This is a tale about risk, hubris, and disaster. I stumbled upon it quite by accident.

Let us begin by taking a look at the chart of a relatively young stock named Rocket Companies (symbol RKT). You may have heard of Rocket Mortgage, but they have a variety of other financial lending products. Anyway, here is the chart, absent a couple weeks of the most recent history:

There isn’t anything remarkable about this chart. The company went public and basically hung out at $22 or so for month after month. For some reason, this was an intensely-anticipated IPO, but after a few weeks of heavy trading, it was clear that it wasn’t going anywhere, so it just stayed stuck.

There was a bit of excitement in late February and early March, and both volume and price exploded higher, but they largely reversed itself. The stock seemed to find a happy equilibrium at about $23, but for some reason, the meme-ness of this stock continued, and the /wsb crowd kept yammering on about it and pouring money into short-dated call positions, hoping for (as always) “the next GME“.

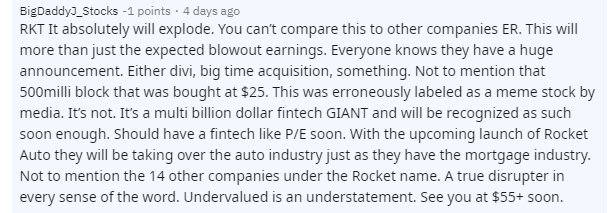

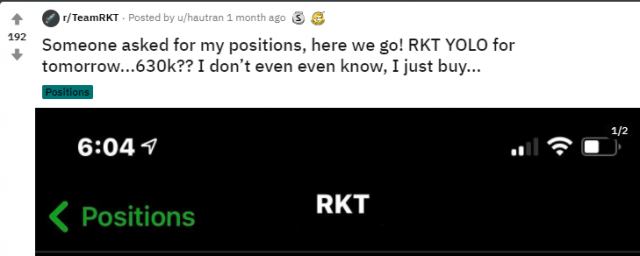

Here is a screen shot of one of these guys who went “all in” and put his entire account into a mixture of RKT common stock as well as call options. I guess he would consider that to be diversification.

What’s kind of ironic about the /wsb folks is that they consider their positions to be fairly well-researched by way of “DD” (due diligence). Here is another chap who speculated that RKT would “absolutely….explode” (he was right, although not in the way he anticipated). A sprinkling of terms like “ER” (earnings release) gives a comment like this a degree of credibility to the more credulous. He anticipates the company will be a “true disruptor” and that he will “see you at $55 soon.” He, too, put his life savings into RKT call options.

Although the guy who bought $630,000 of positions wasn’t quite so reasoned about his own position.

I guess I don’t really have to tell you where this all wound up. The widely-anticipated earnings release (oh, sorry, “ER“) happened after the close on May 5th, and I can only imagine what it felt like in the stomachs of all these millennials who were loaded to the gills with options that expired that very Friday. The stock did a swan dive the next two days. No one, to be sure, would “seeing” any price at $55. More like in the teens.

And, thus, Mr. $630,000 in positions had an update for us all………about a quarter million bucks blown up:

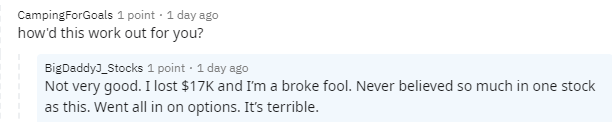

And the guy talking about the “true disruptor” in RKT updated his feelings as well:

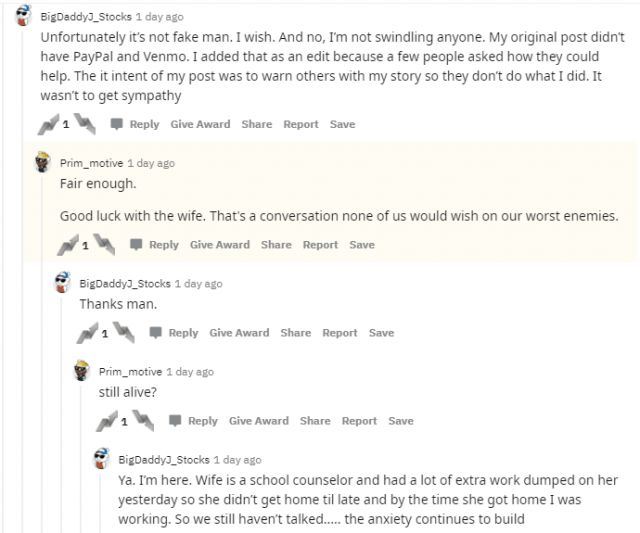

Indeed, this guy was far more damaged than Mr. $630k, since apparently his 17k represented everything he owned. He talked about how he had to face his wife with this news and how he’d have to be taking on Uber gigs in order to make ends meet for his 3 kids and the 4th on the way. He even put out his PayPal and Venmo information, hoping others would throw him some cash……….

I think we can all agree on a few things:

- This absolutely ridiculous shit-show that Bernanke, Yellen, and Powell have created, has created an entire generation of degenerate gamblers;

- Very few of these “traders” considers themselves to be gamblers, because they convince themselves, by way of the echo-chamber of /WSB, that they are making well-reasoned decisions;

- The frequent celebration of one-hit-wonders in the forms of big payouts (with GME being the most famous of all) keeps their hopes up and keeps that call-buying going. It’s sort of like how people roaming the streets of Manhattan stumble upon games of Three Card Monty and watch as participants are apparently making great money, so they figure they want to get in on that sweet easy cash, too.

This stuff isn’t a joke, though. People are wrecking their lives with these insane decisions, and all the while, the most eternal result from Powell’s trillions is that he’s making billionaires richer and giving thousandaires endless opportunities to make fools of themselves. When the day comes that assets persistently decline – – and, in spite of all evidence to the contrary, that day will return – – they’re going to blow up their accounts, one by one, since they simply won’t know any better.