Preface to all parts: It’s that time of year again. I have written over 30,000 posts during the long history of Slope, and at the end of each year, I gather up what I consider the best of the prior year’s offerings. At the end of every year, I assume I’m utterly out of material, and yet at the same time, I look back with amazement at all the terrific posts from the year that has just completed. I’m not sure how long I can keep this up, but my concerns of content exhaustion have been proved wrong since March 2005. For your reading pleasure, I offer the following Best of 2021 Posts:

I Didn’t Ask For This

This is when I started to fall out of love with crypto

White Clouds. And Nothing Else.

A loving tribute to the late Norm Macdonald

Generation XX

A long, contemplative exploration of what has changed in the twenty years since the 9/11 attacks

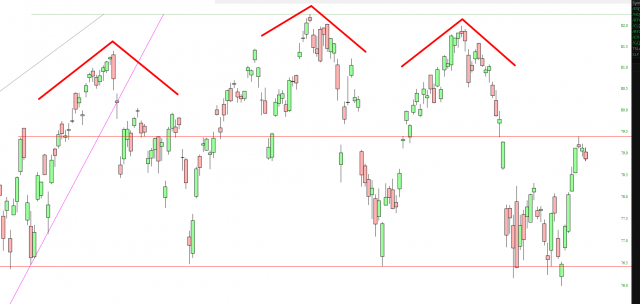

Finally, It’s Clear

So, Tim: what’s the whole bear thing about?

Ladders and Mountains

Personal risk and common sense

Fatal Doses of Radiation

An oh-so-woke Oberlin kid makes my eyes roll backward

Woven Like a Noose

The stock market is slavishly following the Fed’s money-printing