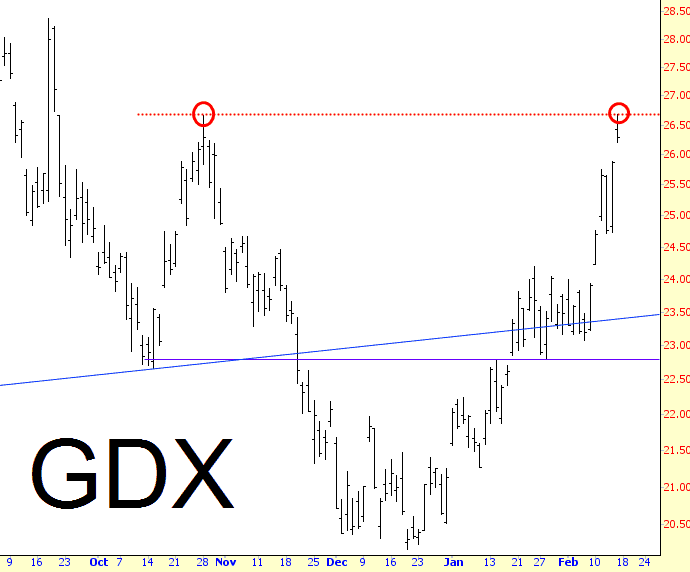

Gold is Monetary Value

We preface the post with a statement that has not changed since I began public writing nearly 10 years ago: Gold is not about price; gold is about value. This point was hammered home to me 11 years ago by a person who had much influence upon my viewpoint toward the financial system and its various diseased components at a time when I was ready to listen and understand. (more…)