Well, I was saddened to hear that Bob Casale (Bob #2) of Devo died. And, as with our beloved BDI, it was from heart trouble (BDI is, mercifully, still with us). I’ve put one of the coolest Devo videos of all time at the bottom of this post as a tip-of-the-power-dome to Bob. (more…)

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

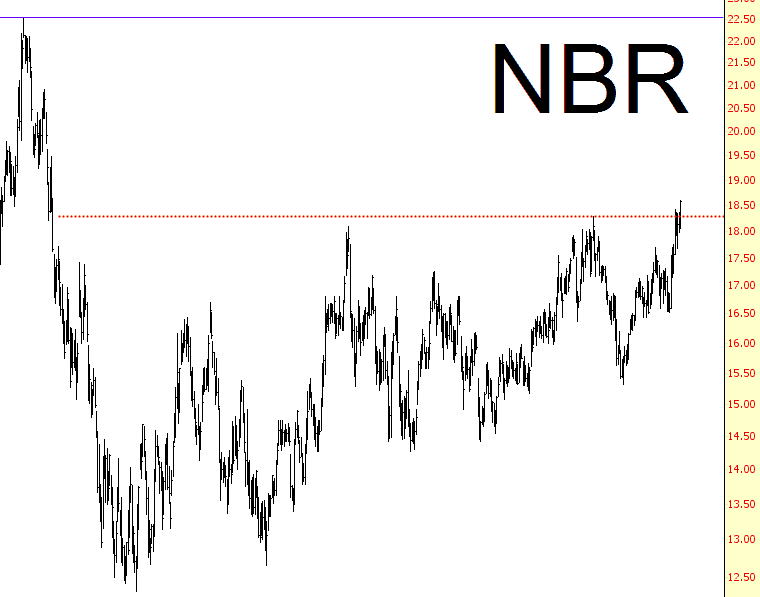

Friend and Nabor

I really meant to post this before the close (honest! honest injun!) but I didn’t. Anyway, this is one of those rare times I feel so bullish about a stock that I’m not only selling naked puts on it, I’m also buying calls. With earnings out after the close, and the stock bumping up 3% right now in reaction, it looks like this is going to pan out (considering the quantity of naked February $18 puts I’ve got, I certainly would hope so). Anyway, NBR looks like a squeaky-clean breakout above its triangle pattern.

Swing Trading Watch-List: BBY, BBD, CYH, BX, BIDU

Or Else What?

Watch the clip below, then read the article that just came out this weekend, and try to discern any difference between an outrageous spoof and reality. (Answer: there is none). (more…)

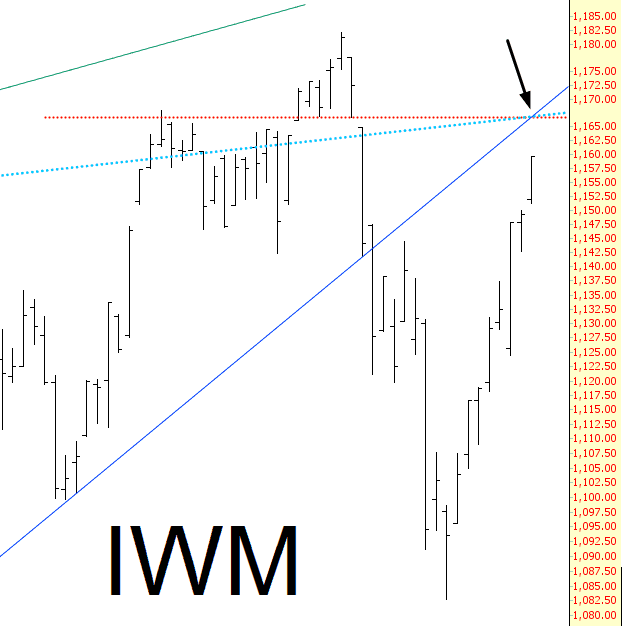

Triple Convergence

I realize that ten days in a row of “up” in a market can put the zap on one’s brain, but I’d like to quietly point out that the Russell 2000 is lurching toward a triple-crown of resistance: first, a gap fill; second, the underside of the intermediate-term trendline from November 16, 2012, and third, the underside of a long-term trendline from March 10, 2000. So, errr, if you still want to buy because Yellen thinks it’s a swell idea, there’s nobody to stop you. Go nuts.