Many people would consider a drop in the S&P 500 to the 1550-1600 area to be a bad thing. But if the bull is real, and if a secular bull market truly has been created out of manipulation of the T bond market (QE’s bond buying and ZIRP’s 0% rates) then a pullback to test that zone would be normal, would it not? It would feel bad but in reality a successful test of the big breakout would launch the grand new bull. SPX has to drop down to test support sooner or later, doesn’t it?

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Memorial Day Bar

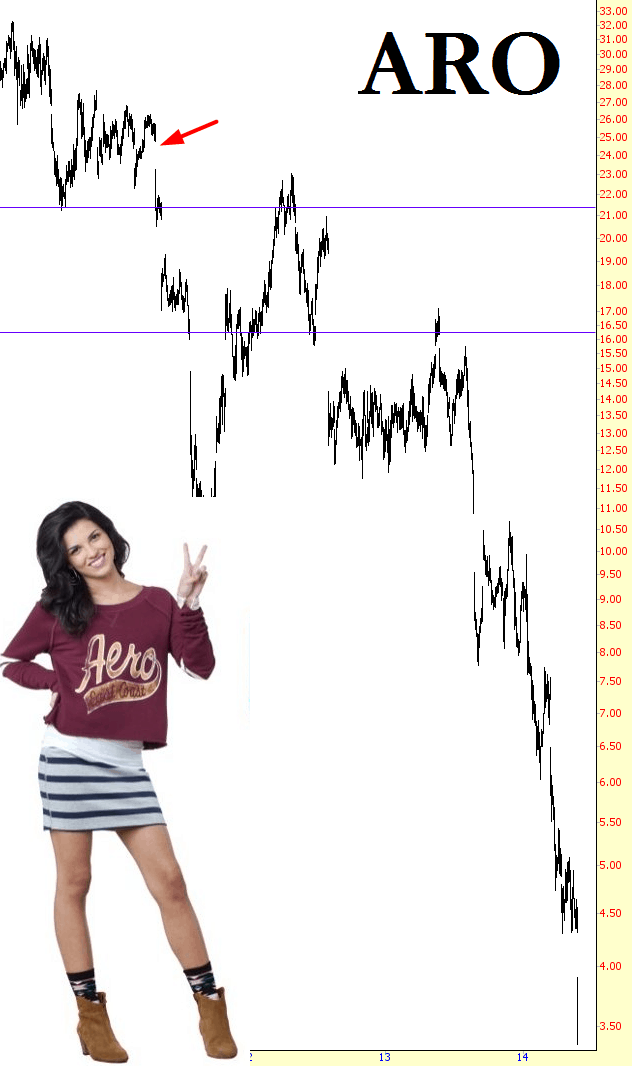

Aero to the Knee

I have been writing snarky posts on Aeropostale since I first shorted it in May 2011 (noted with an arrow below). There’s firm support at $0, obviously, but it just goes to show that, even in this day and age, some downtrends can actually persist.

Swing Trading Watch-List: KORS, LAZ, URI, KEY, HP

To Go Where No VIX Has Gone Before

The rather ridiculous truncated graph shown below seeks to make a point. I am showing the kind of depths the VIX presently is in, and how infrequently it has “lived” there. In fact, for over six years, this is practically uncharted territory. Back in the days of the housing buble, the VIX found itself comfortably around the $11 to $12 level (and, on one occasion, even cracked beneath $10), but, let’s face it, this is a level of complacency virtually unknown to the markets………