It wasn’t that long ago that I didn’t even pay attention to the bond market. Since 2018 began, however, I have followed it constantly, since I believe a sea-change in bonds (and, thus, interest rates) is the only thing left that’ll break equities. If nuclear war can’t do it, maybe soaring interest rates can.

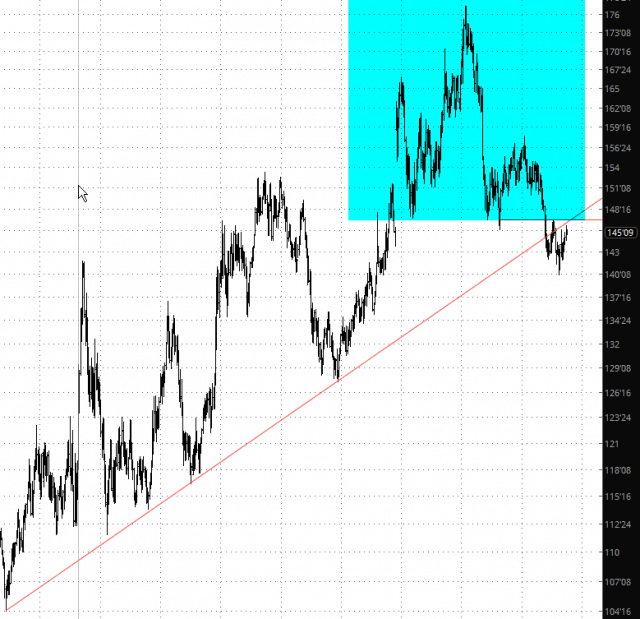

It’s been dicey lately, since bonds have been so strong, but as I pointed out late last week, we were once again getting terribly close to both the topping pattern and the broken trendline:

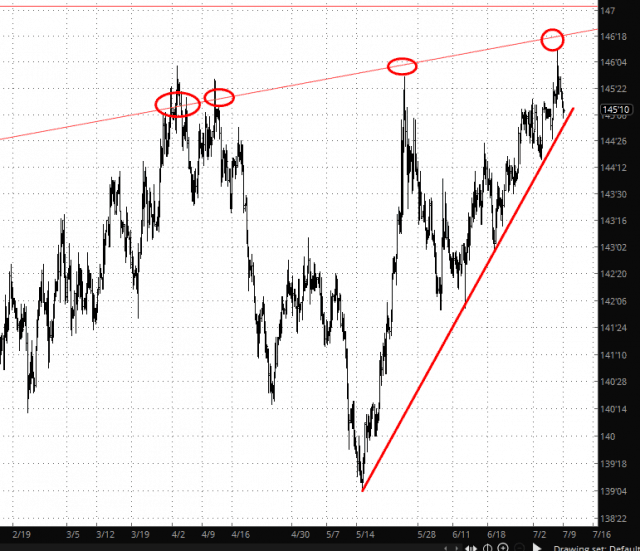

Looking closer, you can see how the trendline has been an excellent repulsion point for prices all year long. As the small trendline shows below, we have been facing the challenge of “higher lows”, illustrating the recovery of the bond market, but if we can manage to break that uptrend, it may be an important shift in the broader direction. Meaning, again, lower bond prices, higher interest rates, and certain sectors of equities (utilities and real estate) taking the brunt of it.