While COVID-19 shut down movie production around the world, and delayed the release of the upcoming 25th official James Bond film…

The virus panic and response to it created a new secret agent.

Bond… SHY Bond.

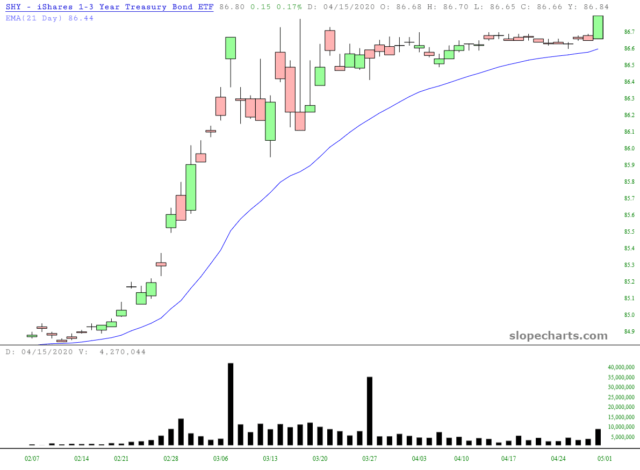

For those who’ve never heard of this double-oh ETF… think of its as the little brother to TLT.

Whereas the big boy TLT targets the longer end of the treasury curve, SHY takes aim with its Walther PPK at the shorter end.

The specifics per its investment objective from iShares:

“The iShares 1-3 Year Treasury Bond ETF seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities between one and three years.”

From a trading standpoint, think of it as a way that non-futures traders can gain exposure to the /ZF (5-year treasury note futures contract) and the /ZT (2-year note contract).

And SHY’s secret status from the majority of the trading community seems to have been burned worse than that snake from “Live and Let Die.”

Just take a look at that volume traded on Thursday! More than 9-million shares, and the ETF made a new all-time high above this month-long consolidation pattern on the daily chart.

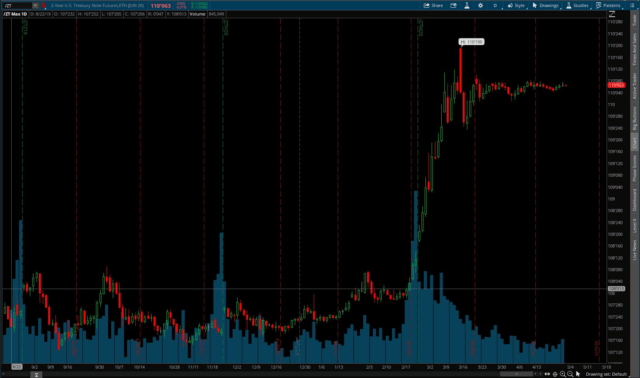

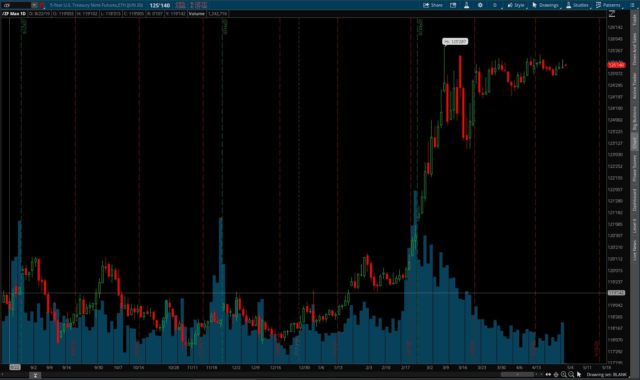

Compare that chart with the /zf and /zt charts…

And we may be witnessing a rare case where its an ETF that leads a breakout in the futures, instead of the other way around.

Of course, higher prices on TLT and SHY indicate traders expect treasuries prices to rise (and yields to fall further).

The journey to negative-infinity may yet be on… and that leads thoughts from one infamous Bond villain.