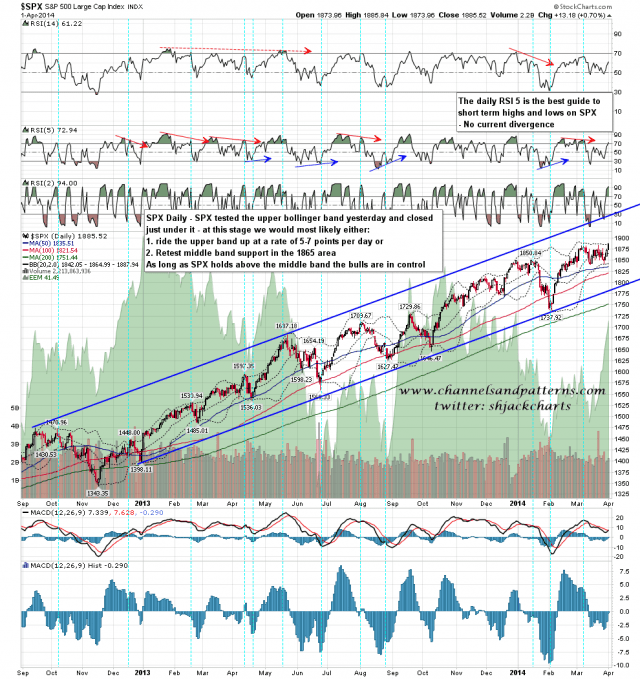

The bulls had a good day yesterday as expected and tested the daily upper bollinger band, closing effectively at the upper band. There are two main options here and the first, if this is a strong breakout, is that SPX would ride the upper band up at 5 to 7 handles per day for several days. The second is that we see some retracement here that might well retest the daily middle band, now in the 1865 area. SPX daily chart:

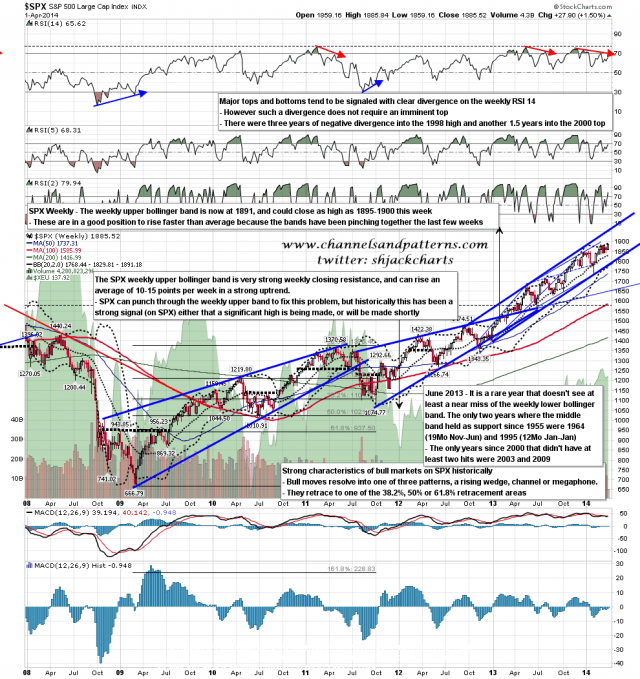

The weekly upper band is strong weekly close resistance and slower moving at an average 10-15 points per week, but is could close this week as high as 1895-1900 and next week as high as 1910-15. There is therefore room for SPX to ride the upper band up if that’s the way this goes. SPX weekly chart:

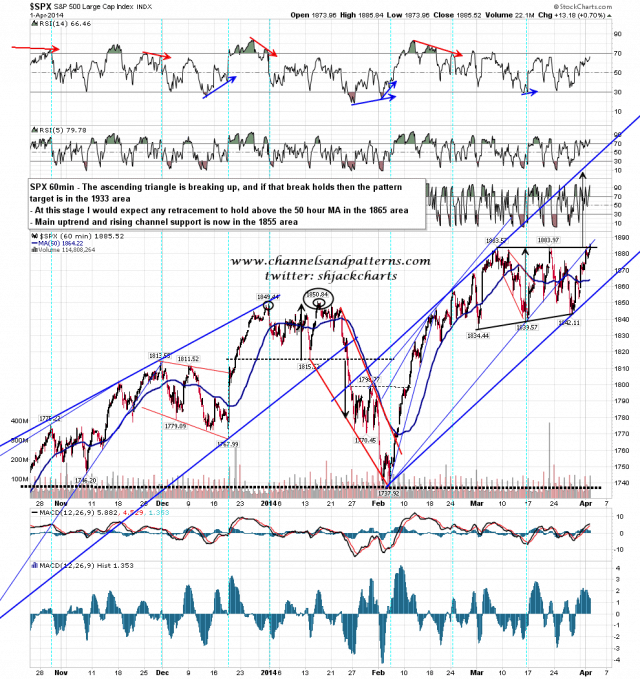

On the SPX 60min chart there was a slight break above the ascending triangle yesterday afternoon, but not a confident break as yet so we could still be at the top of the trading range. If so, key support is at the 50 hour MA, now in the 1865 area and strengthened by the daily middle band in the same area. If we are watching a break up I would expect that level to be strong support now. If that breaks then rising channel support is in the 1855 area, and if that breaks then the bears get another shot at breaking support at 1839/40. SPX 60min chart:

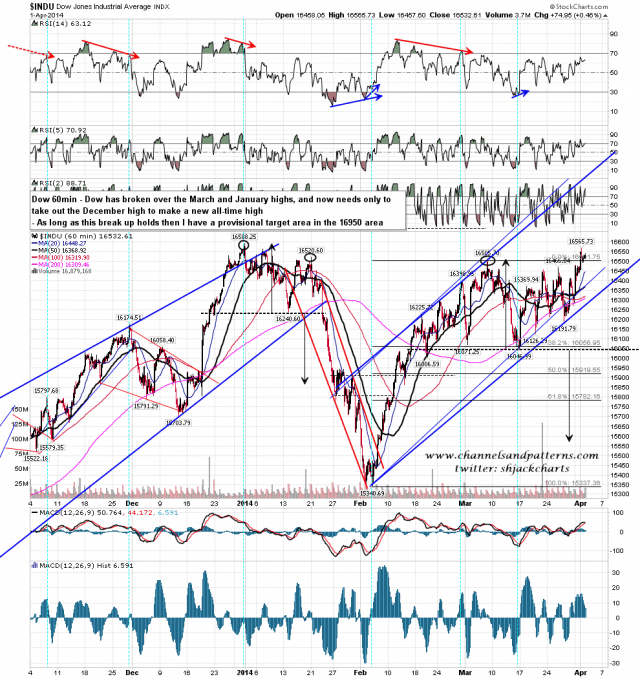

Dow also had a good day yesterday, and broke the series of lower highs from the December high, taking out the March and January highs in yesterday’s move. Dow is close to testing the December and current all time high. Dow 60min chart:

Key support on SPX is now in the 1865 area at the 50 hour MA and the daily middle band. As long as SPX stays above there then the bulls control this tape, and the only questions are how fast we will move up and where this is going next. Buy the dip as long as SPX stays over 1865.