Fellow Sloper Trades shares his thoughts on currency markets here…….

While still speculation at this time, a significant move could be setting up in the currency markets. If everything goes right (and there is a checklist), some serious coin could be made going long or short various currencies. However, it should be recognized that this view runs counter to the consensus.

If one looks at the $USD index (around 2PM, June 6th), there is the potential for the index to come down to match the previous lows around 81.75. This would form a neckline around 81.75. If the $USD went on to form a right shoulder of a potential Head & Shoulders, the resulting move would be from about 83.35 down to 79.00 if it penetrated the neckline

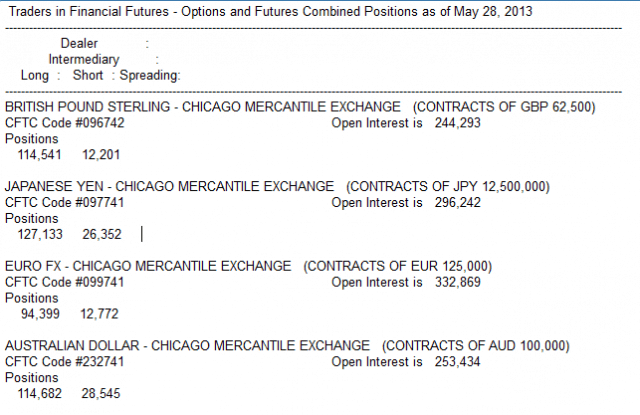

So why is there reason to believe such a move is in the cards? As one can see in the Commitment of Traders, the commercial hedgers are very long the Euro, Yen, British Pound and Aussie Dollar. More often than not, the commercial hedgers usually get their way and extract their pound of flesh.

So let’s look at each of these currencies for the potential they hold, starting with the Euro. We can already see that the Euro has a positive divergence in the MACD and is currently acting out the positive divergence. Let’s say that when it reaches 132 (about the same time the $USD hits the 81.75 neckline), there will be a reaction back down (thus forming the right shoulder in the $USD). The question remains, will the commercials still be long the Euro at that point or will they have cleared their positions? If they still hold significant Euro long contracts, they may take the Euro back up through 132 and penetrate the 81.75 neckline in the $USD.

But as you can see, there are a lot of “if’s”. Do not guess what will happen. Monitor the commercial positions and the technical (i.e. MACD and RSI for starters) to increase your odds. They may even wear you out with back and forth movements. You never know.

Now how about the British Pound? Again we see a positive divergence and again it is acting it out. What if is fills the gap at 154.50 and backs off (again helping to form the neckline and the right shoulder in the $USD)? The same questions must be asked as with the Euro. What are the positions of the Commercials at that time? How are the technicals holding up?

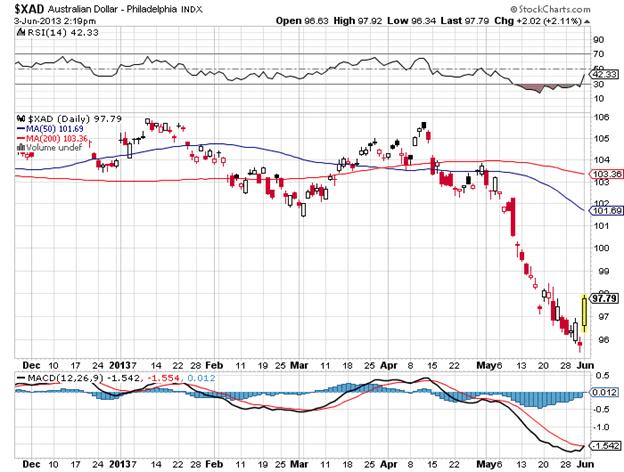

Next the Aussie Dollar. Here we see an oversold bounce. After the bounce, will $XAD back off and form a second bottom with a positive divergence? Will the commercials still have large positions of long contracts?

And finally the Yen. The possibilities off bouncing off the 50 MDA and forming a second bottom with a positive divergence are there. Again, check the Commercial positions and technical.

In summary, maybe, just maybe, a lot of small pieces in a large complex puzzle will come together to form one big picture and a significant profit producing situation. Just be warned, things never happen quite the way you think they might.