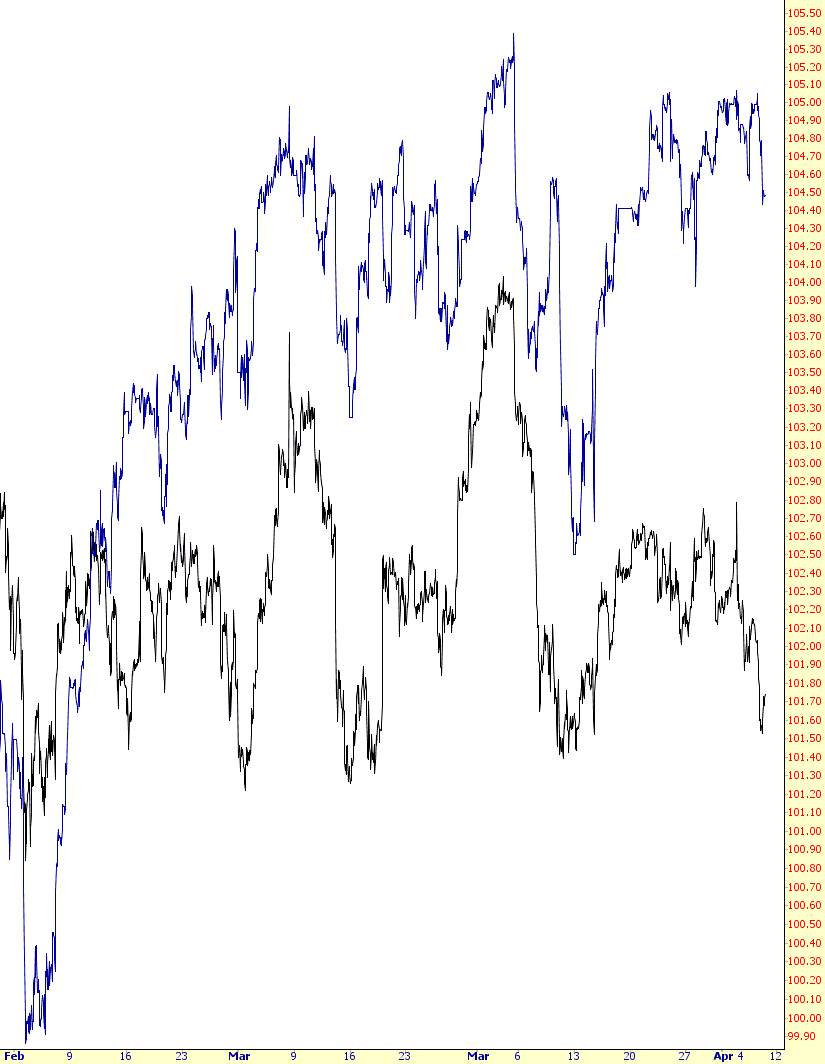

Uber-Sloper BDI wrote me to make note he was watching the US dollar most closely. I decided to take a peek at the cross-rate which has been so important to equity strength, USD/JPY, and compare it on an intraday minute bar basis to the ESM4. I’ll say two things: (a) the US Dollar does indeed seem very vulnerable to a pretty major downturn; (b) The ES has some catching-up to do on the downside! In the chart below, the ES is blue and the USD/JPY is black – oh, whoops – I mean – “a cross-rate of color.”