This is the part of the job I love the most: telling you about new products and features. And this one is a doozy. It took much longer than I thought, and was far more complex than originally anticipated, so we’ve rolled out a beta version (buggy, but quite usable) that I’m delighted to announce. The new feature in SlopeCharts is called Annual Overlay. (Let me say at the outset that I’m not crazy about that name, so if you think of something better, please email me!!)

(more…)Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

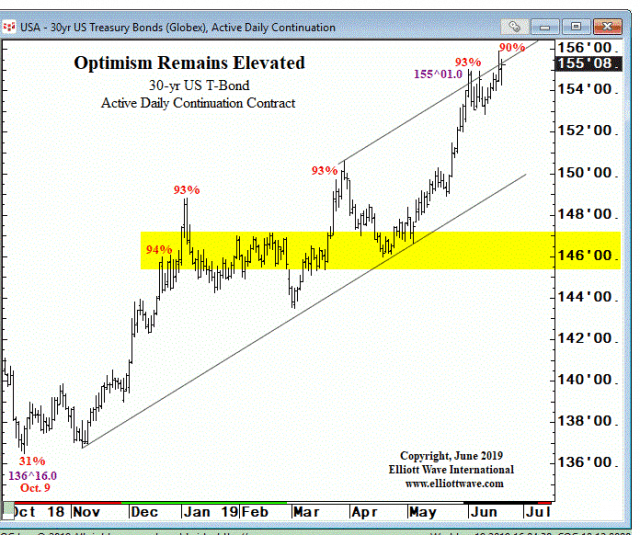

Ignoring Sentiment

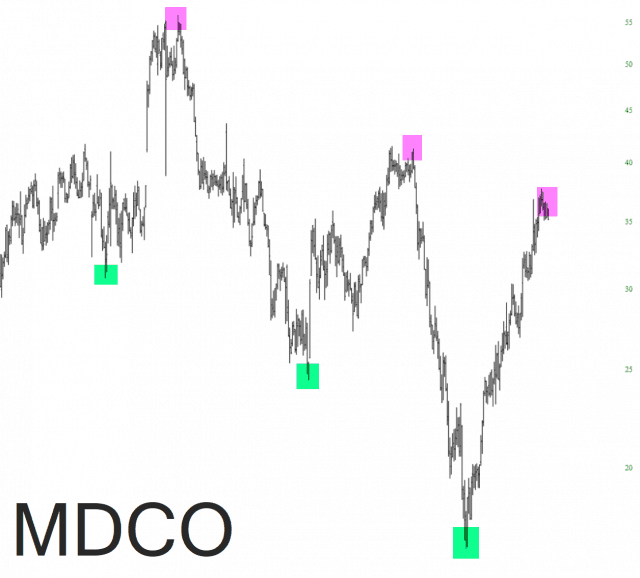

Medicines Short

Biotech Movers to Watch

As we await the Fed…………….Three biotechs, along with recent IPO Pinterest (PINS), are among our four charts to watch today.

G1 Therapeutics, Inc. (GTHX) jumped $4.75, or 24%, to $24.50 on 2.2 million shares Tuesday. The move, on over 5 times its average volume, came on news of encouraging data from the company’s phase 2 study of its trilaciclib treatment for metastatic triple-negative breast cancer. The stock has next resistance at its May high at $27.90, a move through which could take it to $30.

(more…)