I am surprised at myself, at how long it took for me to get really interested in the crypto scene. Bruno (BDI) and I were actually in the throes of starting a gold crypto company called Luster, and had he lived, it probably would have been a fairly cool enterprise.

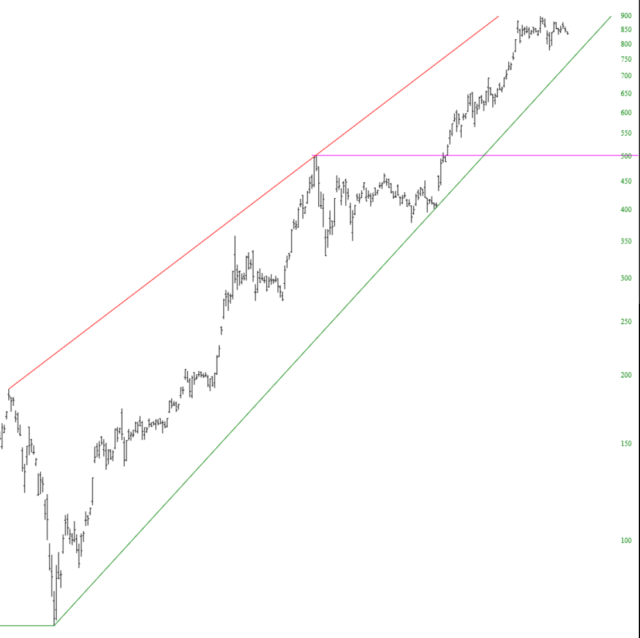

The principle reason I find crypto so fascinating is that it seems to be the last honest market on the planet. Supply. Demand. That’s it. Just like the old days for stocks. A true organic market which can be studied earnestly by way of charts and classic technical analysis.

I have taken the time and trouble to pluck out fifteen crypto charts I thought you would find of interest, and which I believe are representative of the kind of clean charting to which I am referring. These were all created, naturally, with my beloved SlopeCharts. You’re going to think I’ve lost my marbles, but I think every single one of them is long-term bullilsh.

(more…)