Hello, Slopers, and remember today is a shortened trading day, with equities closing three hours before the normal time.

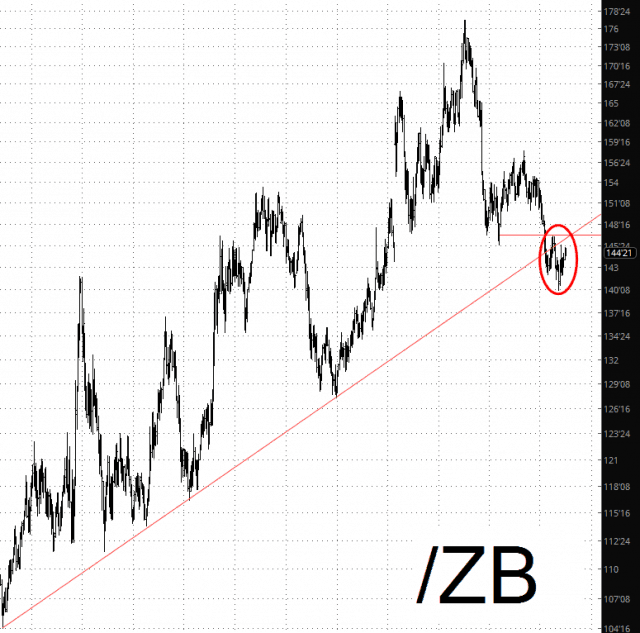

My “Big Short” for 2018 remains bonds. The bond market has, since May 18th, had a powerful push higher, but as I so often write, it’s all about context. The multi-decade uptrend has decisively broken, and my view is that this bounce is nothing more than a push back toward resistance.

A closer look reveals how, months ago, the moving averages all lined up into a downward move, and they’d held fast ever since, even with this recent bout of strength. I maintain my put positions on the TLT as well as the XLU.

Another source of strength, this one lasting much, much longer (ever since the Gartman “no crude above $44 in my lifetime” declaration) is oil. It has fully recovered to its gap (horizontal line).

We’ve managed to sneak a little bit past that gap, but as you can see from the CCI, we reached a severely overbought state, and even if we remain in an uptrend, it seems that it’s time for a bit of relaxation lower for a few weeks.

Bonus Chart: looking at silver, that double top seems really obvious now, doesn’t it? They always do after enough time has passed!