If I see any more articles about how the stock market is clearly showing the “V-shaped recovery” is absolutely here, I’ll strangle whoever wrote it (metaphorically speaking, of course). There’s no recovery. There’s no bright future. There’s just the Fed and their fake bucks.

There is one, count ’em, only one, reason for the market’s rise, and that is Powell’s desire to prop up the stock market for the rich (of which he himself is a member, I might add). End of story. Powell’s cute little “aw, shucks, we’re doin’ it for the average guy” is worthy of the death sentence.

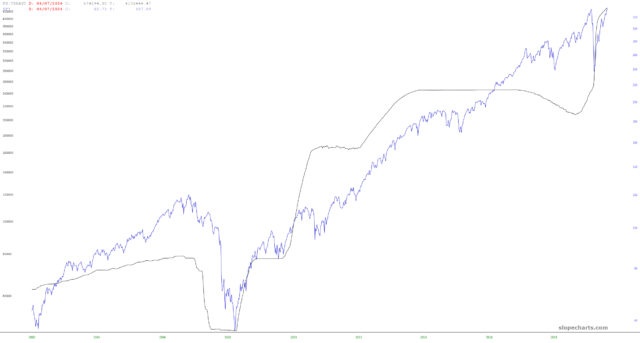

Below is the Federal Reserve Assets Held Outright and the S&P 500 by way of SPY. They are joined at the hip. It is absolutely nauseating to hear anyone to suggest anything except a 1:1 relationship between these two.

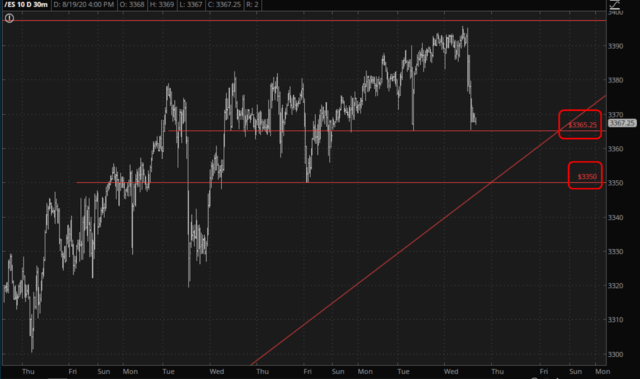

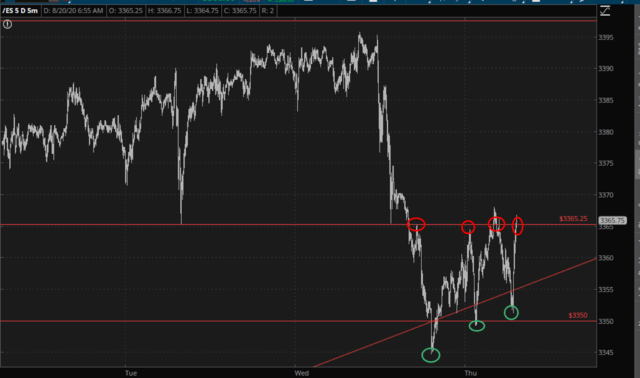

This was on full display last night. I did a post for my premium members which pointed out the very important levels the ES was approaching:

Well, look at what’s been going on since then. The moment we got below the key 3350 level, the Fed went into overdrive, frantically bidding up the market. We’ve been bouncing like a pinball the whole time. Madness!

How much have I covered? Zero. I remain at 61 short positions and 186% commitment level. I’m 61 for 61 right now with respect to P/L on those 61. Onward!