SPX has now spent five days trading in a narrow range with support at 1397 and resistance at 1406. Overall this looks like topping action, as SPX is too close to the upper bollinger band on the daily chart to allow for a lot of upside without at least some retracement. What we might well see though is a test of the April high, which is at 1422.38, with the upper bollinger band now in the 1420 area:

On the SPX 15min chart this consolidation has taken the form of a rough rectangle and this might be a bullish rectangle pattern. If so the target is 1415 which would fit with a test of the highs:

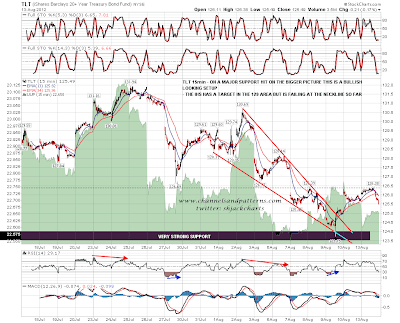

Related markets aren't giving much away this morning. On TLT the IHS that I was talking about yesterday morning has completed forming, but has since been falling away from the neckline. That might yet play out but the retracement below the bottom of the right shoulder isn't a good sign:

EURUSD made the W bottom target I gave yesterday, but has since made a marginally higher high on negative RSI divergence. This too might be topping out short term:

Oil is completing the trio of indecisive looking charts today and the bounce at support the other day has not yet resulted in a new high. This is starting to look like a double-top with a target at 88.70, as part of a larger double-top that could retrace all of the gains since the June low. CL needs to take 95 and hold it to maintain the current uptrend:

What I would like to see here is an SPX test of the April highs in the 1420 area, followed by failure and a strong move down. ES is at 1409 as I write this so we could well see that today. The top of the daily bollinger band is in the 1420 area as well as resistance at the last high so that will be an attractive short entry if we see it.