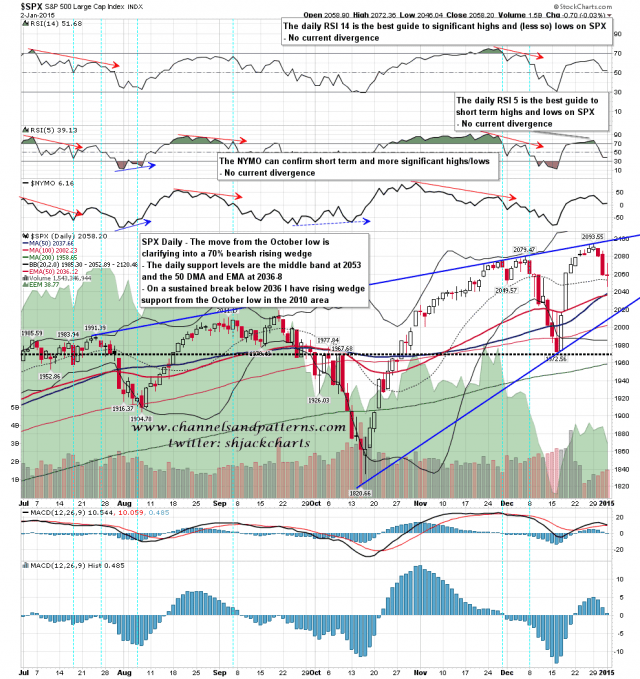

SPX tested and held the daily middle band on Friday. That closed at 2053 and if that is broken with any confidence today then the next decent support is at the daily 50 MA and EMA in the 2036/7 area. If that breaks then the very obvious target will be rising (wedge) support from 1820 in the 2010 area. SPX daily chart:

In all honesty I’ve been expecting a reversal back up to at least retest the highs before a larger move down started. That doesn’t have to happen of course and I’m starting to wonder if it will.

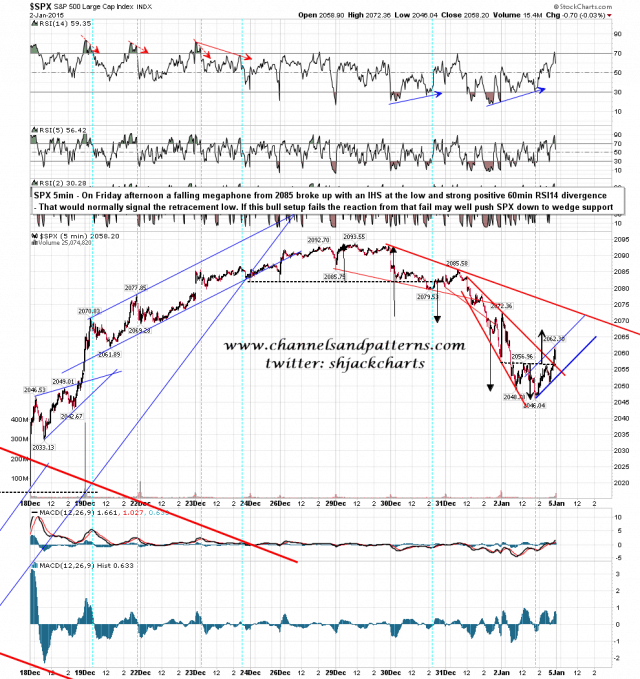

There was a very nice reversal setup building on Friday afternoon. A falling megaphone from 2085 broke up, with a supporting IHS at the low, and strong positive divergence on the 60min RSI 14. Generally speaking with this setup the retracement low would be in, but there was a strong rejection just before the close on Friday and ES has run down almost ten points more overnight. This might just be a retest of the lows, that is always a risk on any break in either direction, often unexpected, and often very harsh, but if ES makes more than marginal new lows then that bull setup will most likely entirely fail, and the momentum from that failure might well take SPX to 2010. SPX 15min chart:

I’ll be watching the open with great interest today. An open below the SPX daily middle band will be a strike against the bulls, Two strikes if the IHS is invalidated. We are nearing the stage where rising wedge support in the 2010 area will become the obvious next target.