Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Retracement Levels and ProphetCharts

A lot of you have been taking advantage of the ridiculously low price being offered to Slope of Hope readers for Retracement Levels. I want to emphasize that this offer is only on Slope. Indeed, the owner of Retracement Levels is very sensitive to the fact that the discount is so big, so it isn’t mentioned anywhere on his site or subscription page, although he says it’s OK for me to mention it here. (In case you missed the mention, it’s normally $1250 per month……….but you can chop off the “$1200 part” since you’re on Slope. In other words, it’s fifty bucks a month.) You can click here to get to the subscription page, and you must click the “SOH Offers” checkbox in order to get the 96% discount. Unless, of course, you’d rather pay full price. Please note you do not have to enter a coupon code; simply checking the checkbox will give you the cheap price.

A Matter of Perspective

Well, so far today the market is rolling forward As God Intended, and I sold my SPY, thanked it very much for its profit, and am pure bear again. One of my positions is Aeropostale, symbol ARO. Looking at the 10 year daily chart, which is my usual perspective, I was wondering if it was “bottoming out”………. (more…)

Oh, Yes. Come To Butthead.

So Now What?

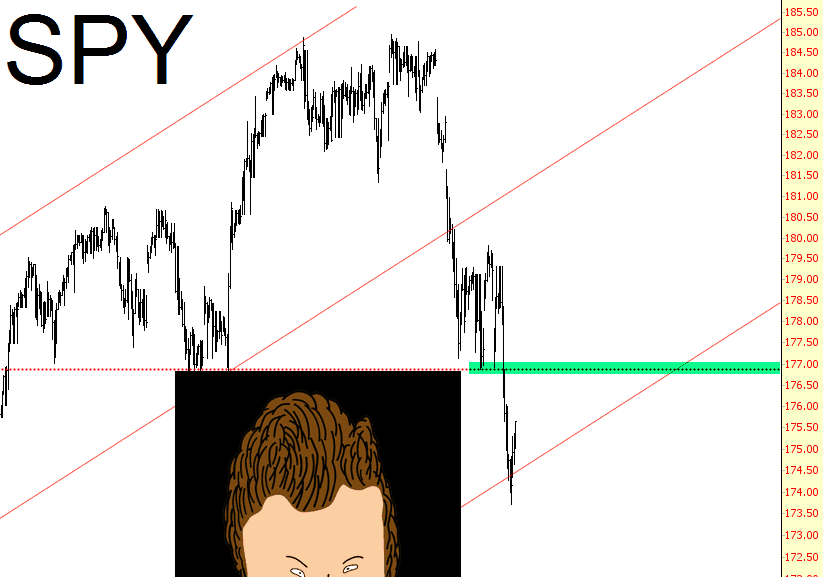

Well I said yesterday morning that the day was going to be a very important test for bulls and so it was, with a massive bull fail as strong support in the 1770 SPX area broke and SPX fell very hard towards the next big support levels. I posted a falling wedge on ES yesterday morning and that broke down with a target in the 1720 ES area. The overnight rally looks a lot like a bear flag so it may be that we are going to see that 1720 target made today. ES 60min chart: (more…)