Well, I'm halfway through my pseudo-vacation, and the markets remain quite interesting in my semi-absence. There are a couple of amazing bear setups that are getting away from me. One of them is bonds, which at long, long last seems to be entering an honest-to-God crumble. The technical damage is getting extreme, and it seems the world is finally waking up to the fact that counting on multi-century lows in interest rates is a dead proposition.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Our Story In Two Minutes…………………………………….

Another Happy Customer

Wednesday’s Volatility Crush (by Strawberry Blonde)

With today's (Wednesday's) "gap-up-and-go" action on the SPX, RUT, and NDX,

volatility got crushed, as shown on the three Daily ratio

charts below.

The SPX:VIX ratio closed just

above trendline resistance. I'd say, if price can hold above

95.00, it has a good chance of going higher, provided the

Momentum indicator stays above the zero level now.

The RUT:RVX

ratio closed at major resistance. I'd say, if price can hold

above 46.00, it has a good chance of going higher, provided the

Momentum indicator stays above the zero level now.

The NDX:VXN

ratio closed in between trendline resistance and support. I'd say, if

price can hold above 150.00, it has a good chance of going

higher, provided the Momentum indicator stays above the zero level now.

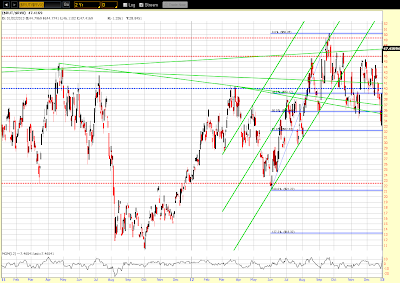

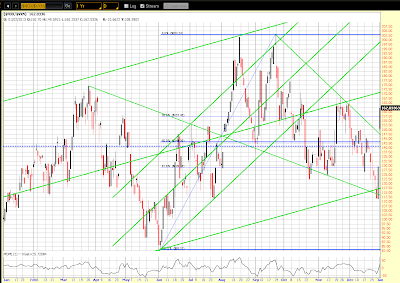

As shown on the

Daily charts below, and looking at a bigger picture, there is

still plenty of room in a larger channel from the June 2012 lows on the SPX and

NDX before they hit their upper channel, while the upper channel is much closer

at around 890.00 on the RUT. Whether the RUT hits its upper

channel and continues to run higher without either consolidating or pulling back

remains to be seen, if the SPX and NDX continue their rally…one to

watch for continued leadership, particularly after making it's all-time

high/closing high today.

My New Shorts Today

I know just throwing out raw symbols is lame, but forgive me, I'm partly incapacited due to travel. In any case, here are the new shorts I'm entering:

- ABFS

- APA

- CAB

- DIOD

- IRBT

- KBH

- KO

- KRO

- NII

- PANL

- PLXS

- PNC

- SO

- TIBX