I am struck by the similarity of almost all the indexes and ETFs I am looking out. Simply stated, the relief rally that I anticipated (exactly one day too soon, it turns out!) is raging away, and we’ve tacked 1300 points – THIRTEEN HUNDRED! – on the Dow in just a few days. The amount we may have left to go varies somewhat from index to index, but I’ve tinted below what I consider the major overhead supply zones for a variety of them. Enjoy!

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

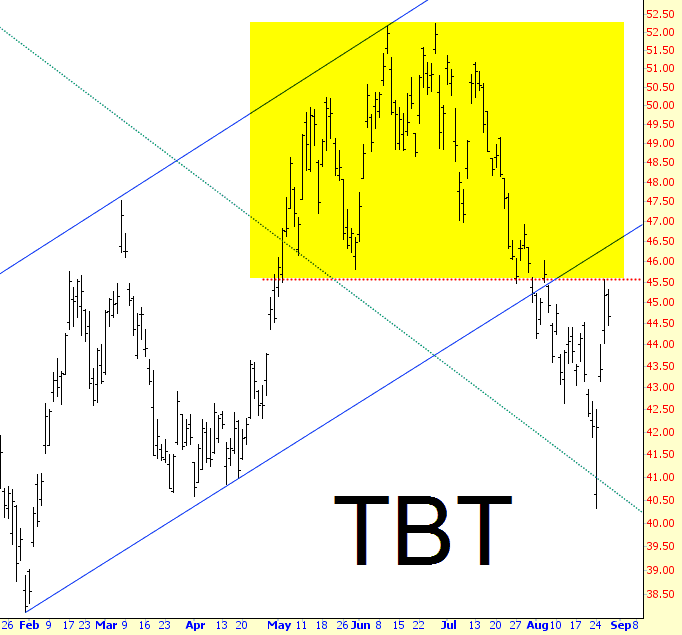

Shorting Interest Rates

I’ve been shorting again today, taking advantage of market strength. Here’s a new one:

What’s Still “UP” on the Year?

After the market pullback that we’ve seen, of late, I thought I’d simply post the following Year-to-Date percentage-gained/lost graphs of a variety of world markets, to illustrate (at a glance) which ones are still “up” on the year (as of their close on Wednesday, August 26th)…presented without individual comment.

They can be monitored to see if they strengthen or weaken over the coming days/weeks, as a possible gauge of general sentiment for the remainder of the markets, particularly, those markets that have lost the most ground this year. (more…)

Mind The Gaps

The bears had a try to make a lower low on SPX yesterday and failed into a move up that closed well above the 2SD daily lower band. The bulls have a shot at turning this back up today and on a sustained break over double bottom resistance at 1954.09 the target is the 2041 area. For some reason I called that in the 2050s yesterday but the target would definitely be 2041 area.

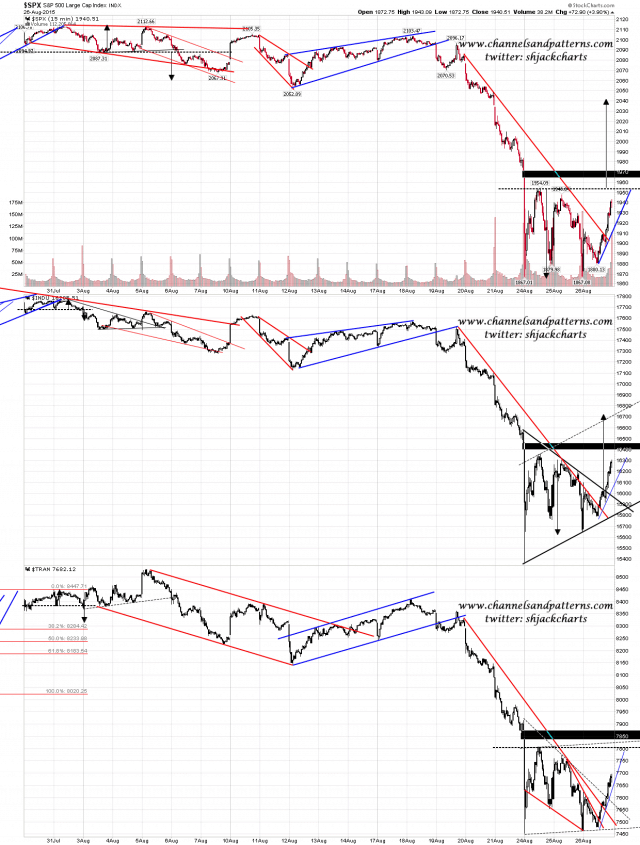

I ran the optic run 15min charts yesterday and I’d assess those as being neutral to bullish, with the most bullish chart being RUT. If RUT is leading then bears are in real trouble here. Scan 3x 15min SPX INDU TRAN charts:

Like It Never Happened

And, voila, just three days later, the crash has been erased!