That electric vehicles are the future has been known for some time, but it seems as though the auto industry in general is only now getting to grips with the reality of the situation. The greater competitiveness within this space is not good news for Tesla (TSLA), which has long been touted by its supporters as the trailblazer in the electric vehicle sector.

The Auto Industry Is Getting Serious About Electric Vehicles

Despite footage of Elon Musk and Volkswagen (VLKAF) chief Herbert Diess driving the new fully-electric Volkswagen Electric ID.3 model, the likelihood that Tesla will become more involved with its chief competitor in the electric vehicle market is remote. What the interaction between Musk and Diess does illustrate is that the traditional auto industry is finally getting serious about electric vehicles.

The trend is towards a switch from petrol to electricity, and this switch requires batteries and software to permit the batteries to work in sync with motors. Multiple firms, such as AMETEK (AME), Johnson Electric (JELCF), and WEG (WEGZY) are making electric motors. Ninety-one factories are expected to produce battery cells by 2028, and half of these are already producing now. Overall, the global electric vehicle battery is currently valued at $30.7 billion, and is estimated to reach $87 billion by 2027. Furthermore, the electric car market itself was valued at $162.34 billion in 2019, and is projected to grow to $802.81 billion by 2027.

Tesla, specifically, would seem at first glance to be in pole position to benefit from this projected growth. In July it overtook Toyota (TM) as the most valuable carmaker by market capitalization, a reflection in investor confidence in the future of electric vehicles overall – and in the less-certain prospect that Tesla will continue to lead the pack.

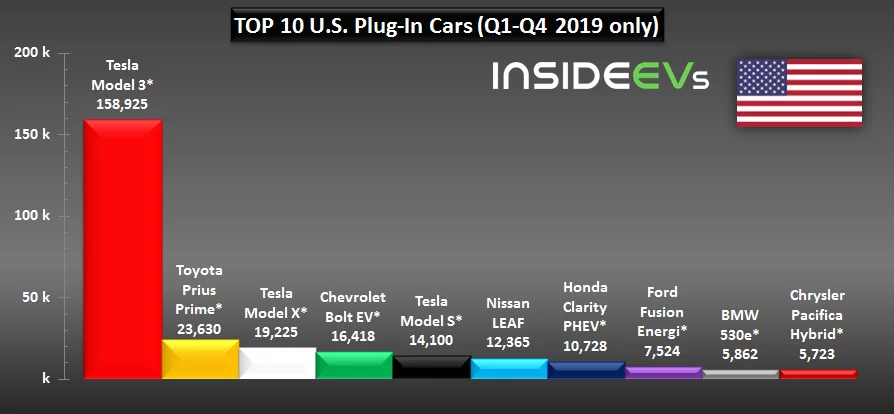

Tesla currently has the advantage of holding 16% of market share in the global passenger electric vehicle market, it has been manufacturing electric vehicles at scale longer than any other company, and sells more of them than any other company – of the top ten U.S. plug-in cars sold in 2019, three of the ten were Tesla models. Furthermore, sales of the Tesla Model 3 outpaces its closest rival (Toyota’s Prius Prime) by over 135,000 units.

Chart generated by InsideEVs.

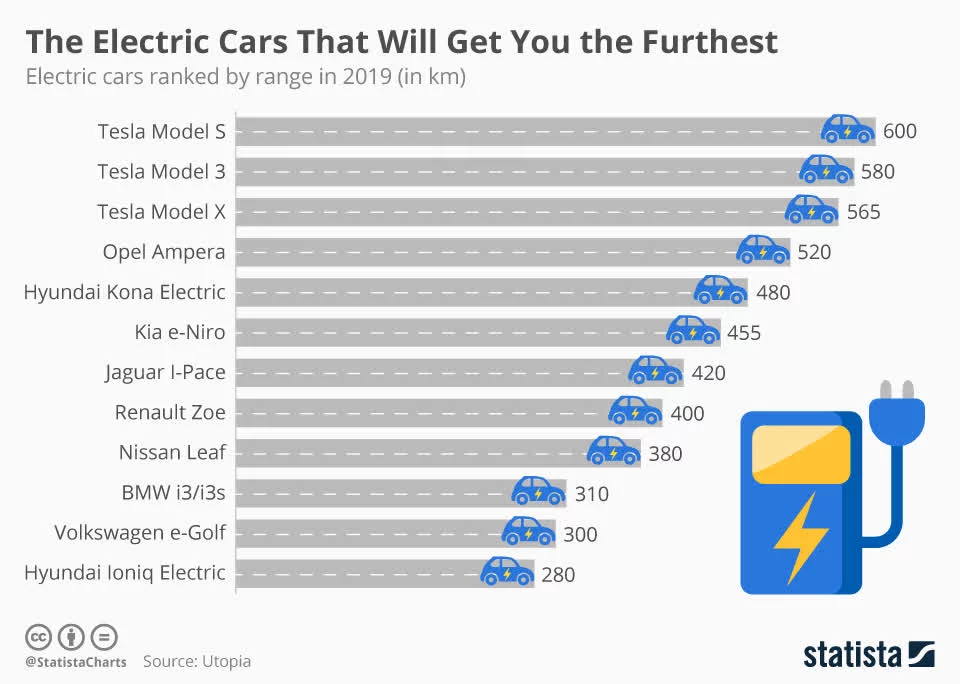

Tesla’s Electric Vehicles Have The Greatest Range

Tesla benefits from the fact that its electric cars have the greatest range – the Model S, Model 3, and Model X can travel from 565-600 kilometers on a single battery charge, and are the top three ranked electric cars by range as of 2019.

These factors seem to augur well for Tesla’s long-term prospects, as does the fact that it looks set to post a profitable year for the first time in its history. Since it went public in 2010, and according to figures going back to at least 2006, Tesla has reported consistently rising revenues in tandem with consistent net losses.

| Year | Revenue ($) | Net Income ($) |

| 2006 | – | -29.96 million |

| 2007 | 73,000 | -78.16 million |

| 2008 | 14.74 million | -82.78 million |

| 2009 | 111.94 million | -55.74 million |

| 2010 | 116.74 million | -154.33 million |

| 2011 | 204.24 million | -254.41 million |

| 2012 | 413.26 million | -396.21 million |

| 2013 | 2.01 billion | -74.01 million |

| 2014 | 3.2 billion | -294.04 million |

| 2015 | 4.05 billion | -888.66 million |

| 2016 | 7 billion | -773.05 million |

| 2017 | 11.76 billion | -2.24 billion |

| 2018 | 21.46 billion | -1.06 billion |

| 2019 | 24.58 billion | -775 million |

Figures collated from 10-K reports available on the SEC website and on Tesla’s investor relations page.

At first sight, however, it appears as though Tesla has finally turned a corner and become profitable.

| 2020 Quarter | Revenue ($) | Net Income ($) |

| Q1 | 5.99 billion | 16 million |

| Q2 | 6.04 billion | 104 million |

| Total | 12.03 billion | 120 million |

Figures collated from quarterly reports available on Tesla’s investor relations page.

Long-Term Issues That Tesla Has To Overcome

Tesla hopes to maintain this edge through sales of electric cars, and with the line-up being extended to lorries and pick-ups. Battery production will also aid Tesla’s bottom line, not merely in sales but also in extending the firm’s cost advantage. However, despite the rosy picture painted hitherto, there are a vast number of long-term issues that the firm still has to overcome.

| 2020 Quarter | Revenue ($) | Net Income ($) |

| Q1 | 5.99 billion | 16 million |

| Q2 | 6.04 billion | 104 million |

| Total | 12.03 billion | 120 million |

Figures collated from quarterly reports available on Tesla’s investor relations page.

Long-Term Issues That Tesla Has To Overcome

Tesla hopes to maintain this edge through sales of electric cars, and with the line-up being extended to lorries and pick-ups. Battery production will also aid Tesla’s bottom line, not merely in sales but also in extending the firm’s cost advantage. However, despite the rosy picture painted hitherto, there are a vast number of long-term issues that the firm still has to overcome.