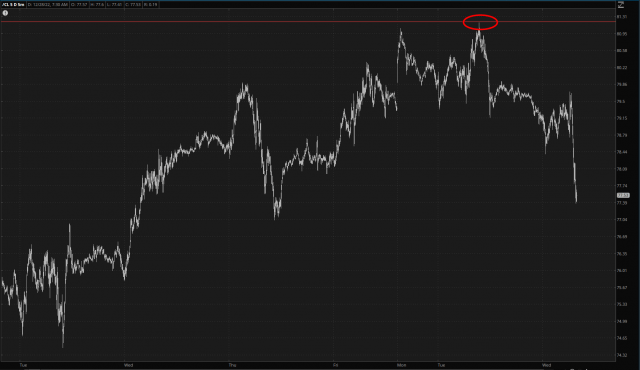

I am jacked to the tits with energy shorts, even moreso now because I’ve augmented and added even more. This is in light of the fact that yesterday crude oil (/CL futures) tagged to the penny my resistance level and then reversed.

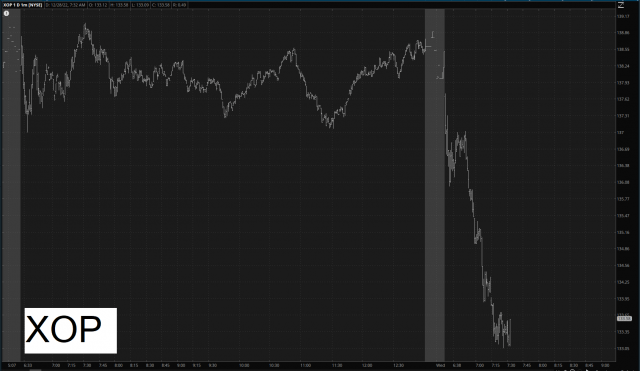

So, at long last, ETFs like XLE and XOP are behaving themselves.

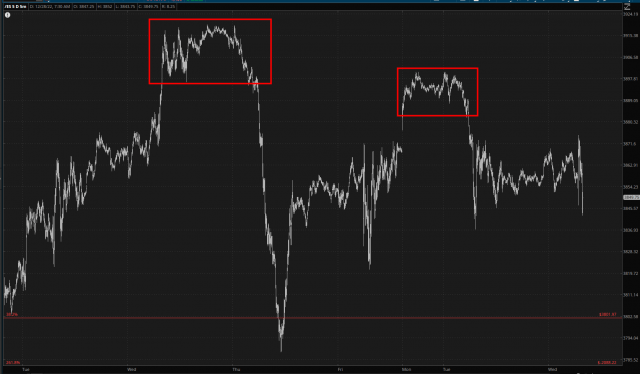

As we struggle through the final 17 trading hours of the year 2022, the battered bulls keep trying to push things up but get repelled by reality.

My current risk profile:

- ETF account: four bearish positions, almost no cash left (SLV, XLE, XOP, FXI)

- Equity Puts account: twenty-seven bearish positions, average days until expiration of 121, 100% of positions profitable, nothing expiring earlier than March 17th.

- A little under 20% cash in main account. I’ll probably leave it alone, since the morons will probably bid stocks up with the new year since they’ll think 2023 is going to be great, even though it will wreck them utterly.