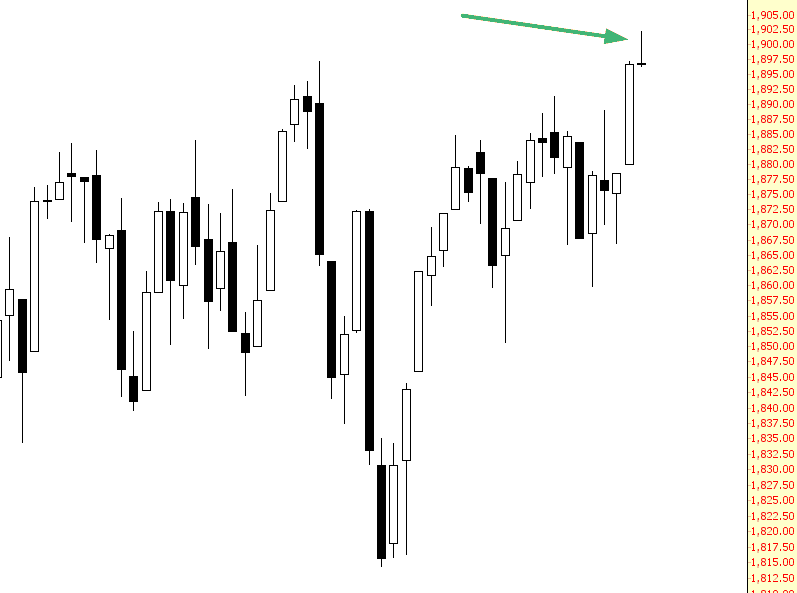

The market continues to teeter at the top.

Approximately 58.5% of the ETFs we follow in the daily options blog are in a short-term extreme state at the moment. Typically when we see levels this high a short-term reprieve follows.

One of the reasons the ratio is above 58% is the international ETFs. All of the highly-liquid international ETFs we follow are in a short-term extreme. India (EPI) is by far the most overbought at the moment, but it’s actually the emerging markets ETF (EEM) that has drawn my attention. (more…)