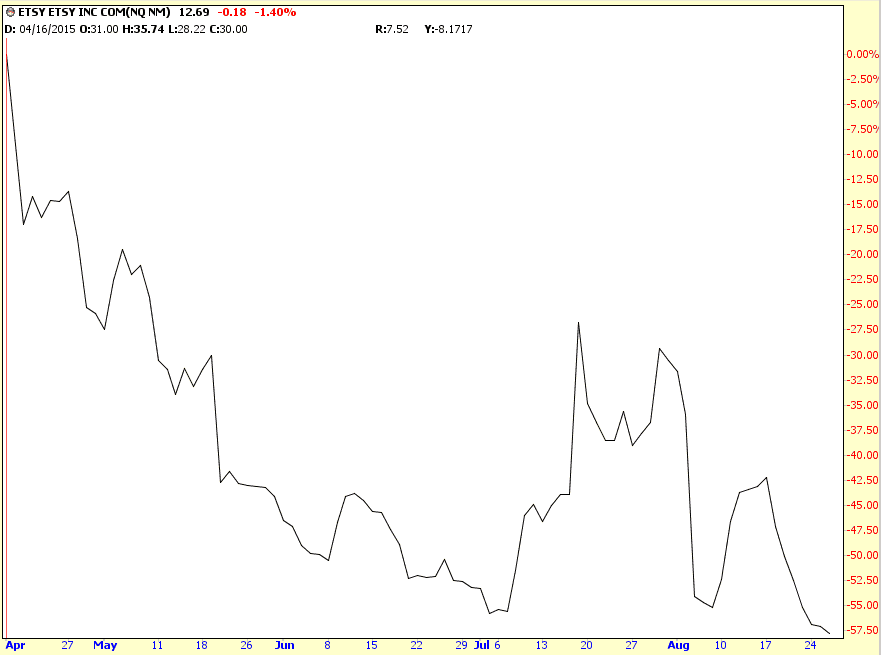

It remains beyond me while the public dives into IPOs in the throes of a bull market. Below are some of the widely-hyped public offerings over the past year or so, shown in percentage form. The results speak for themselves. And keep in mind, this was in the context of a raging bull market. Imagine what these will look like six months from now.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

The Horrible Hole

I’ve had my fair share of horrible memories in life (hey, that’s a cheerful way to kick off a post, isn’t it?) but one that stands out as one of the worst was September 1, 2010. I’ve mentioned this date before, because it was a searing, horrible experience for me.

At the time, I was very, very aggressively short the market, and I (very naively) thought that, with interest rates at 0, there was nothing left for the Fed to do. Ummm – – wrong! As we all know, the Fed really has no limits as to what it can conjure up, and Bernanke unveiled a massive quantitative easing program. Trillions of dollars later, we all can plainly see that it didn’t work (although the man still gets paid a quarter million bucks to make a single boring speech), but at the time, it was just the tonic the stock market needed. (more…)

Harry Boxer’s Charts of the Day

Originally published on TheTechTrader.com.

Bain de Soleil

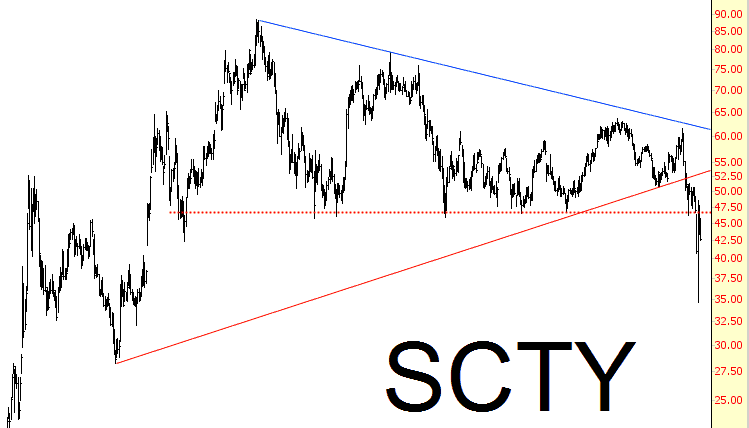

SolarCity has lost well over 50% of its value since last year, so Elon Musk is probably feeling a little desperate. Thus, a couple of days ago, he made a big stink about buying up SCTY shares from his vast, vast fortune. Well, I took the rally as my opportunity from my tiny, tiny fortune to short this crap, because it’s got a glorious broken triangle that spells nothing but doom ahead.