There’s nothing easier than hindsight. Yet hindsight – – even that which gazes upon only a few weeks past – – can be instructive. Let us examine the wipeout which has taken place in the entire crypto space over the past month by simply examining some of the breathless coverage that was going on near the top.

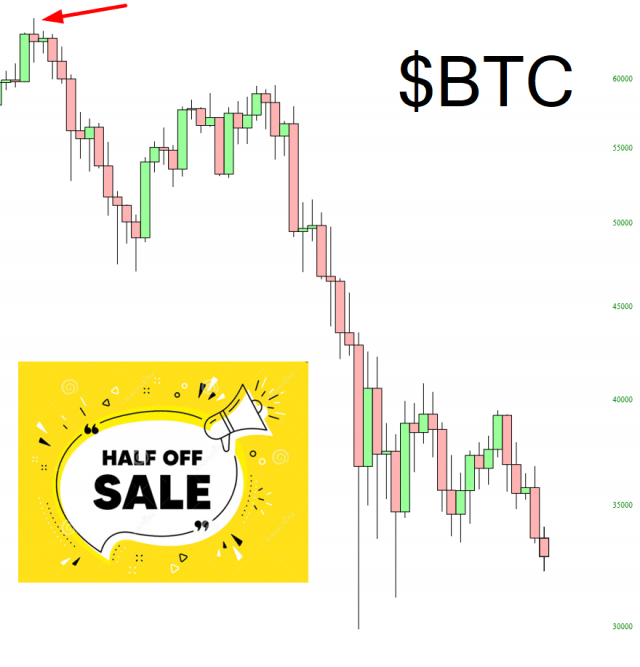

We need not look far. Examine this headline from no less a source than NASDAQ, which proclaims, on the heels of Bitcoin’s ascendency to $64,000, that the top may be “nowhere near”. It will come as absolutely no surprise to you that this was published roughly to the millisecond that the top itself was hammered out.

Of course, back in those days, a long, long four weeks ago, it seemed every company on the planet was trying to get on the crypto bandwagon and mimicking Elon Musk’s behavior by buying billions of dollars of crypto for their own corporate treasury. One doesn’t see many press releases lately about how much crypto this-or-that megacap corporation has been purchasing, because they have, in short order, already looked like complete buffoons.

This plays out in the public markets too, of course. Here we see a Bloomberg headline in anticipation of the widely-heralded Coinbase IPO that was forthcoming.

In one of those ironies that is so pervasive in the capital markets, Coinbase did indeed go public, and it did so on the precise same day as the Bitcoin top. It has provided its own “investors” with the same hearty negative fifty percent returns that Bitcoin itself has proffered.

But I must offer you an anecdote from a coin which is not BTC, and it is one I had never heard of until I start punching this post together. The coin is called, cleverly, “Internet Computer”, and as this headline declares, it “has people buzzing” since it just showed up out of the blue and was instantly worth $35 billion – – – a figure which, in more rational times, would be the market cap of a very profitable, rapidly-growing producer of goods or services. But this was, of course, just a digital contrivance dreamed up by God-knows-who.

And what’s so special about this new coin, which is just one among hundreds and hundreds of others? Well, let’s have the media educate us on this important topic:

Allow me to tell you, as a person who has devoted his life to technology since 1979, what a wheelbarrow full of unabashed crap the above prose is. I mean……..

- “a number of applications and platforms“

- “one could build decentralized applications“

- “developers can build websites and other internet services“

- and my favorite: “because of the way it is set up”

I do not have the artistic ability to express my nausea at this ridiculous twaddle, so I’ll let Blackadder take this one:

It didn’t take that long for the investing public to catch on, however, in spite of the ability of this new coin to build websites and be fast like the Internet because that’s the way it’s set up. Here is the performance of this travesty, which took only a few weeks to lose virtually its entire “value”:

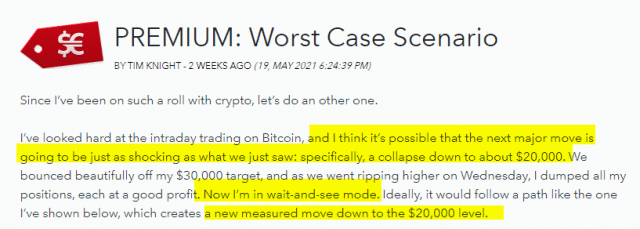

The wretched cynicism I have about the whole crypto space is not news, though. During the heady days of crypto-euphoria, I offered up my own estimate (which seemed insane at the time) of BTC falling to $20,000.

We aren’t there yet, but by God, we’re making good progress.