Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

The SPY Who Loved Me

If there’s one ETF that neatly captures the entire US stock market, it is the oldest of the old, and the biggest of the big: the SPYders (S&P 500 ETF symbol SPY). Here is a quintet of this symbol, flanked by a variety of indicators:

Go. Stop. Yield.

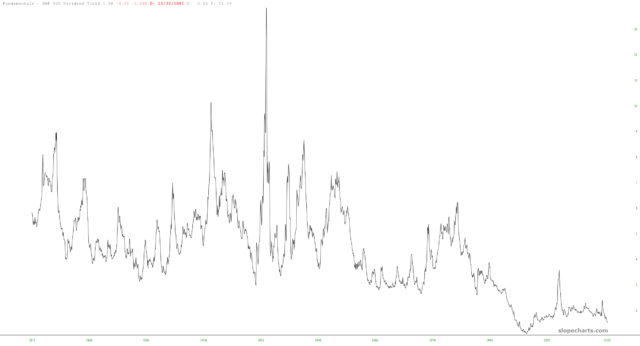

If you want some long-time perspective as to how ghastly-high the stock market is, look at this dividend yield chart dating back to 1871. It’s clear that the classic purpose of stock investing – – the dividend yield – – is about as out-of-style as buggy whips and your old grandpappy’s handlebar mustache.

Funny Pages

Long-time readers know I have an adversarial relationship with boredom. I can’t stand it. There’s a reason I wrote twenty published book by the time I was twenty years old. I get antsy. I’ve got to be creating.

Thus, last night, I was going out of my mind. There was nothing left to clean. Nothing left to organize. Hell, I’ve already done all my personal and corporate taxes months before they are due. So I decided to prowl our bookshelves for something to read. What else was I supposed to do? Watch an idiotic TV show? Come on.

I found something interesting that I had originally bought years ago for one of my beloved children. It is basically a 300 page comic book (oh, sorry, graphic novel) about Economics called, appropriately, Economix. It’s absolutely superb, and this ‘comic book’ imparts more information than over 99% of the American public understands.

I’d like to share one snippet with you in particular, which for some odd reason I find germane to ours times. The tinting is my own:

(more…)Buffett Buys a Copper Stock!

Just kidding. Warren Buffett’s Berkshire Hathaway may or may not own copper stocks. I did not dig deep enough to find out. For the purposes of this post it does not matter.

With the Buffett Buys a Gold Stock! hysterics last summer, the subsequent (and inevitable) fallout and the Buffett Pukes a Gold Stock! resolution, you never know. It’s worth asking the question about what sort of investors are now true-believing in copper and the industrial metals where once upon a time last summer gold was the object of affection.

Look, the contrarian dynamics in play now are 180° from where they were last spring, coming out of the deflationary crash, when we first started to get a handle on and act upon the coming inflation aimed at reflating the economy. NFTRH has used a lot of indicators, starting then and continuing today to be on the right (inflationary) side of this macro dynamic. With all due respect and foresight about macro decision points to come, we remain on the inflationary side today.

(more…)