Using the charts I did for chart service subscribers at theartofchart.net last night.

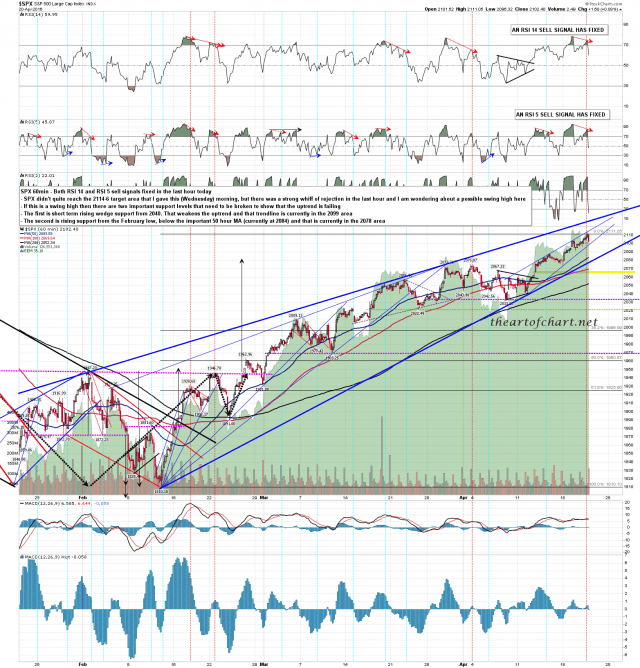

SPX didn’t quite make my 2114-16 target area yesterday, but it reached 2111, and the pullback in the last hour was sharp enough to fix an SPX 60min sell signal. Having had a look across the indices I’m logging this as a candidate high and what would be required next are some significant support breaks.

The first support break I was looking at on the SPX chart last night is a small one but we’ve already seen that break at the open today, and that is the break of rising wedge support on the little rising wedge from last week’s low at 2040. SPX 60min chart:

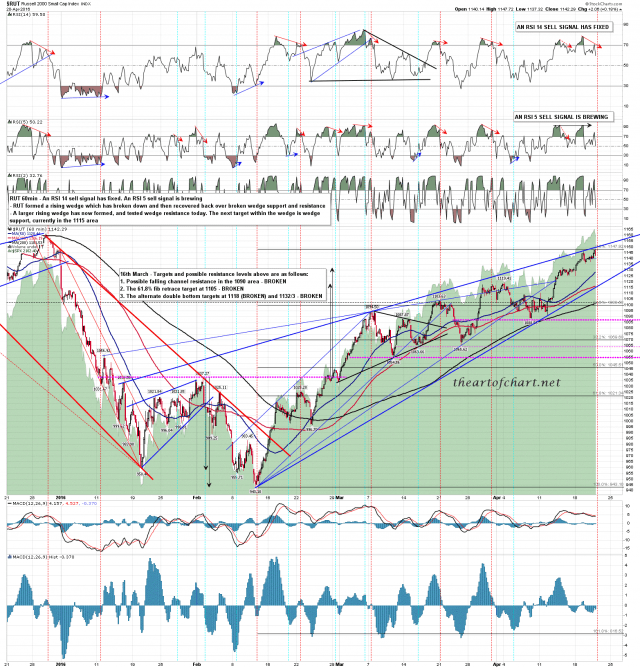

A 60min sell signal also fixed on RUT, and on the larger rising wedge on RUT there has already been the touch of rising wedge support that SPX missed doing yesterday. RUT 60min chart:

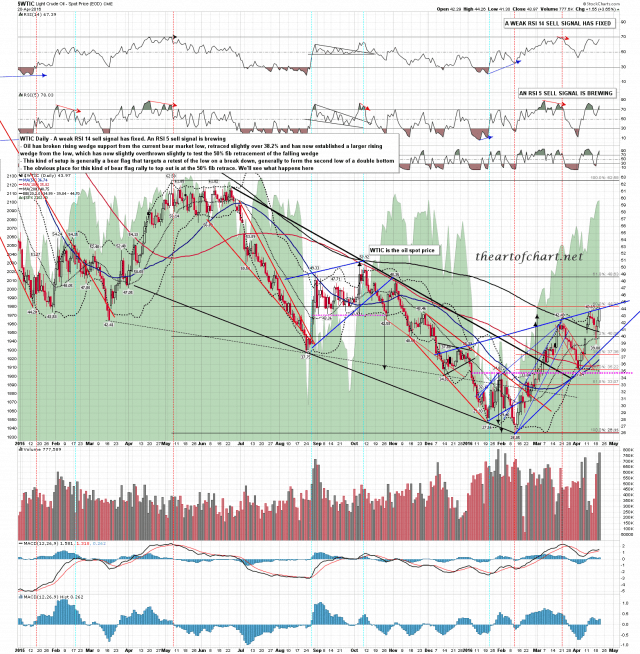

I’m not huge on trading with correlations, but I would say that to the extent that this move up on SPX has been supported by the big rally on oil, that support may well be ending here, as this is a very sweet setup on oil to retest the current bear market low at 26. We’ll see how that goes. WTIC daily chart:

I have strong support on SPX in the 2078-84 area (approx 2072-8 ES), and I’m not getting excited about the prospects for a retracement here until that support is broken, but the setup here looks promising so far. We’ll see how that develops today and tomorrow.