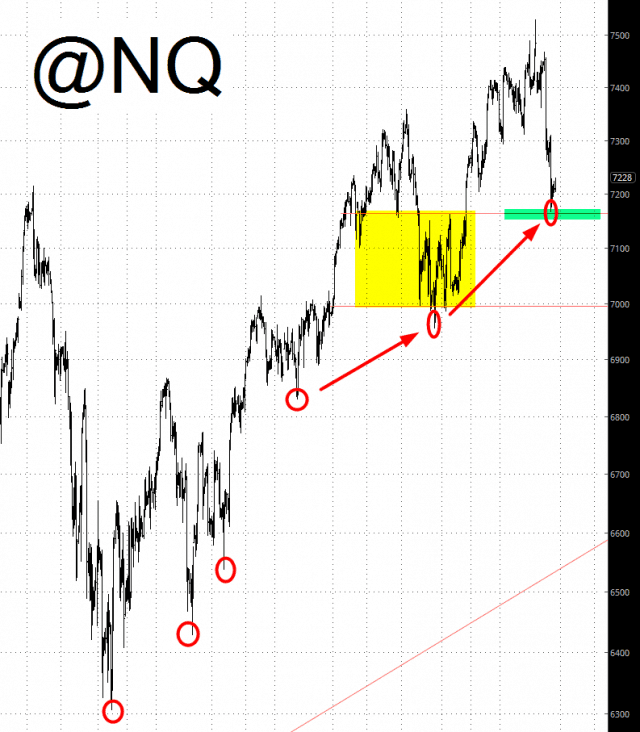

There’s been plenty of hoo-ing and ha-ing about the miniature tech wreck going on. You know me well enough to recognize that no one cheers on a wreck more than me, but the uptrend is absolutely intact and, unless we push below the green tint below (let’s call it around 7170) nothing is going to change.

That “change”, of course, could come in the form of AAPL tonight, but I’m not holding my breath. Apple isn’t really in the habit of surprising investors. Personally, I’m stunned the world keeps gobbling up new iPhones. I reached the point of satisfaction (e.g. it does EVERYTHING I need) a few years ago, and although my model ( I don’t even remember – – a 5, maybe?) is becoming an antique, I simply don’t need anything else. I guess most people aren’t like that and prefer to go through them like disposable cups.

Anyway, AAPL obviously merits close attention this afternoon when they report their earnings.

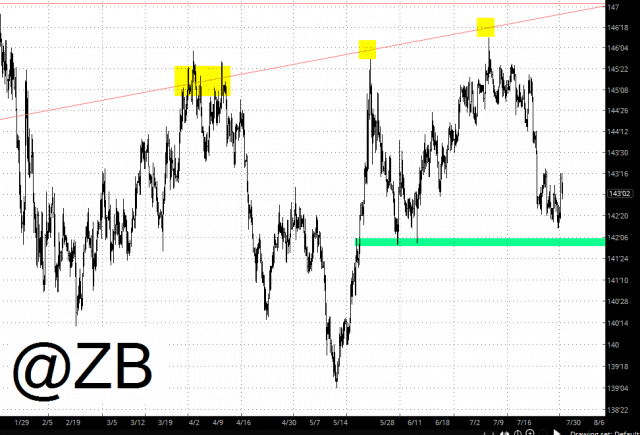

The other chart that qualifies for close watching is bonds, shown below with /ZB. I’m delighted how the broken long-term trendline has repelled prices with greater and greater certainty (yellow tints). What needs to happen at this point is a break beneath the green tint. As I’ve said through the year, a rising interest rate environment is pretty important to my overall thesis.