On the first day of the year, on my flight out here, I was vividly reminded of something I had just read the day before from a certain market analysis firm that shall go unnamed: they declared that the market would lose "10,000 points in the next 3 1/2 years". Even I, Tim Knight, Mr. Short Everything, found the statement ludicrous, but given some of the eye-opening descriptions of Hedgehogs versus Foxes that I wrote about this morning, I was able to understand a bit more clearly what was going on. Wildly dramatic statements get a lot more attention than sober analysis.

If the Dow is going to lose 10,000 points over the next 3 1/2 years, I guess after today it's going to lose 10,300 points. I again say to those of you who embraced last Friday's frenetic selloff as a huge call-buying opportunity two things: (a) congratulations! (b) my mailing address for excess cash is available on this blog.

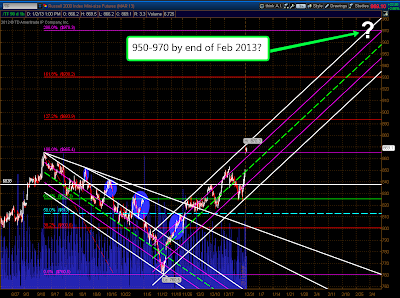

The last trading day of 2012 and the first trading day of 2013 absolutely crushed volatility: