Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Sexy SOXS

Wonderful and Awful

Well, right about the time there were folks yammering on about how 1400 was the next stop on the S&P, the market started to fall apart, and it hasn't stopped. I guess the moon just didn't feel like helping this time.

Even I – the Bear of Bears – was thinking yesterday that things were really (and here's that dangerous word again) "oversold". So I ended the day with 29 shorts – – very, very light for me – – and one large long with SPY.

I dumped the SPY at a nasty loss before the market opening this morning. Of my 29 longs, all 29 are profitable – – but I have 200 (literally) other stocks I wanted to short at good prices. I'm starting to wonder if "good" prices are ever going to happen at this point, since the bears seem to have finally – thank you, Jesus – wrenched control away from the Bull Criminal Scumbags.

In any event, I am vastly underperforming the market today (in other words, I'm up, but not nearly what I should be), so it's disappointing. Very disappointing. There are a breathtaking number of issues falling 20% in a single day from what I can see, including many old favorites of mine.

Maybe Satan Bernanke is just putting things together for his Jackson HOLE crime speech. I'm going to be shorting a few more carefully-selected issues, but I sure wish I was 200% committed instead of 35%. But at least I'm not positioned long. Sheesh.

Failed Bounce Overnight (by Springheel Jack)

Last night when I was about to go to bed I posted a very nice looking bull setup on ES with a falling wedge that had broken up, an IHS that had formed at, and was breaking up through, the important 1257 resistance level. That failed in the mid-1260s though, the 1257 level was rebroken and ES has been as low as 1240 overnight. This obviously looks a lot less bullish, and I'm wondering whether we'll see a move to test the broken wedge resistance trendline near yesterday's low:

On the SPX, NDX, and RUT charts I now have three very similar broadening descending wedges. The next obvious moves on these wedge are up to hit the upper trendlines, but it's worth noting on the SPX 60min version that it is the 13 EMA that has mainly been acting as resistance on this move down, and that SPX hit the 13 EMA at the close yesterday:

That isn't as clear on the NDX or RUT charts however,and the next obvious trendline hit would be the upper trendline. Here's the NDX 60min version:

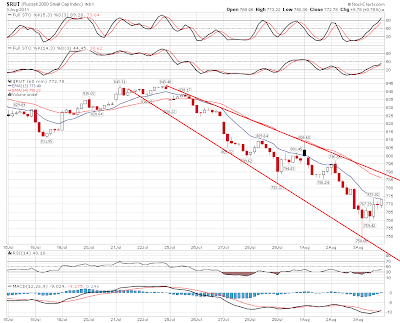

Here's the RUT 60min version of this wedge:

I'm wondering if we will need to hit the key support level in the 1219 SPX area before we see a strong bounce here. If this down move is the start of something bigger, as I think it is, then I'd expect to see a bounce off this support area before a return to break it. Here's the SPX 6yr chart to show how important a support / resistance area this has been over the last few years:

On the three year SPX chart I've shown this support level more clearly, and it's also well worth noting the RSI is hitting 30 on the daily chart as well. RSI has held 30 at every hit since March 2009, and that's another reason to expect at least a bounce here. What I've also shown here is my preferred target for a bounce, which would be a kiss of death retest of that rising wedge lower trendline, which has only two hits so far and needs a third to properly confirm the trendline:

I've heard some talk that this big move down is related to contagion fears on Euro-zone debt, but I don't think that the currency action this week particularly is backing that up. EURUSD has weakened somewhat since Monday, but has been successfully clinging to the 1.427 support / resistance area:

That's in sharp contrast to AUDUSD, which has crashed almost 5% since the start of the week and looks set to fall further. A move to big support in the 1.04 area looks likely:

What does this sharp relative underperformance from AUDUSD suggest? Well, it suggests that the main concern here is that the US is close to a double dip recession, and there's good reason to think that. Here are the GDP figures since Q3 2009:

- 1.7

- 3.8

- 3.9

- 3.8

- 2.5

- 2.3

- 0.4

- 1.3 (not revised down yet)

Not an inspiring series and close to levels which in the past have almost always been followed by recessions. On average equities fall by 40% in recessions, or so I have read, so fear of recession is a very rational reason for equities to be falling sharply.

I have mixed feelings about the outlook for today. I will be strongly bullish if SPX gets below 1230.

Tigger Time

The wonderful thing about tiggers

Is tiggers are wonderful things!

Their tops are made out of rubber;

Their bottoms are made out of springs!

They're bouncy, trouncy, flouncy, pouncy,Fun! Fun! Fun! Fun! Fun!

But the most wonderful thing about tiggers is

I'm the only one!

There isn't a person on the planet better at beating me up about trading than me. Today, however, I'd like to give myself a hearty pat on the back. This is one of those few days that I'm really pleased at how I handled myself.

I came into this day with 84 short positions and no longs (I sold my SPY before the opening bell at a profit). And I ended the day – a day in which all the major indexes were higher! – with a profit. It wasn't a huge profit, but for me to have that many shorts at the day's beginning and end the day with a profit is something about which I'm quite pleased. (I did a fair bit of successful day-trading on the long side).

So, I'm happy with myself, big deal. What's to be learned? Well, it all comes down to anticipating moves and executing based on that plan. In my case, although I thought there was a risk the market would pop higher (hence the SPY hedge), I thought there was still potential for more weakness before a real bounce happened. I swiftly moved through all my positions and took profits on most of them. As I sit here typing this, I still have 29 shorts that, in my opinion, continue to offer good risk/reward. They are balanced by one very large SPY position. So I'm presently half in cash with a 33/67 split of long/short in my actual positions.

But here's the most important point I have to make: I look at over 1,000 charts every single day (yes, I'm quick). And I cannot remember any instance in my life when I've seen a greater abundance of short setups. These setups are far too risky at these heavily depressed levels. But – oh, my God in heaven – given an adequate bounce, it is entirely possible that I will position myself with literally 200 different securities that, collectively, offer a tantalizing opportunity for a serious fall.

So how long do we have to wait? I dunno. It took 30 trading days from the March bottom to the May peak before we flipped down again. The next ascent higher from bottom to top took a mere ten days. Maybe this next lift will take just a week – I honestly don't know. The price level is what counts, not the day of the week.

I don't want to have to trust my judgment on when an index may or may not have peaked. I will more than likely be wrong (as will you, bucky). I am comfortable, however, looking at all the stocks in my Bear Pen each day and, as they are individually at levels that represent a prudent entry point, I shall enter them one by one.

What's the risk in being so "light" right now? Well, for a bear like me, the risk is that the bottom will fall out, and I won't be fully participating. Believe me, that's a nearly omnipresent dread of mine. But to heavily short a market simply based on the prospect that there's a chance it might fall the next day is, to me, illogical. I take the market on a chart-by-chart basis, and I spread my positions thin.

So I must exercise a virtue which, for my personality, is absolutely puny – and that is patience. I say to you again that I think the most fantastic bull trap in years might be forming over the coming days or weeks. What will the catalyst be? Maybe all the rah-rah surrounding the prospect of that jackoff Bernanke introducing QE3 at Jackson HOLE late this month.

The most delicious irony, of course, would be if a rally into his HOLE speech delivered to us bears the aforementioned bull trap. We shall see. But the reason hardly matters. I simply believe that, although it may take a little longer than I'd like, our deliverance may soon be at hand.