I believe we are at the start of a new bull market in oil. In the famous words of Dave Chappelle, “Oil? Oil? Who said anything about oil?” Isn’t the world swimming in oil right now? Isn’t every possible tanker and storage facility filled to the brim? Why on earth do I believe that oil is starting a new bull market? I’m glad you asked. Let’s take a look.

Since this is the one and only Slope of Hope, let’s begin by taking a look at some charts. After that we’ll examine the geopolitical and monetary fundamentals that I believe will also play a role.

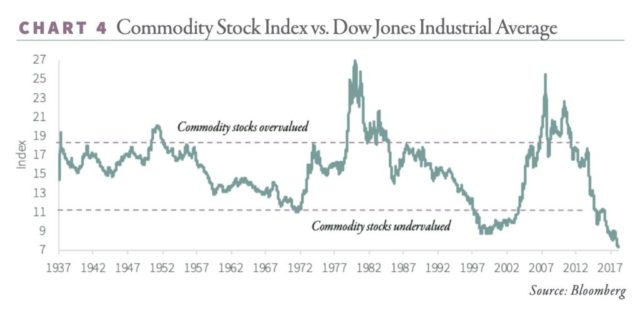

Earlier this month Jesse Felder penned the article, “A Generational Opportunity in Commodities?” He discussed the idea that rising U.S. fiscal deficits is bearish for the U.S. dollar, with one of the consequences being a return to a commodities bull market. The chart that caught my attention the most in his article is the chart shown below. This chart compares the Commodity Stock Index vs. the Dow. As you can see, the last commodity bull market ended in 2008, and commodities have been in a bear market ever since. This data goes back to 1937, and commodities are now the most undervalued relative to the Dow in that time span.

Now that we have established the long term value of commodities versus stocks, why do I expect that now is the time when commodities are beginning to turn higher in earnest? To answer that question, I will point you to an analog that Tom McClellan discovered a number of years ago.

McClellan utilizes a gold to crude oil analog with a twenty month lag time. This means that what gold was doing twenty months ago, crude oil should be echoing now. You can read about the analog here. A note on Tom’s analogs; they generally do not reveal the magnitude of the directional move, but instead look to reveal key turning points and directions.

So what has gold been doing over the past twenty months? If you are a Slope reader, you probably already know the answer to that question. The below chart shows how gold has performed over the past two years. The highlighted circle in red shows where gold was twenty months ago. If McClellan’s analog holds, the price of crude oil should begin steadily moving higher throughout the end of 2021.

Simply put… gold leads, oil follows. Gold is the bright flashing warning light on your car’s dashboard letting you know something is wrong monetarily, and will be beginning to cause problems in other areas in short order.

Macro Fundamentals

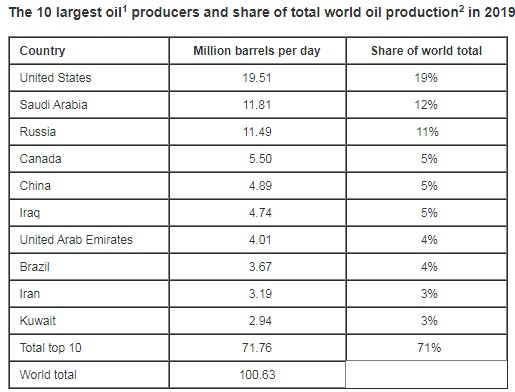

Next, let’s examine the global macro picture for oil. The supply/demand landscape is interesting, and listed below. Here are the production statistics for 2019.

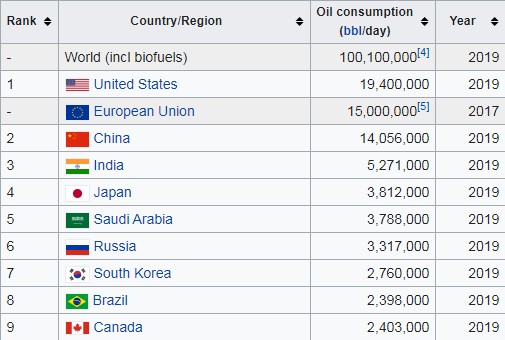

And here are the consumption statistics:

As you can see, the United States is the largest consumer of oil in the world, but it is also now the largest producer of oil. This has been achieved by one of the key fundamentals of the oil market over the past decade; the rise of U.S. shale.

In the IEA’s 2019 report on the oil market, they state:

“The United States will lead oil-supply growth over the next six years, thanks to the incredible strength of its shale industry, triggering a rapid transformation of global oil markets. By 2024, the United States will export more oil than Russia and will close in on Saudi Arabia – a pivotal milestone that will bring greater diversity of supply in markets.”

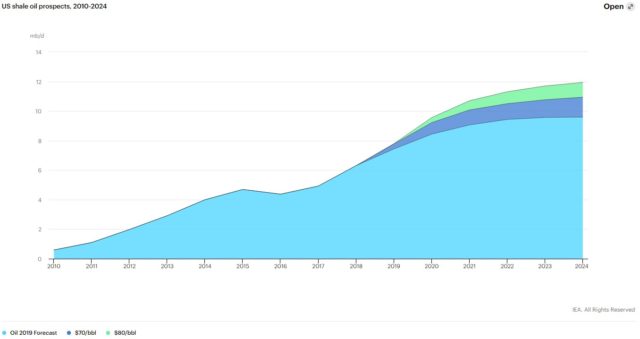

The below chart shows the rapid advance of U.S. shale production over the past decade, and its forecasted production into 2024.

So we now know that the United States produces enough oil to satisfy its own consumption. The next interesting point to acknowledge from this data is that China does not. Over the past decade, as the U.S. has been increasing its oil production, China’s rapidly growing economy has also been rapidly increasing its consumption of oil. Will this be a problem? Yes.

In the IEA’s March 2020 report they state:

“Through 2025, global oil demand rises by a total of 5.7 mb/d, with China and India accounting for about half of growth… Strong growth in Asian oil demand is creating major opportunities for oil producing countries that can boost exports. But growth in non-OPEC production is set to lose momentum after a few years, indicating a greater role for OPEC+ countries. The pace of expansion in the United States is slowing as independent producers cut spending and scale back drilling activity in response to pressure from investors. The deceleration in US and other non-OPEC growth from 2022 will allow OPEC producers from the Middle East to turn up the taps to help keep the oil market in balance, thereby increasing their importance for oil consuming countries. “

Geopolitical Fundamentals

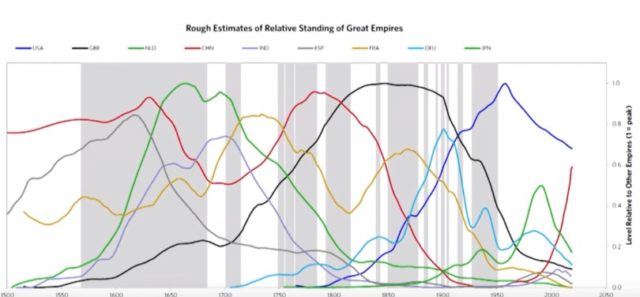

So why do I believe rising oil consumption and imports by China will be a problem? To begin to answer that question let’s take a look at some of Ray Dalio’s recent analysis. Earlier this year Ray Dalio released some excellent work on the rise and fall of empires. He compared a variety of key data points to examine the status of different empires over the most recent centuries that controlled the world reserve currency.

In the chart below, Dalio combined all of his indicators into one summary indicator to visualize how nations rise and fall. As you can see, the United States has been in decline for some time. China however, is rising rapidly. We are nearing an inflection point.

What will this inflection point look like? What will the ramifications be? The world as we know it will be reshaped. This reshaping of the world will be led by the relationship of China and the United States. Will the United States simply learn to co-exist with China as it increases its share of global dominance and power, or will the struggle for power be something more confrontational and violent? History would argue that the latter is the more likely outcome. The United States does not have a precedent of simply voluntarily ceding power.

Oil as a Weapon

To understand why I am bullish on oil from a geopolitical standpoint, let’s take a look back at the history of World War II to understand the strategy behind how it was fought. In the article “How Oil Defeated the Nazis”, ZeroHedge examines the strategy behind World War II, and how oil was at the center of the conflict.

Hitler was bent on conquering Europe, but Nazi Germany had an Achilles heel. Oil. Germany needed oil to make their war machine run, but they were dependent on oil imports.

“Despite being one of the most powerful industrial nations on earth, Germany had no oil reserves. Furthermore, it lacked an empire – like the British – that would give it access to oil overseas. In fact, in the 1930s oil production was dominated by a handful of countries—the United States, which accounted for 50% of global oil production, as well as the Soviet Union, Venezuela, Iran, Indonesia, and Romania. But in order to fuel its industrial economy and power its growing war machine, Germany would need oil reserves – as German oil production was negligible. Hitler had two choices: either it get by on alternatives – such as producing synthetic oil from coal, which Germany had in abundance – or secure oil through conquest. Thus, the war in Europe was often fought over petroleum, which Hitler needed to build and sustain the German empire.”

Why were the Nazis fighting in North Africa? They were attempting to secure the Suez Canal, the pathway to Middle Eastern oil. Why did the Germans invade the Soviet Union when they were already weakened by their war in Europe? Oil.

“On June 1941, a vast German army invaded the Soviet Union. One wing advanced towards Leningrad, another towards the Soviet capital at Moscow. A third army group cut through the south, slicing through the Ukraine. It’s objective: the Soviet oil fields in the Caucasus Mountains. The Battle of Stalingrad, the turning point for the war on the Eastern Front, came after the German army made a push towards the Caucasus Mountains – the heart of the Soviet oil industry. Capturing the refineries and oil fields around Baku would have given Hitler the oil he needed to fuel the German economy and war-machine. But the German advance was turned back at Stalingrad. After the initial shock of the invasion, the Soviet army recovered its strength and began pushing the German forces from Russia. Hitler’s armies failed to secure access to Russian oil, and in 1943 began a slow retreat, beaten back by overwhelming Soviet forces.”

The Allied forces were aware of this strategy as well, and placed a focus on bombing Romania. Romania? Why would the Allies bomb Romania if Germany was the enemy? Romania was a partner with Germany, and their largest supplier of oil.

“ In 1943 and 1944, British and American planes targeted the Ploesti oil fields in Romania, a German ally. Romania was Hitler’s major source of oil, since he had failed to conquer the Russian fields. The Allied bombers had trouble hitting the oil fields and refinery – like other bombing raids in WWII, the majority of the bombs failed to hit their targets. But the sheer number of sorties left a mark. By June 1944, German access to oil had been seriously impaired – and the results were devastating. The Luftwaffe, Germany’s mighty air force, was grounded. Panzer divisions couldn’t maneuver for fear of using up precious oil. German army units lacked mobility and couldn’t respond quickly when the Allied armies arrived on the shores of Normandy. Lack of fuel crippled the German army.”

How is this understanding of history applicable to today’s China/U.S. approaching confrontation? China is the world’s largest importer of crude oil. Simply put, China is addicted to oil. Without it, the country and its economy will collapse. It is their Achilles heel.

Part of the United States’ strategy to continue to exert its dominance as the world sole superpower has been to attempt to control the world’s oil supply, whether explicitly or implicitly. For nearly twenty years the U.S. has fought the “War for Oil” which was rebranded as the “War on Terror”. Each military aggression has one thing in common… Oil. The desire to control the supply of oil remains the ongoing policy of the United States, regardless of party.

I do not believe the issue will ever be that there is not enough oil to go around. The fact of the matter is that there is more than enough oil on the planet to supply all that we need. I believe one of the primary drivers of the price of oil will be those in power attempting to wield power over other nations through control of oil.

Monetary Fundamentals

The final issue I will discuss is central bank monetary policy. As has been the case since QE began, the Federal Reserve, and the other global central banks, remain the largest fundamental factor influencing asset prices. Earlier this week at the virtual Jackson Hole meeting, chairman Jerome Powell detailed a new policy framework for the Fed. Powell detailed what he termed “average inflation targeting” with the goal of achieving “inflation moderately above 2 percent for some time.”

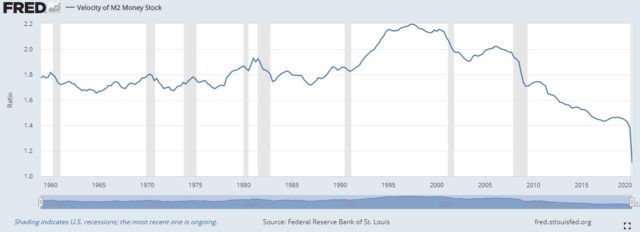

My question to Mr. Powell would be how does the Federal Reserve plan to achieve this goal, when over a decade of QE has not succeeded in achieving 2 percent inflation? You may also ask the question why has inflation not soared over the past decade as the Federal has dramatically increased their balance sheet? The answer lies in the below chart of the velocity of money.

The velocity of money in the U.S. is at a historic low. It is not only at its lowest level in the past sixty years, but has taken another plunge lower with the Covid crash and subsequent monetary response. In order for inflation to grow rapidly, the velocity of money must turn higher. There needs to be a desire for money to be changing hands rapidly for inflation to take hold.

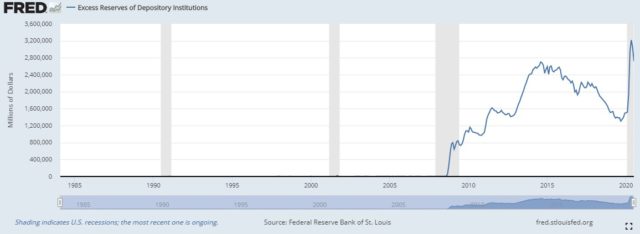

So if the Fed has been printing money for the past decade, why is it not changing hands? Where is it going? The answer lies in the below chart of excess reserves held at the Fed.

As you can see there has been a large, historic rise in the amount of excess reserves held at the Fed. This “money” is simply sitting in storage at the Fed. It is being used by large institutions as collateral, and leveraged to speculate on assets… namely stocks and bonds. There my friends, is where inflation is being seen over the past decade. Not in commodities (yet), but in stocks and bonds.

The answer to how to increase inflation is simple, and I believe the Fed has already stated its intention. The answer is creating money, and giving it directly to the people. Earlier this month ZeroHedge published the article “The Fed is Planning to Send Money Directly to Americans in the Next Crisis.”

The article details an interview with two former Federal Reserve officials, Simon Potter and Julia Corondado.

The two propose creating a monetary tool that they call recession insurance bonds, which draw on some of the advances in digital payments, which will be wired instantly to Americans.

As Coronado explains the details, Congress would grant the Federal Reserve an additional tool for providing support—say, a percent of GDP [in a lump sum that would be divided equally and distributed] to households in a recession. Recession insurance bonds would be zero-coupon securities, a contingent asset of households that would basically lie in wait. The trigger could be reaching the zero lower bound on interest rates or, as economist Claudia Sahm has proposed, a 0.5 percentage point increase in the unemployment rate. The Fed would then activate the securities and deposit the funds digitally in households’ apps.

As Potter then elucidates, “it took Congress too long to get money to people, and it’s too clunky. We need a separate infrastructure. The Fed could buy the bonds quickly without going to the private market. On March 15 they could have said interest rates are now at zero, we’re activating X amount of the bonds, and we’ll be tracking the unemployment rate—if it increases above this level, we’ll buy more. The bonds will be on the asset side of the Fed’s balance sheet; the digital dollars in people’s accounts will be on the liability side.“

And that, in a nutshell, is how the Fed will stimulate the economy in the next crisis in hopes of circumventing the reserve creation process: it will use digital money apps (which explains the Fed’s recent fascination with cryptocurrency and digital money) to transfer money directly to US consumers.”

I would contend that this is indeed the path to real inflation in the consumer economy, and it will have an impact on the price of crude oil. This is the path to letting “the genie out of the bottle”. This is the pathway to the destruction of the U.S. dollar.