Back in March 1995, my wife and I flew down to Austin to attend the wedding of a friend. While  there, I went into a grocery store (probably to get us some snacks) and was amazed. It was the first time I had ever been in a really nice grocery store. Sure, I had been in places like Safeway dozens of times, but this one was really……….nice. This was years before chains like Whole Foods were well known. I don’t remember the name of the small chain down in Austin, but everything was so well-organized, tasty looking, and clean. I never wanted to set food inside a Safeway again. (more…)

there, I went into a grocery store (probably to get us some snacks) and was amazed. It was the first time I had ever been in a really nice grocery store. Sure, I had been in places like Safeway dozens of times, but this one was really……….nice. This was years before chains like Whole Foods were well known. I don’t remember the name of the small chain down in Austin, but everything was so well-organized, tasty looking, and clean. I never wanted to set food inside a Safeway again. (more…)

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

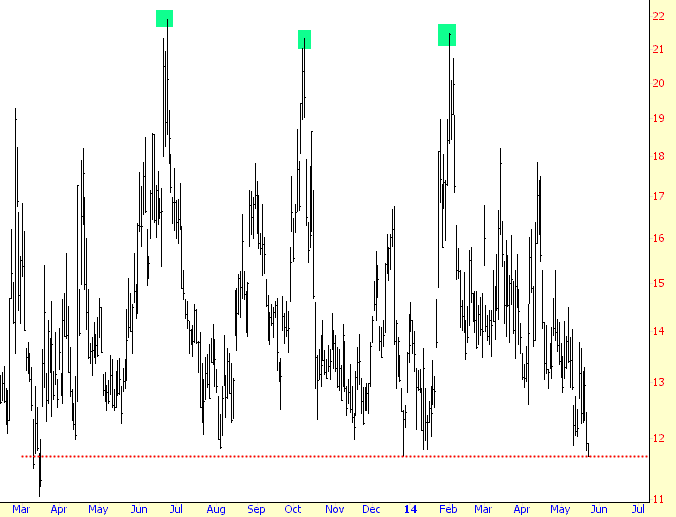

VIX Pricks

Langorous placidity reigns o’er the land. The “bursts” of panic, marked with green tints, seem fairly regular, and if I may dare say so, we’re due.

For-Profit Education Bombs Again

From early 2009 to early 2013, for-profit education firms (the kind that you see advertise constantly on daytime television, such as ITT Technical Institute) were getting firebombed. It was one of the few sectors that was persistently weak during the roaring bull market. Weirdly, these stocks recovered mightily through 2013 and into the beginning of this year. Why, I’m not sure – – perhaps a naive notion that these firms could “retrain” workers for better jobs? Who knows. In any case, the bear market in this sector has returned with a vengeance.

Swing Trading Watch-List: TIBX, TER, OVTI, CTSH, EXH

SPX:VIX Ratio ~ Pushing it to the Limit

Further to my post of May 8th, we can see from the following Monthly, Weekly, Daily, and 60-minute charts of the SPX:VIX ratio, that the bulls are pushing the SPX to the limit, in terms of major resistance on the price ratio, as well as the Momentum indicator.

In spite of the new price-ratio high reached today (Wednesday), momentum has yet to confirm any bullish breakout on all four timeframes…one to watch closely over the next few days. In any event, any breakout may be short-lived, in order to relieve an overbought situation at historically high levels in momentum.