A reader recently emailed me, asking how he could hedge a "typical $500k

mutual fund portfolio". I'm going to walk through a step-by-step

example of doing that in this post.

Step One: Choose A Proxy Exchange-Traded Fund

If you own a portfolio of

stocks or stock funds, you can hedge that portfolio against market risk

by buying optimal puts* on a suitable exchange-traded fund, or ETF. The

first consideration is that the ETF will need to have options traded on

it, but most of the most widely-traded ETFs do. The second

consideration is that the ETF be invested in same asset class as your

portfolio. Let's assume your portfolio consists primarily of blue chip

U.S. stocks. An ETF you could use as a proxy would be the SPDR Dow Jones

Industrial Average (DIA), which, as its name suggests, tracks the Dow

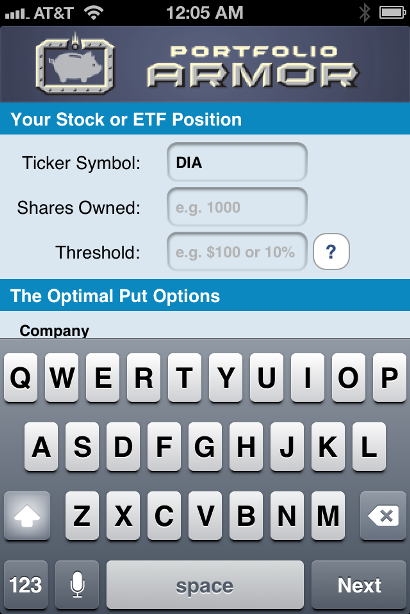

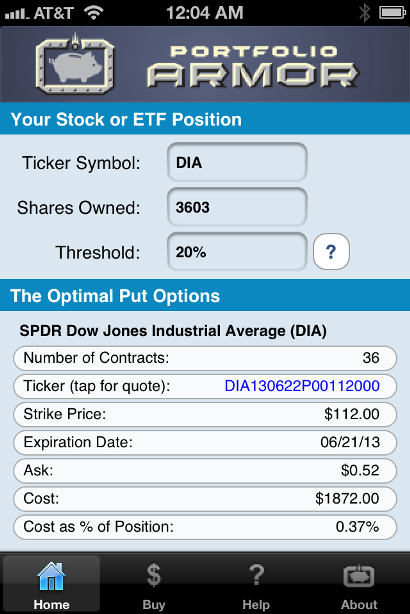

Jones Industrial Average. You could then enter its ticker symbol, DIA,

in "Ticker Symbol" field in the Portfolio Armor app, as in the screen

capture below.

Step 2: Pick A Number Of Shares

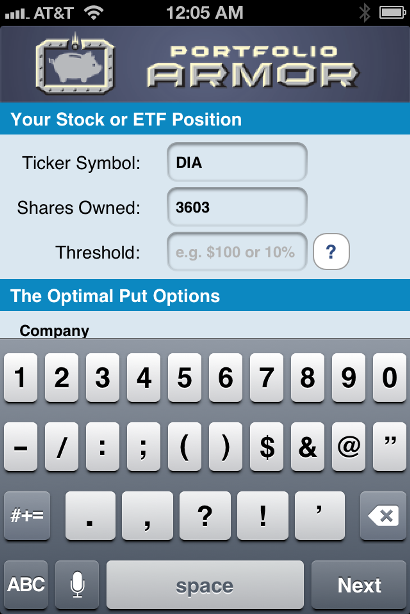

In order to hedge a $500k

equity portfolio against market risk, you would want to hedge an

equivalent dollar amount of your proxy ETF. Since DIA traded at $138.76

on Wednesday, you would simply divide your portfolio dollar amount,

$500,000, by $139.76, and enter the quotient, 3603, in the "Shares

Owned" field, as in the screen capture below.

Step 3: Pick a Threshold

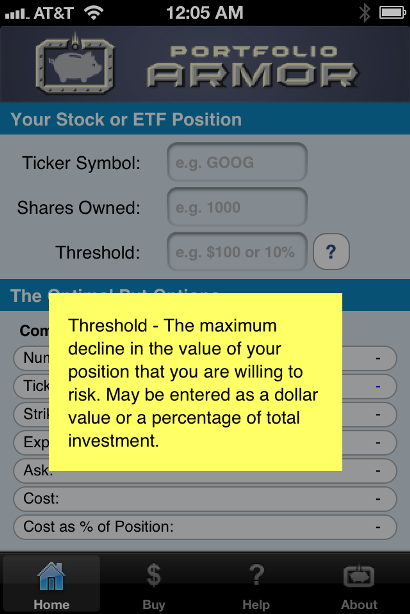

"Threshold", in this

context, means the maximum decline in the value of your position that

you are willing to risk. If you weren't sure of that, you could click on

the question mark to the right of the Threshold field above, and you'd

see this explanation in the screen capture below.

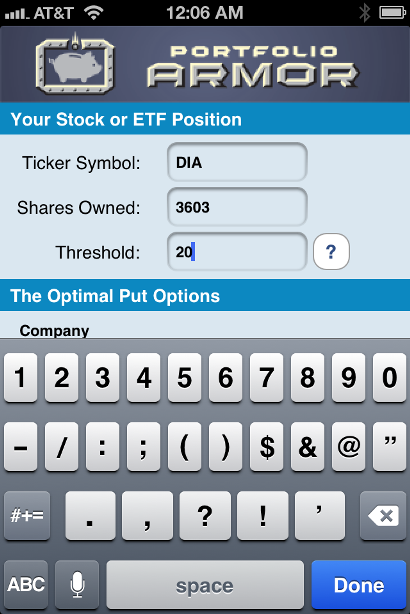

What is the maximum

decline you are willing to risk? Generally, the larger the decline

threshold, the less expensive the hedge, and vice-versa. In some cases, a

threshold that's too small can be so expensive to hedge that the cost

of doing so is greater than the loss you are trying to hedge. In a

market comment in 2008, fund manager John Hussman offered a reason for

considering a 20% threshold:

An intolerable loss,

in my view, is one that requires a heroic recovery simply to break even …

a short-term loss of 20%, particularly after the market has become

severely depressed, should not be at all intolerable to long-term

investors because such losses are generally reversed in the first few

months of an advance (or even a powerful bear market rally).

Essentially, 20% is a

large enough threshold that it reduces the cost of hedging but not so

large that it precludes a recovery. So, for this example, we'll enter

20, in the Threshold field below, and tap "done", as in the screen

capture below.

Step 4: Find the Optimal Puts

A moment after tapping

"Done", we are presented with the optimal puts. The screen capture below

shows the optimal puts, as of Wednesday's close to hedge against a

greater-than-20% drop in DIA.

As you can see at the bottom of the screen capture above, the cost of this protection was only 0.37% of your position value.

How This Hedge Would Protect Your Portfolio Against Market Risk

Remember, the reason we

picked DIA in this case is because our hypothetical investor's portfolio

consisted of blue chip US stocks. If those stocks drop in value due to a

market decline, most likely, the Dow Jones Industrial Average will have

dropped as well. And if the Dow has dropped, the ETF tracking it, DIA,

will have dropped as well. If the Dow drops more than 20% — if it drops

20.5%, 30%, 40%, or even more before June 21st — the put options above

will rise in price by at least enough so that the total value of a

$500k position in DIA + the puts will have only dropped by 20%, in a

worst-case scenario.

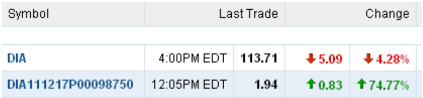

Put option

prices can move in a nonlinear fashion, which enables a small dollar

amount of them to hedge a much larger dollar value position in an

underlying security. Here is an example of that nonlinearity in action:

in June of 2011, I bought the optimal puts to hedge against a

greater-than-20% decline in DIA over the next several months for my

portfolio. Those optimal puts happened to be the $98.75 strike, December

expiration puts (represented by the symbol DIA111217P00098750 in the

screen capture below). On one day early that August, the Dow and DIA

dropped 4.28%. On that day those optimal puts on DIA were up 74.77%.

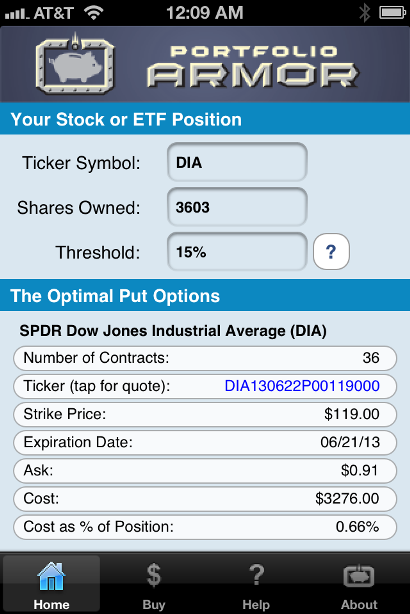

Hedging Using A Smaller Threshold

If you want to scan for

an optimal hedge using a different threshold, you can do so. All else

equal, it will be less expensive to hedge against a larger decline, and

more expensive to hedge against a smaller decline, but the cost of

hedging against market risk is low enough right now that you might

consider using a smaller threshold. Below is a screen capture of the

optimal puts to hedge against a greater-than-15% decline in DIA, as of

Wednesday's close.

Hedging A Portfolio Of Stocks And Bonds

The example above is

simplified in that we've assumed our hypothetical investor's portfolio

is entirely invested in equities. But what if he had some bonds as well?

In that case, he could use a similar process to hedge his portfolio

against market risk, except instead of using just one proxy ETF, he'd

use one per each asset class. So, for example, if 60% of the investor's

assets were in blue chip US stocks, and 40% in investment grade

corporate bonds, he might scan for optimal puts for a $300k position in

DIA and then scan for optimal puts for a $200k position in the iShares

iBoxx $ Investment Grade Corporate Bond ETF (LOD).

*Optimal puts are the ones that will give you the level of protection you want at the lowest possible cost. Portfolio Armor (also available as an iOS app) uses an algorithm developed by a finance Ph.D to sort through and

analyze all of the available puts for your stocks and ETFs, scanning for

the optimal ones.