There are dozens of common sayings, expressions, and aphorisms when it comes to the markets and trading. Some, I think, are true (“Don’t throw good money after bad.“) Some are silly and wrong. Recently, two classics have been proved false.

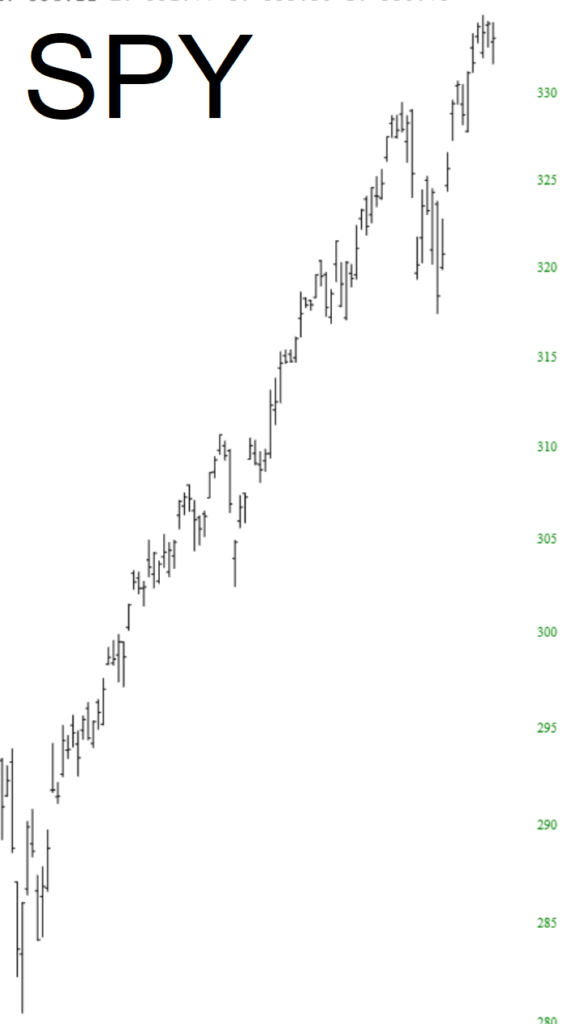

The first one is “Never short a dull market.” Let’s examine the market early this year, shall we?

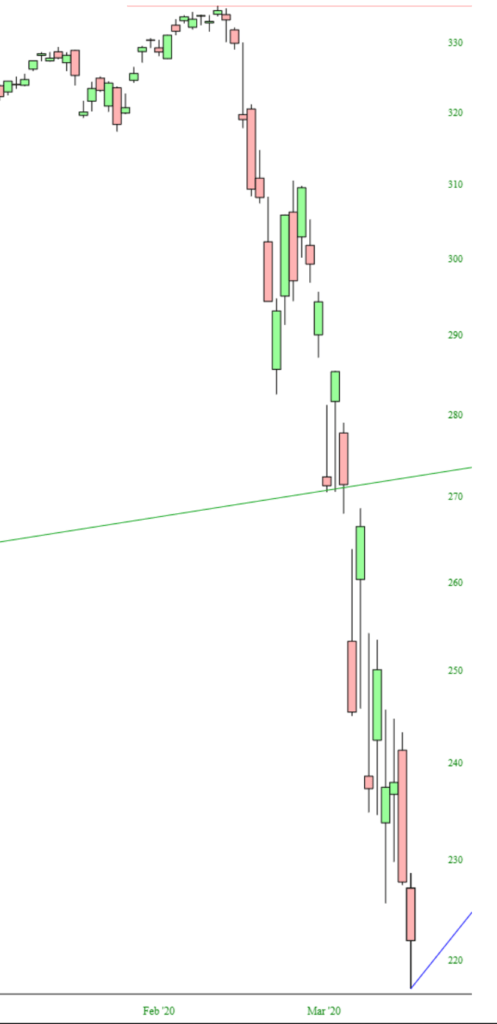

There we have the very absence of dull. It’s steady. It’s non-fluctuating. The damned thing just tromps higher day after day. Even though, for weeks, there was all kinds of chatter about a deadly virus. Then, all of a sudden, prompted by absolutely no specific change in particular:

Wow, 217 on the SPY. Can you even believe it? But I digress. The point is that a “dull” market got very exciting extremely fast.

The other old saw is “Markets hates uncertainty.” Well, life is always full of certainty, but I think we can all agree that, these days, we’ve got some gigantic uncertainties looming that dwarf the norm:

- What’s going to happen about the next Covid economic stimulation package? 1 trillion? 3 trillion? 0 trillion? Something different?

- Is there going to be a second wave of the virus?

- Who is Biden’s running mate going to be?

- Who is going to win the election, which is just 85 days away?

- Who will dominate the Senate?

- What’s going to happen to all of this politically-driven financial support the moment the election is over?

And that’s just a few.

So how is the market handling this mountain of absolutely epic uncertainties?

By going up.

Every.

Single.

Day.

Let’s just say I think we can toss ’em both at this point.