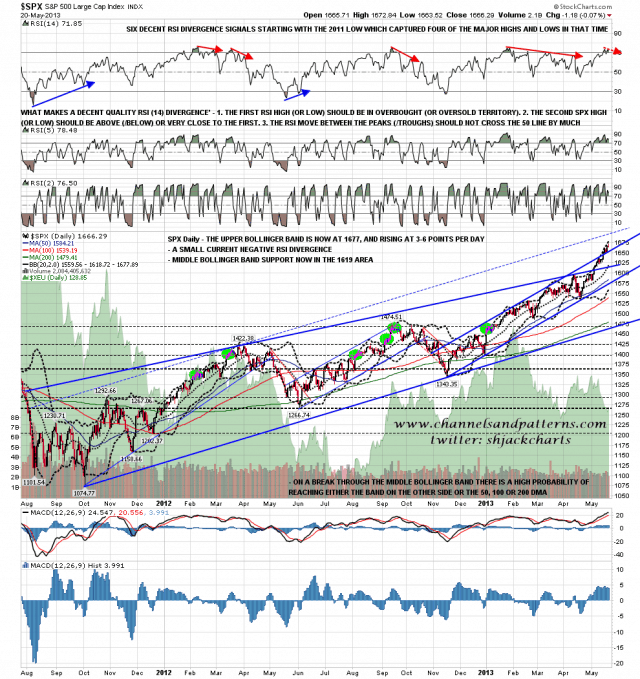

What are the chances that this interim top is right here? There’s not much to suggest it here on the daily chart, though there is a little negative daily RSI divergence. It’s also worth noting that the obvious reversal level would be the two resistance trendlines I’ve been mentioning in the 1690-1720 area. The lower of those is marked on the daily chart below:

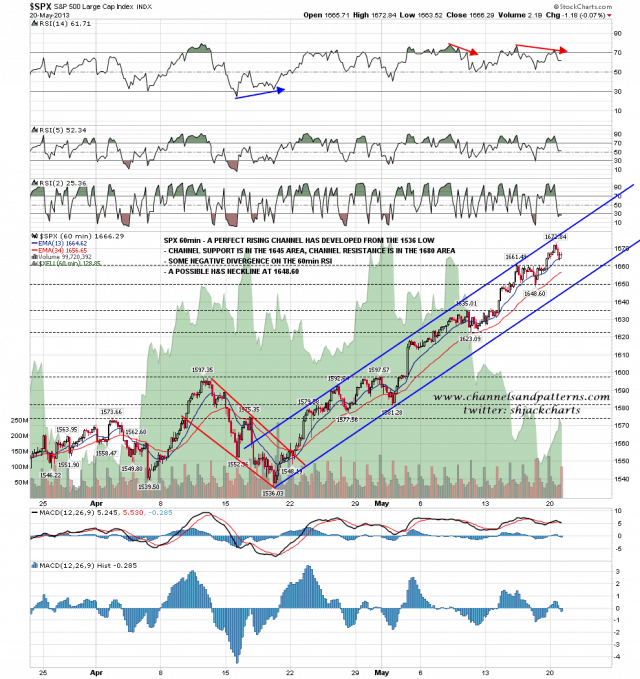

However, before any significant interim top there tends to be a practice spike down before the main high, and the prospects for that here are looking more promising. My rising channel on the SPX 60min chart is still holding, and there is now some decent looking negative 60min RSI divergence on this chart. I have a possible H&S neckline in the 1648.60 area, just above rising channel support:

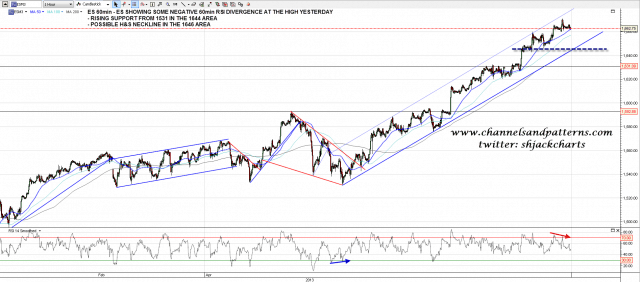

There is also some negative RSI divergence on the ES 60min chart at the high yesterday. There I have rising support in the 1644 area and the possible H&S neckline in the 1646 area. The 50 hour MA in the 1662 area has been tested extensively this morning but is holding so far. The prospects for some downside here will improve considerably if we see ES close an hour below that:

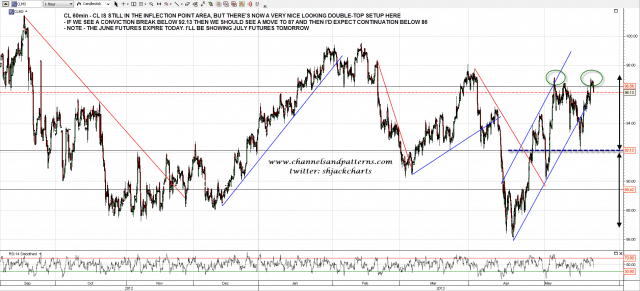

CL is still in the key inflection point area but there is now a promising looking double-top that may deliver. If we see a move below 92.13 the double-top target would be in the 87 area and I’d be looking for a move below 86. NOTE: I’ve charted this on the June futures which expire today:

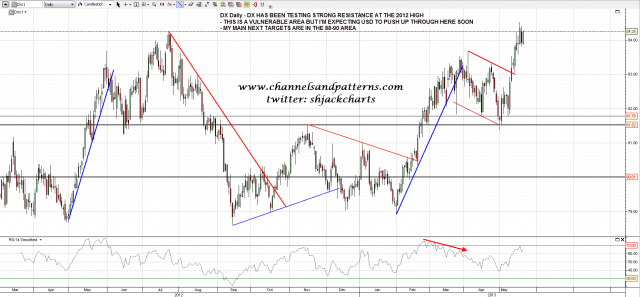

DX has been testing the area of the 2012 high, though that has already been repeatedly exceeded, and there is some vulnerability here. I would like DX to break this area with confidence soon and am expecting to see that happen:

This move up from November has been so strong that I am now considering seriously the possibility that we won’t see a decent retracement (and buying opportunity) on equities until QE Infinity is scaled down. If that isn’t the case then the historical case for a significant interim top soon is a strong one. We’ll see how that goes. That case would be strengthened by a smaller reversal soon as we generally see one of those not far from a significant interim top.