Before I begin, I wanted to mention at the outset that we’re planning on taking the site down tonight for 20 minutes (hopefully!) as an important step in speeding up everything. The speed improvement won’t be done for about another week or so, but at 1:00 a.m. EST we’re going to be shutting things down, so please know this is planned. Now, on with the post…….

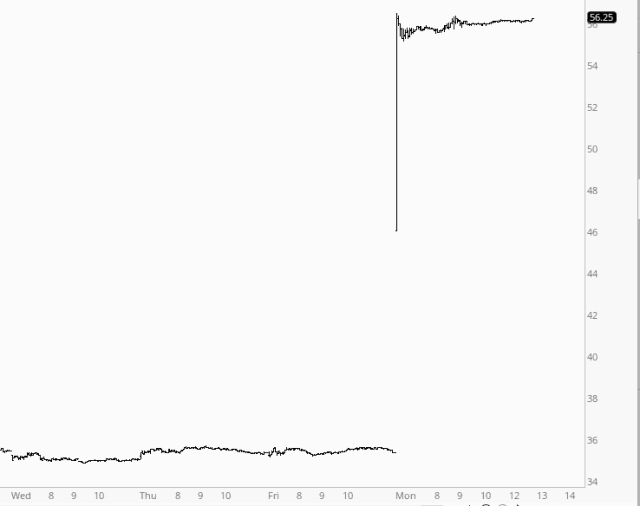

When I started the trading day on Monday morning, I was puzzled and startled by a rather large loss, because the ES and NQ were only up a little bit. It only took a moment or two for my eyes to land on the culprit:

The chart you see above is Sotheby’s (symbol BID), the multi-century old company which, surprise surprise, is going to now be taken private. And the purchase price was much, much higher than Friday’s close. Indeed, BID closes up nearly 60% by the end of trading Monday.

This was obviously a wonderful surprise to some, and a terrible surprise for others. There’s bound to be one or two loonies out there who had short-dated calls on this thing who couldn’t believe their eyes at the opening bell. Conversely, surely there must have been one or two lunatics who had sold calls naked against this thing, creating for themselves ruinous losses.

For myself, I was short BID, so obviously this news sucked. But here’s the important point: it wasn’t a disaster. And why? Because this was 1 out of 54 positions.

My general way to trade is to have lots and lots of small short positions. Once or two a year, for whatever reason, there’s some kind of shocker amongst these positions. Sometimes it’s good. Sometimes it’s bad. BID was bad. Perhaps the worst I’ve ever had.

Having said that, though, the damage caused by BID was well-contained. Sure, it pissed me off, and this single position’s loss was enough to turn an otherwise profitable day into a small loser, so I resent the hell out of it. But, in the end, I have to ask myself this question: did you make an error in being in the trade? Did you make a bad decision based on the chart? And I can say with a straight face, and a clean conscience, the answer is no.

Up until the opening bell on Monday, the chart had all the characteristics I would like to see in a short position. But I’m not clairvoyant, and the news about the purchase was kept secret, just as it is supposed to be, so there was no clue in the chart action about what was coming. So, again, the news stinks, but I’m not kicking myself all over the place, particularly since none of my positions is going to make up more than about 2% of my portfolio.

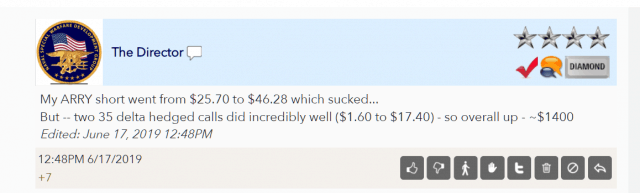

As I was composing this post, I noticed on the Slope of Hope Daily Digest that one of the most popular comments was from The Director, who wrote:

I took a look at ARRY, and its intraday chart looked just like BID’s. That is: straight up! So maybe The Director could share with us some of his insights about how he managed to take what would have been a “disaster” and construct a trade to clearly mitigate the situation. As for myself……..BID is dead to me, and I’m moving on!