‘A quarrel in a faraway country, between people of whom we know nothing’

Neville Chamberlain, PM of Great Britain, talking about Czechoslovakia in 1938

Back in 1963 there was an significant milestone in the transition to modern warfare when the the name of the British Ministry of War was changed to the Ministry of Defence. Many other euphemisms about war have been used since then with ‘police actions’, ‘military advisers’ and many others becoming common.

At the same time the absurd situation arose, as the age of empires passed away and the British Empire was dismantled, that the only two remaining true empires, based in Russia and China, posed as anti-imperial powers, with the pejorative description ‘imperialist’ mainly applied by them to Western Powers who had already lost or given away their foreign territories.

Fast forward fifty years and this absurdity has survived even the worldwide collapse of Communism, and with it the ideological basis for arguing that Russian and China were not imperial powers. Separatism in Chechnya was put down by Russia with a brutality that was strongly reminiscent of Nazi Germany dealing with slavic untermensch. The half of Chinese territory that was dominated by ethnic Tibetans, Uighurs and Mongols is kept in line with harsh repression and long term policies of moving enough Han Chinese out into them to swamp the indigenous population and thereby ensure that these Chinese colonies can never be separated from Han China in the future. These things are a running sore in the world, but are obviously just some of the many terrible things that make the world outside the democratic industrialised part of this world that we live in so dangerous and cruel.

What we are seeing now in Ukraine is a very traditional imperial land grab. Russia had a workable argument for taking back the Crimea. It was a historical oddity that had left it in Ukraine at the collapse of the USSR, though Crimea had only first been annexed by the Russian Empire in 1783, and the treatment of the native Tatars first by Russia and then the Russian-dominated USSR makes for some really very grim historical reading. Still, it could reasonably be argued that taking back Crimea was as justified as Nazi Germany taking back the ethnic-german dominated parts of the Sudetenland, which was what Hitler was originally demanding in 1938.

What we are seeing in Ukraine now is akin to Germany demanding the remainder of the Sudetenland that was not majority German later in 1938, something that Neville Chamberlain allowed and justified with the infamous appeasement quote at the top of this post. Russian-armed and backed separatists have started a civil war in areas of eastern Ukraine with large Russian populations, and Russian troops are massing on the border as a threat to the Ukrainian government in the event that they try to used force to regain control of their territory. Pro-russian insurgents are calling for them to invade under the euphemism ‘peacekeepers’, and for Ukraine to be effectively partitioned under the euphemism ‘federalism’.

How will western powers respond to this? Well the traditional response to Russian and Chinese imperial aggression and genocidal policies has been to try to ignore them and describe them as something else,and that may well happen again here. The problem here however is that this is right on Europe’s doorstep, and it is therefore harder to pretend nothing of importance is happening. The history and ethnic composition of Eastern Ukraine is also uncomfortably close to that in the Baltic States Estonia, Latvia and Lithuania, all formerly Russian imperial (USSR) possessions and now independent members of both the EU and NATO.

What’s the takeaway here? Euphemisms apart, Russia has fomented a civil war in the Ukraine, and may well extend that into full annexation of the areas that have large Russian minorities, and possibly military domination of the remainder of the country that doesn’t. Given that Russia is ruled (contrary euphemisms notwithstanding) by a nationalist dictator that has made clear his view that the breakup of the USSR was a tragedy, the parallels with the Czechoslovakian crisis in 1938 are uncomfortably close.

Meanwhile back on the US equity markets we are seeing large part-formed topping patterns on equity markets, are now in the weaker half of the year, and are in the part of that weaker half of the year where significant highs are most often made. With the right trigger equities could fall hard this summer, and if the situation in Ukraine deteriorates then we may not have to wait long for such a trigger. At the least this is not the time to be married to long equity positions.

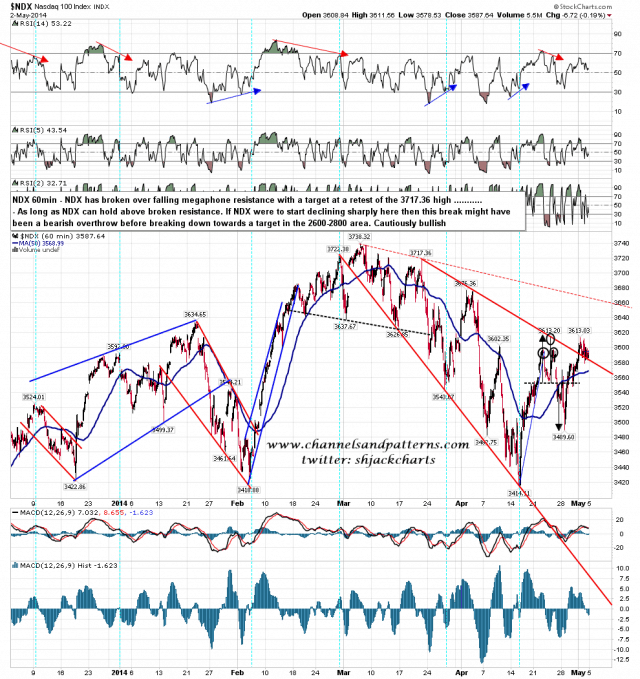

The most important chart to watch here in the short term in my view is the NDX chart. The break above falling megaphone resistance last week has a target back at 3717, and if NDX makes that target I would expect that to carry SPX and Dow to new highs. There is still a danger however that this break could be a bearish overthrow before that falling megaphone reverses to break down, and I’m watching to see whether NDX can hold above broken megaphone resistance. If it can then great. If it can’t then the very bearish overthrow scenario needs to be borne in mind. NDX 60min chart:

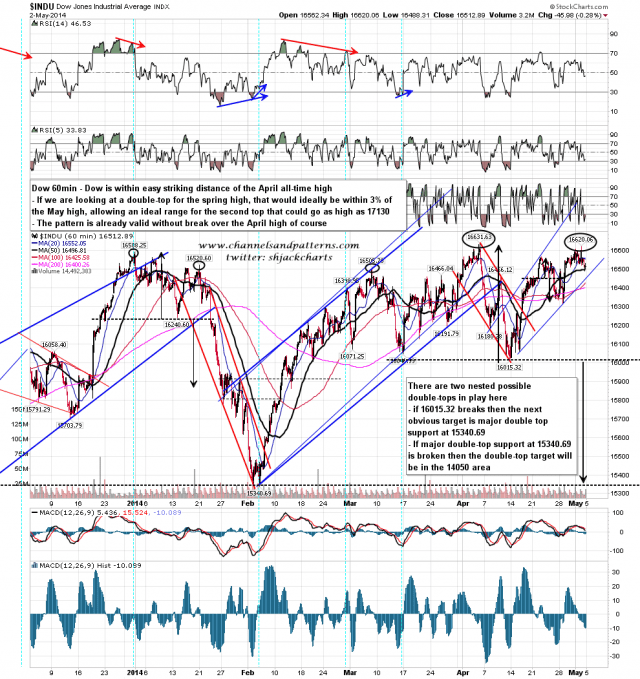

If the setup on NDX resolves bullishly then Dow should make new all-time highs. If that doesn’t happen then there is a model topping scenario on Dow here with nested double-tops that would target the 14100 area on a break below 15340. Dow 60min chart:

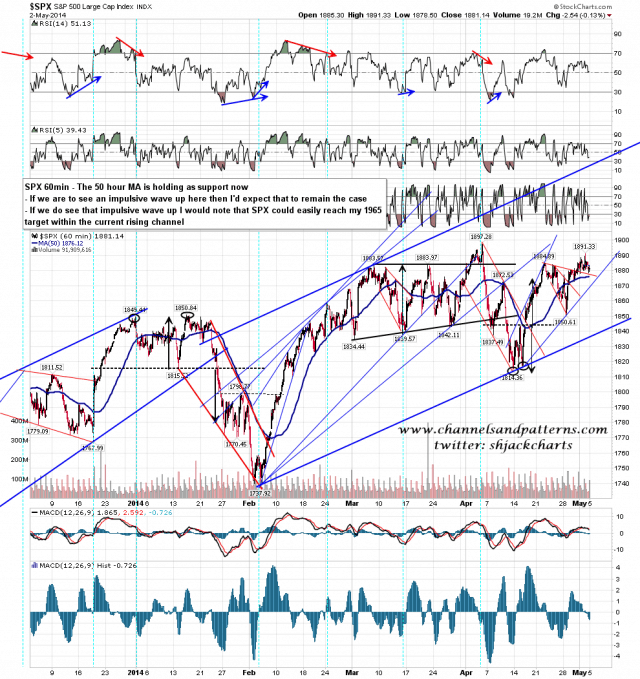

ES has been weak overnight, and if that extends into trading hours then there are two very important support levels to watch on SPX. The first is the 50 hour MA, currently at 1876, which wasn’t tested on Friday but would be broken at the open in the event that ES can’t recover over 1870 by then. This support should not be broken in my view if a new impulsive wave up has started, so a break below would make that much less likely. SPX 60min chart:

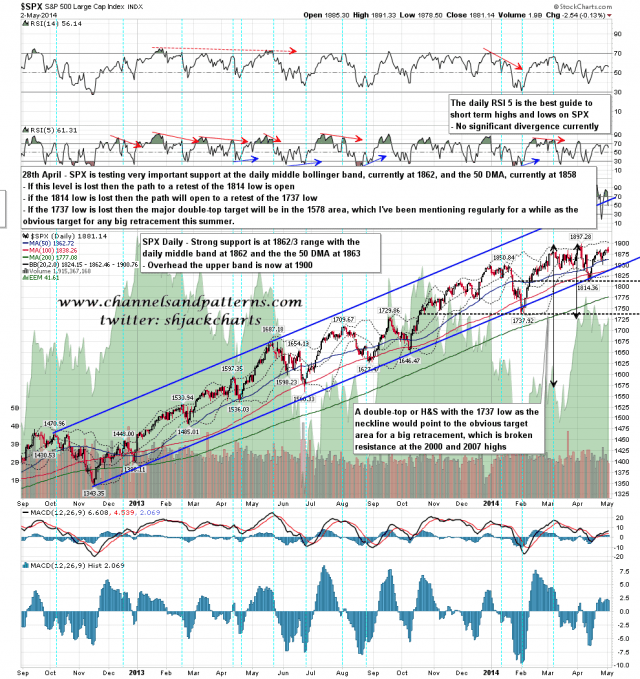

If SPX breaks back below the 50 hour MA then the next level of strong support is at the daily middle bollinger band and the 50 DMA, both now at 1862. These should be very strong daily closing support, though we could see an intraday break below. if we see these break on a daily closing basis, I would be thinking that a the spring high had more than likely now been made. SPX daily chart:

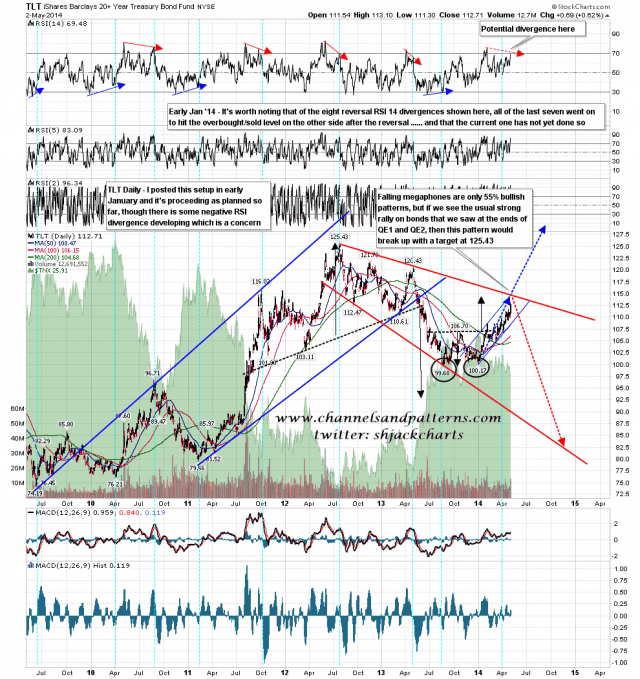

I was chatting to a currency trader friend over the weekend and the subject of bonds came up.He remarked that the current rally on bonds was all the more more impressive because no-one could see it coming at the start of 2014. I referred him to the TLT chart that I posted in January with my projection of the likely path for TLT in 2014, and on that chart I drew a rally into the 114/5 area in this month, and then either a break upwards to test the 2012 high, or a reversal back down towards the 2011 low. With the Fed tapering QE3 at speed, I’m strongly favoring the bull scenario, and with the TLT high on Friday at 113.1, the point of decision is approaching fast.

Just to mention, if we do see that bull scenario play out, then I would expect that retest of the 2012 high to very possibly make the second high of a very large double-top that would then target a retest of the 2009 low at 74.19, so if this bull scenario plays out that may well be setting up the most interesting trade of 2015/6. TLT daily chart:

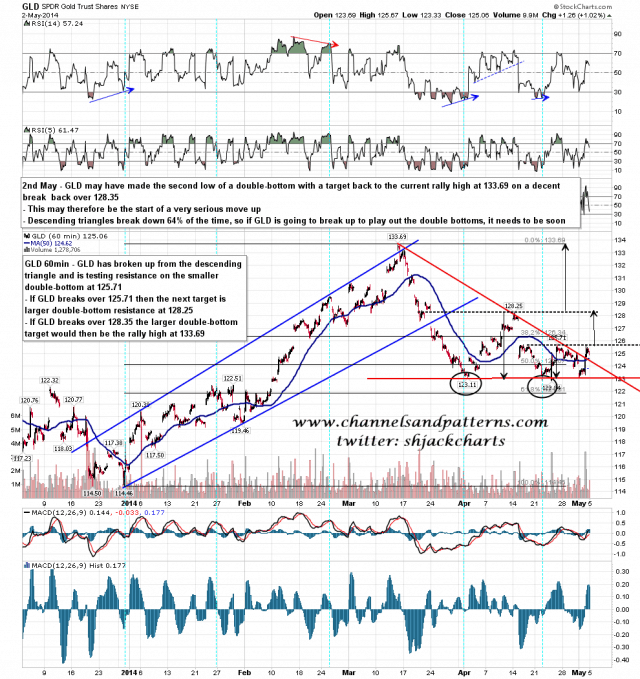

So what may be the most interesting trade of 2014? I’ve been saying on and off all year that my prime candidate is gold, and we may now be starting the serious move up that I’ve been looking for the last few months. I posted this GLD chart on 7th January and on the smaller GLD chart I was posting last week I showed nested double bottoms that could play out to trigger the much larger double-bottom on that earlier chart. On gold the overall move would be from here at 1300 to about 1700, and if that 1700 target was made then the bear market on precious metals should be over and new all-time highs in sight. GLD 60min chart:

I’m going to try to find time to put out a dedicated post on precious metals later today showing the three very nice related long setups on gold, silver and GDX, as this is a key inflection point here, and I think they may well break up hard in the very near future.

The historical stats for the first three days this week lean strongly bearish, and the ES action overnight is leaning bearish as well. If we see a gap below the SPX 50 hour MA at 1876 this morning then we may well be testing key resistance at 1862 SPX shortly thereafter. If that fails then the spring high may well be behind us. Until that breaks though, that would look like a decent buy the dip opportunity.