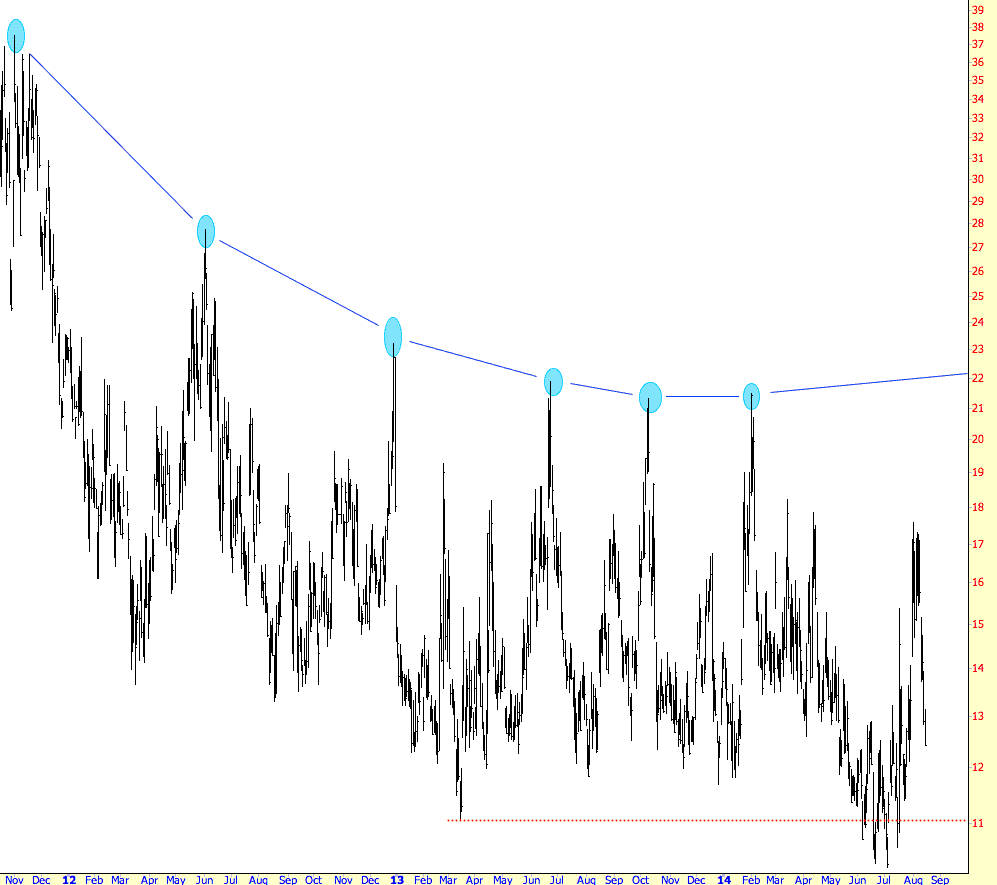

My beloved son finally returns home tonight, so I’m going to be involved in that happy homecoming – – – but before I get into that, I just wanted to do a short, sweet post about this chart of the VIX, which I’ve sexed up with a few lines and circles:

I realize there are plenty of people who think that the modest dip we got late in July and early in August was “it” – – in other words, after a very long dry spell, the bears enjoyed about actually two whole weeks (whoopee freakin’ do!) of a down-market – – – and, bidabang bidaboom, that’s all they’re gonna get.

Well, I’ll say two things: first, congratulations to those who very correctly judged the “oversold” nature of the market last Friday and bought it. They’ve obviously done quite well for themselves, and who knows, maybe this countertrend rally still has a bit of strength left.

But – – my second point – – as the chart above suggests – – I don’t think that little dip was “it”. To my way of thinking, we are “due’ for a lift in the VIX to around 22, or maybe a touch under, to mark the end of any meaningful intermediate-term diminishment in equity prices. We got up to 17, but now we’re sub-teens (again!) so, simply stated, I’m going to keep holding fast and, where appropriate, augmenting existing short positions. As one Sloper suggested, perhaps those like me (including me!) are on a never-ending Quixotic quest. Heaven knows where we went wrong: Don Quixote or Donkey Kong.