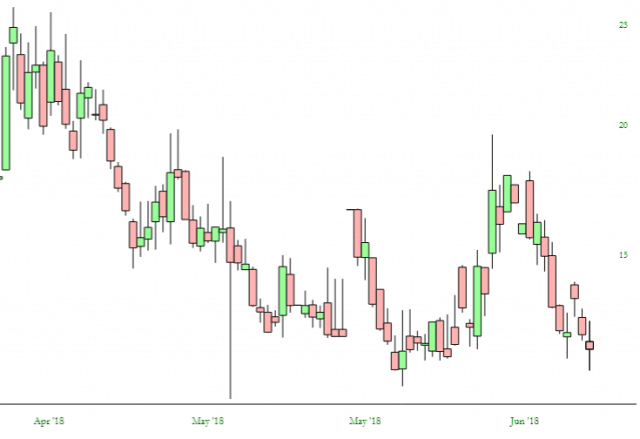

Over the past three months, from April 2 forward, the market has been bullying its way higher almost without respite. This can be seen, for instance, with the volatility index, which is being suffocated to death:

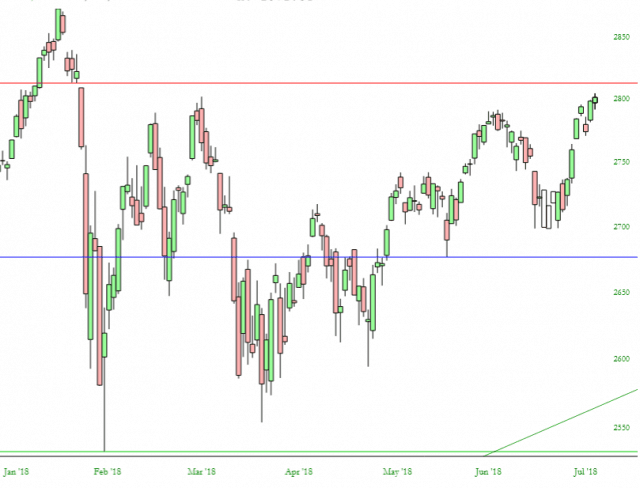

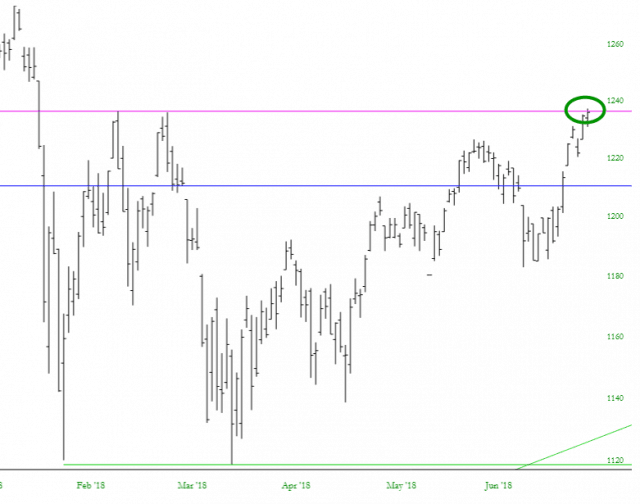

The bulls have plenty of celebrate. The scare they got in those few days early in February are a distant memory, and the S&P 500 looks poised to complete its bullish setup. It just needs to cross above that horizontal.

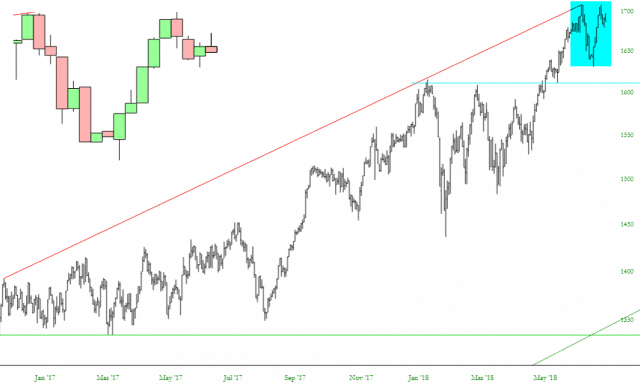

Of course, that horizontal still represents resistance, not support. Just look at the Russell 2000 to see how important this can be. In the case of the small caps, they have been repelled by their trendline, and a close-up view shows the double top that just took place.

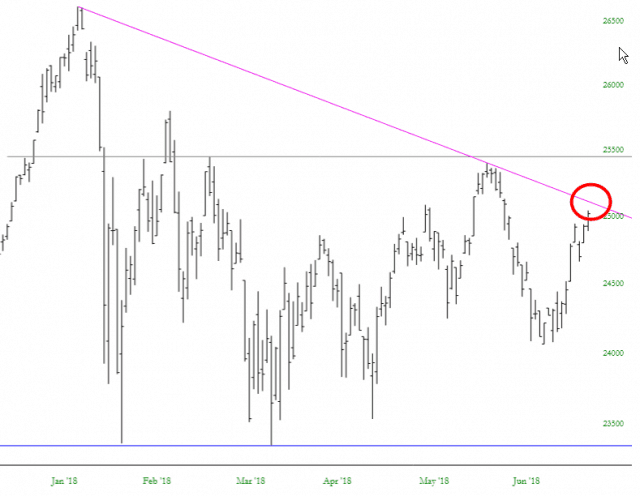

The Dow Industrials also have its own resistance challenge. The week ahead could be a very important one as these tests are reached “make or break” levels.

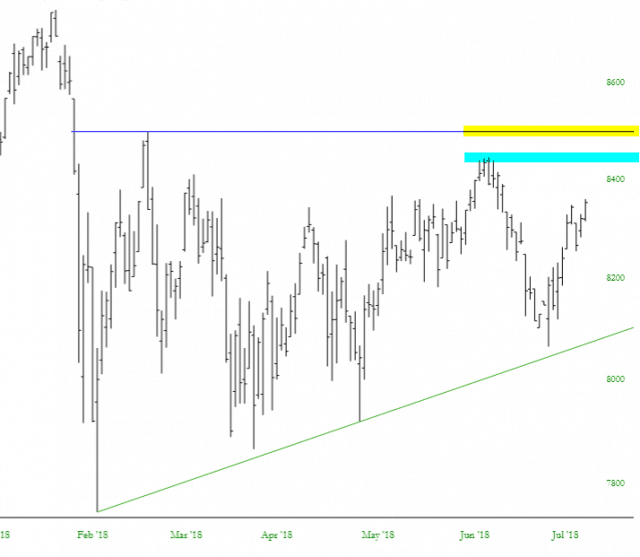

Instead of focusing on one narrow sector, I think it’s helpful to look at something a bit more all-encompassing, such as the Dow Composite. It has a beautiful bullish setup too, but it has two important levels, tinted below, which is has to conquer in order for the bulls to put their party hats back on.

One index that has already achieved this victory is the S&P 100. The breakout is a modest one so far, but it is a legitimate breakout nonetheless.

For myself, I am “medium” in terms of risk, being in 50 different short positions and using about 150% of my buying power. These shorts tend to be in the financial, real estate, and energy sectors.