Hey Fellow Slopers,

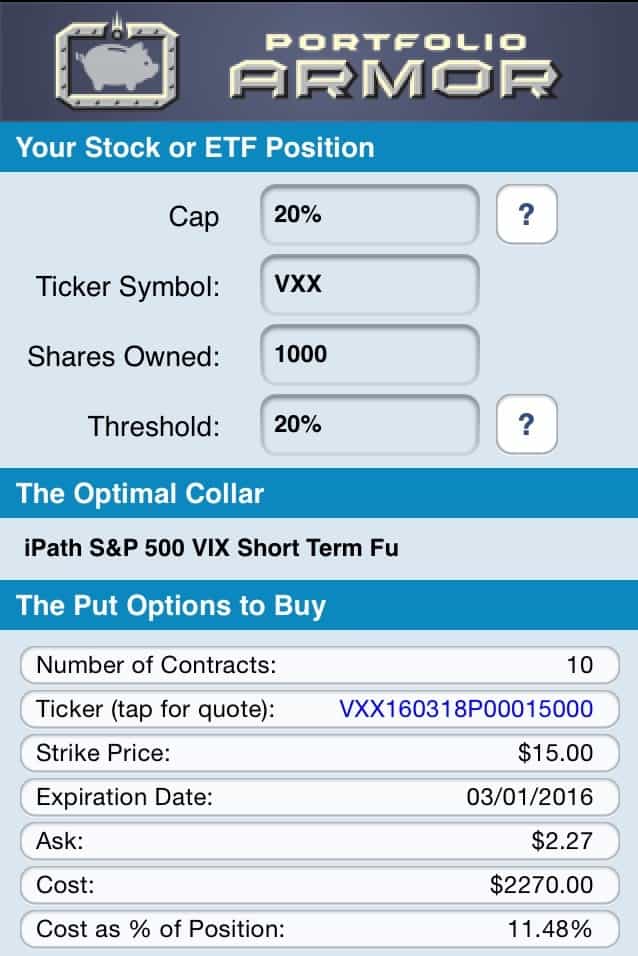

With the VIX jumping again on today’s market drop, here’s a quick Portfolio Armor optimal collar hedge that might of interest to some playing VXX: cap your potential upside at 20%, limit your downside risk to a max drawdown of 20%, get paid 6.47% of position value to hedge.

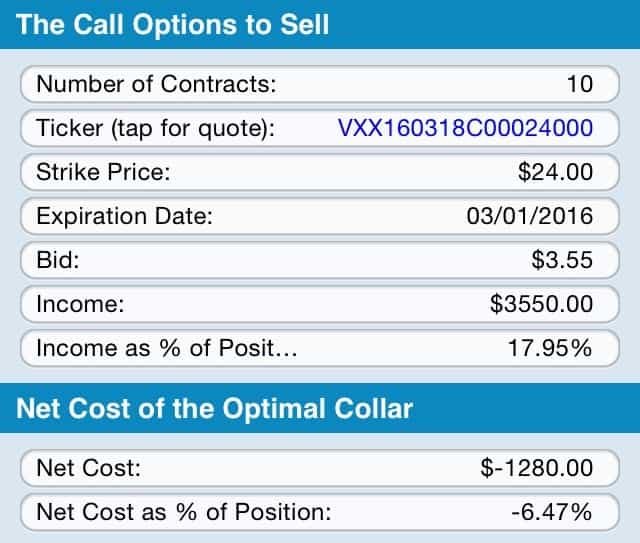

As you can see at the bottom of the screen capture above, the cost of the put leg of this collar was $2,270, or 11.48% of position value. But if you look at the call leg below, you see that the income it generated was greater: $3,550, or 17.95% of position value…

… So the net cost of this optimal collar hedge was -$1,280, or -6.47% of position value, meaning an investor would essentially get paid to open this hedge.*

*To be conservative Portfolio Armor calculated the cost of the puts at the ask, and the income from the calls at the bid; in practice, you can often buy puts for less (at some point between the bid and ask) and sell calls for more (again, at some point between the bid and the ask). So you would probably have collected more than $1,280 to open this hedge.