Today (that is, Tuesday) was pretty damaging for any bears left out there. Everyone was bracing themselves for the Wednesday Fed meeting, but there was a one-two punch early on Tuesday that was unexpected in its scope: first, the Draghi capitulation, and second, the Trump-Xi meeting tweet.

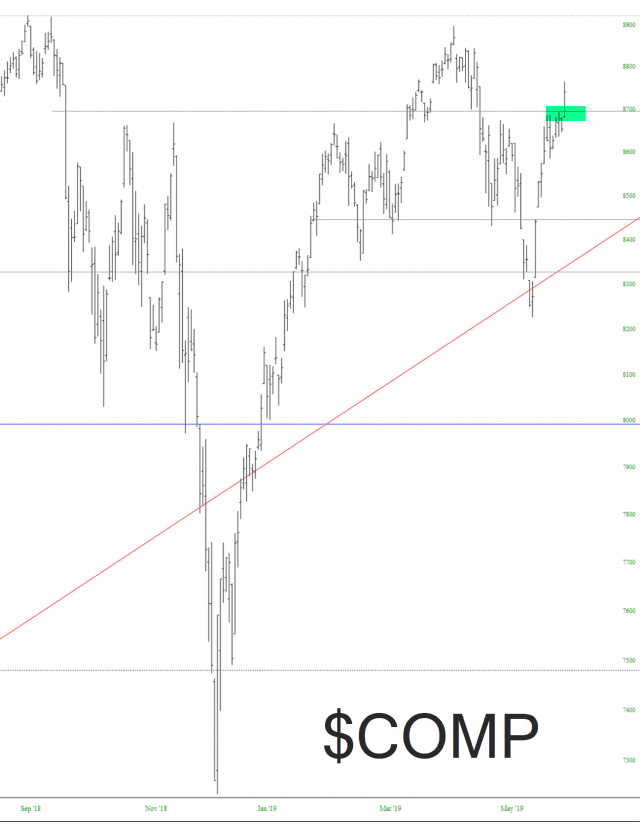

A number of major cash indexes broke above medium-important resistance levels, putting more wind into the bullish boat sails. Here is the Dow Composite: