Further to my last weekly market update, this week's update will look

at:

- + 6 Major Indices

- + 9 Major Sectors

- + 3 Ratio Charts of the SPX:VIX, RUT:RVX, and NDX:VXN

- + Ratio Chart of AAPL:NDX

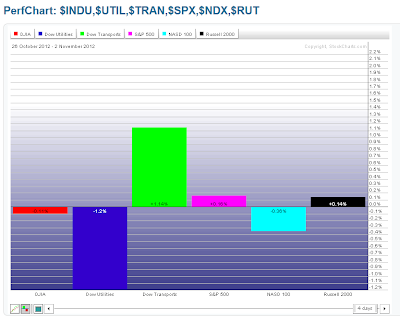

6 Major Indices

Trading was mixed in the Major

Indices during this 3-day week, as some closed slightly higher, and

some closed lower, as shown on the Weekly charts and the 1-Week

percentage gained/lost graph below.

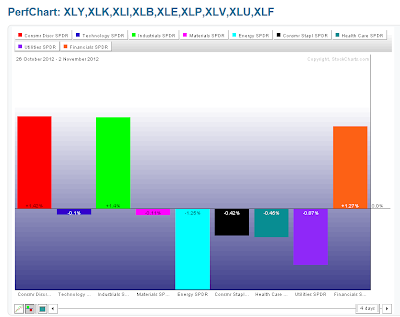

9 Major Sectors

Trading was also mixed in the

Major Sectors during this 3-day week, as some closed higher,

and some closed lower, as shown on the Weekly charts and the 1-Week

percentage gained/lost graph below.

In

general, it would appear that this week's gains vs. losses in specific

Indices and Sectors can be primarily attributed to the devastating effects

caused by Hurricane Sandy. Most of the Indices and Sectors are trading at/near

their mid-Bollinger Band on the Weekly timeframe. This week's trading can be

described as volatile, at best. With the U.S. elections coming up on Tuesday,

bringing with it more volatility and uncertainty, I can only suggest monitoring

price action on these around their mid-Bollinger Band in order to gauge relative

strength (above) or weakness (below). Generally speaking, those Indices and

Sectors currently above the mid-Bollinger Band are outperforming those below.

Whether this continues next week, or in the weeks ahead, remains to be

seen.

3 Ratio Charts of the SPX:VIX, RUT:RVX, and NDX:VXN

On a

Daily timeframe, I'm watching for a break and hold below the

last swing low (on the following three ratio charts comparing the SPX,

RUT, and NDX Indices with their respective Volatility Indices)

to confirm that further selling/weakness is occurring in the SPX, RUT, and NDX

on accelerating volatility momentum. In all three, the Momentum Indicator is

still in bearish territory below the zero level and is suggesting further

weakness ahead for the SPX, RUT, and NDX, as they were unable to hold onto

Thursday's gains and as price closed, once again, below near-term resistance

levels.

Ratio Chart of AAPL:NDX

I've added a Daily ratio

chart of AAPL:NDX, as well. I've discussed AAPL in

several posts recently, most notably in the first one on October 23rd. I've been watching for a break below its

near-term support level, and that occurred in Friday's action. Momentum is

accelerating to the downside and is well below the zero level. Further action

below the zero level is subject to bearish influences of more weakness and

volatility. It's one that I'll continue monitoring over the days/weeks ahead

inasmuch as it's such an influential stock in the Nasdaq 100, S&P 500, and

S&P 100 Indices.

P.S. Just a reminder that Daylight Savings ends November

4th.

Enjoy your weekend

and good luck next week!

N.B. I'll be posting a number of charts

showing support and resistance levels for a variety of instruments during the

course of the weekend, so please feel free to check my Blog for that post.