The first property I ever bought in my life was a small house – – I think it’s called a “patio home” since it’s a freestanding structure, but it’s a part of a bunch of homes on a large plot of land. It was way back in 1989, and I was recently down there in Sunnyvale and drove by it.

I paid $205,000 for it, and believe me, that was a stretch. I got married, and about a year later, we decided to move to Palo Alto to buy a house with a big yard. We sold the little patio home for over $300,000, so I made a 50% return in just two years. Not a bad start in life!

Anyway, when I was down there just recently, I decided to fire up Zillow and see what the place was worth now. My eyes bugged out when I saw it had grown to almost $2 million in value, and even with recent weakness, it was still above $1.6 million. This was yet another one of those “you should never sell anything, ever” kind of moments. My feeling of genius when I made $100,000 in profit on it was wiped away. I felt like quite a dope.

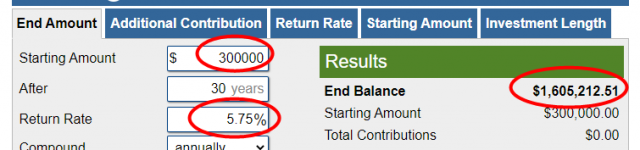

But one thing I still haven’t really learned is what a big difference time makes, and – – errr – – how long I’ve been alive. I found an investment calculator and quickly discovered that even though the $1.6 million price seemed absolutely incredible, and I had missed out on an amazing opportunity, in actual fact all it meant was that over the intervening years the property had increased in value at 5.75% per year. A nice gain, sure, but we’re not talking AMZN here.

So two things came out of this. One, I didn’t feel quite so stupid. And two, I got a real-life example of the power of compounding interest (and the power of time).