Good morning, Slopers, and welcome to a new week. The earnings season is finally going to start ramping up, and of course there’s that Putin/Trump meeting happening, so it should be an interesting few days.

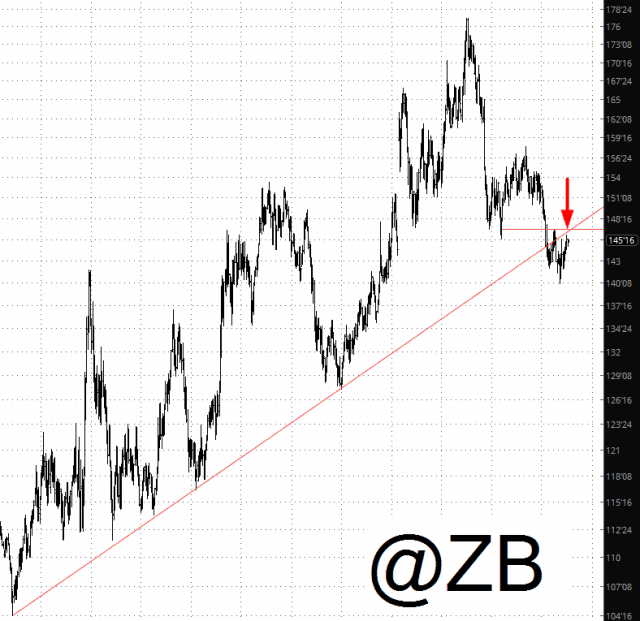

There aren’t exactly a lot of fireworks this morning, so let’s take a step back and look at a few basics. First, the bonds below remain completely intact for what I am hoping is a sea-change in the world of bonds and rates. The uptrend, having been broken, was challenging with a multi-week rally, but this mercifully seems to have been repelled where I’ve put the arrow. My only two options positions are substantial stakes in XLU and XLF January 2019 puts, and obviously the XLU is quite dependent on a strengthening interest rate market. My opinion is that we’ll see bond prices tumble away from this resistance point.

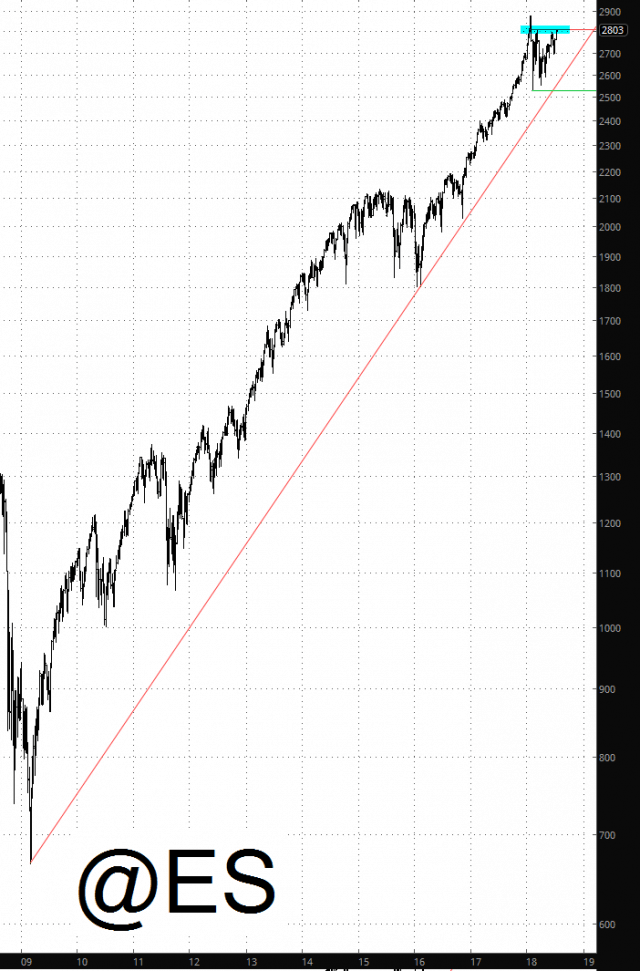

Equities have not broken their nearly decade-long uptrend, and the cyan tinted area is what my recent

“drum roll, please” anticipatory posts have been related to. A breakout above this would give the bull run yet another lease on life. At the immediate moment, the 2809.50 zone has been repelled again. It would take a LOT of bad news to break the uptrend (although I will say, out of thousands of companies, a single reversal on the part of a giant like AMZN based on earnings would go a long way toward that).

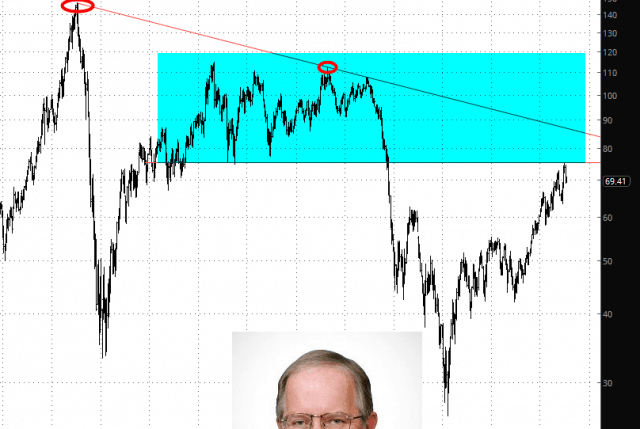

Lastly, the crude oil market continues to be fascinating. We had moved up literally a couple hundred percentage over the past two and a half years, but even with that explosive move, the market didn’t tag its descending trendline (see red ovals). More importantly, that mountain of overhead supply between the upper 70s and about $110 are a formidable foe, and the repulsion from this zone is quite telling. I have been adding to my energy shorts lately, and this resistance is key.