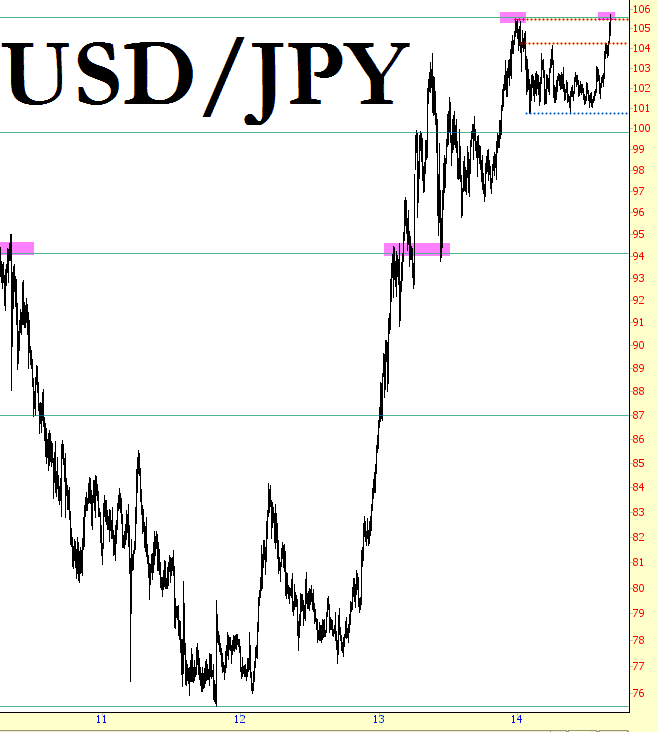

It seems the key cross rate driving the US equity market (for years, it seems) has been the dollar/yen, so I’ve been watching the Fibonacci retracements with interest. The USD/JPY was strong enough earlier to inch just past the present retracement level, but………….

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

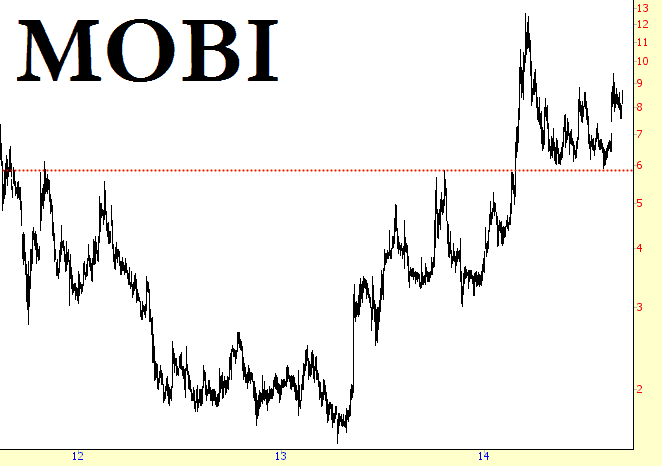

More Mobi

Before the jobs report came out this morning, the ES was down hard, but it seems today is the upside-down version of the other days this week (e.g. big move in one direction, then spends the whole day going the opposite). Given the market’s resurgence, I guess I’ll limply offer one of the few charts that still looks bullish (without having too far yet, such as, for instance, CENX).

EZ Listening Trading

I offer this up for three reasons: (a) it’s a lovely song; (b) it’s a clever video; (c) Diana Krall is a babe.

SPX Daily Sell Signal

A daily RSI5 and NYMO sell signal fixed on SPX yesterday. I haven’t had enough time to run the performance on these back to the start of 2007 yet, but as there are eleven signals going back to the start of 2012, all in one of the most powerful bull runs in history, that’s a decent sample to use today.

The signals have a target at the 30 level on the daily RSI 5. Of the eleven previous signals eight went directly to target with retracements from high to low of 38, 55, 147, 55, 127, 45, 113 and 87.

The other three signals (all in 2013) reversed at or slightly below the 50 level on the RSI 5, made a marginal new high on continuing negative RSI and NYMO divergence, before turning back down for a larger retracement to a low below the first low. Two of those made it to the 30 level target, and the third made it to 34, just short. The retracements from the signal (first not higher) high to the low were 30, 25, 127. (more…)

Bearish Trade Setups If The Market Can’t Hold It Together

Apple (AAPL) pulled back hard yesterday and with it is trying to take the Nasdaq down as well.

But the market has not reached a point where it is time to flip to the short side. You have to wait for price to confirm the sentiment no matter how strong that sentiment might be.

But for now, I’ve put together the current list of bearish trade setups that should be considered this week if the market decides to start some acceleration to the downside.

Here is the bearish list of trade setups:

Be sure to checkout more of Ryan’s Swing-Trades at SharePlanner.com